U.S. Supreme Court Threat to Trump Tariffs

Hearings at the U.S. Supreme Court over the legality of Trump’s reciprocal tariffs suggests that at least a partial ruling against the tariffs is likely, probably before the end of the year, though there is no date set for the decision. Over half of Trump’s tariffs are threatened by the case before the Supreme Court. A ruling against them would reduce inflationary risk but positive effects on growth would be limited with Trump attempts to offset any such ruling generating fresh uncertainty. A partial rejection of Trump reciprocal tariffs would also create volatility in financial markets.

The legal case against Trump’s tariffs

The tariffs under threat are those imposed under the International Emergency Economic Powers Act of 1977, with Trump having taken a very broad interpretation of what constitutes an emergency. The impact of fentanyl on the United States can be seen as carrying a heavy cost in American life, though the role played by traffic across the Canadian border is a small proportion of the problem. Large and persistent U.S. trade deficits clearly have not prevented healthy growth in the United States economy, though some individuals and communities can point to adverse impacts. Trump’s opposition to the domestic politics of Brazil, a country with which the U.S. has a trade surplus, or to a TV advert coming from a provincial Canadian government, take the definition of emergency to implausible extremes.

The Supreme Court, with six conservatives and three liberals, has been fairly favorable towards Trump, but questioning on tariffs by conservatives Roberts, Gorsuch and Barrett suggest that in this case Trump cannot count on a majority. Questions were raised not only on the sweeping scope of the emergency, covering almost every country in the world, but also on whether tariffs are taxes under the authority of Congress, and the risks of ceding too much power to the President relative to Congress.

The likely decision, and Trump’s likely response

The Supreme Court case does not impact all of Trump’s tariffs, with product tariffs such as those on autos, steel and aluminum not threatened. Chief Justice Roberts has often tried to compromise, as when he cast the deciding vote upholding the constitutionality of Obamacare while ruling against obligations the law attempted to impose on the States. However the Supreme Court may be reluctant to take on the role of deciding what is and what is not an emergency, with some suggesting true emergencies would require stricter limits on trade than tariffs which simply restrain it. The Court may accept tariffs which have been agreed with major trading partners such as the UK, EU and Japan, though the challenge to the tariffs comes from importers that are paying them rather than the governments of the trading partners.

The Supreme Court will probably rule against most of the reciprocal tariffs, which would probably be close to around half of the tariffs raised by Trump’s policies. Trump would be unlikely to accept a defeat at the Supreme Court, something he has said would be devastating for the country and would require a game two plan. Trump has other potential tools, though all are more complex than simply declaring an emergency and imposing tariffs. Trump has used Section 232 which deals with threats to national security, and requires a Commerce Department investigation. This is relatively easy to use for strategic goods but harder to justify for consumer goods. Another option is Section 301 when foreign trading practices are deemed unfair, which requires an investigation by a U.S. Trade Representative. However with U.S. tariffs now well above those imposed by most trading partners arguing that foreign practices are unfair stretches credibility. Trump’s argument has often been that trade deficits are bad by themselves. Section 122 allows action for balance of payments issues, but after 150 days has to be approved by Congress. Trump may have support in the House, but in the Senate, despite Republicans holding 53 of the 100 seats, there is a group of four Republicans, Collins in Maine, Murkowski in Alaska, and McConnell and Paul in Kentucky who have recently ensured a Senate majority vote against Trump’s tariffs on several friendly nations. More appealing to Trump may be Section 338, which does not require investigation or action by Congress, which deals with discrimination against U.S. commerce. However, should Trump use this as broadly as he has used emergency powers, he may face a similar legal challenge. Trump could also threaten some of these with countries that have agreed trade framework deals (e.g. EU/Japan) to convert reciprocal tariffs into agreed standard tariffs, but this would likely be a long and complex process.

Our central scenario

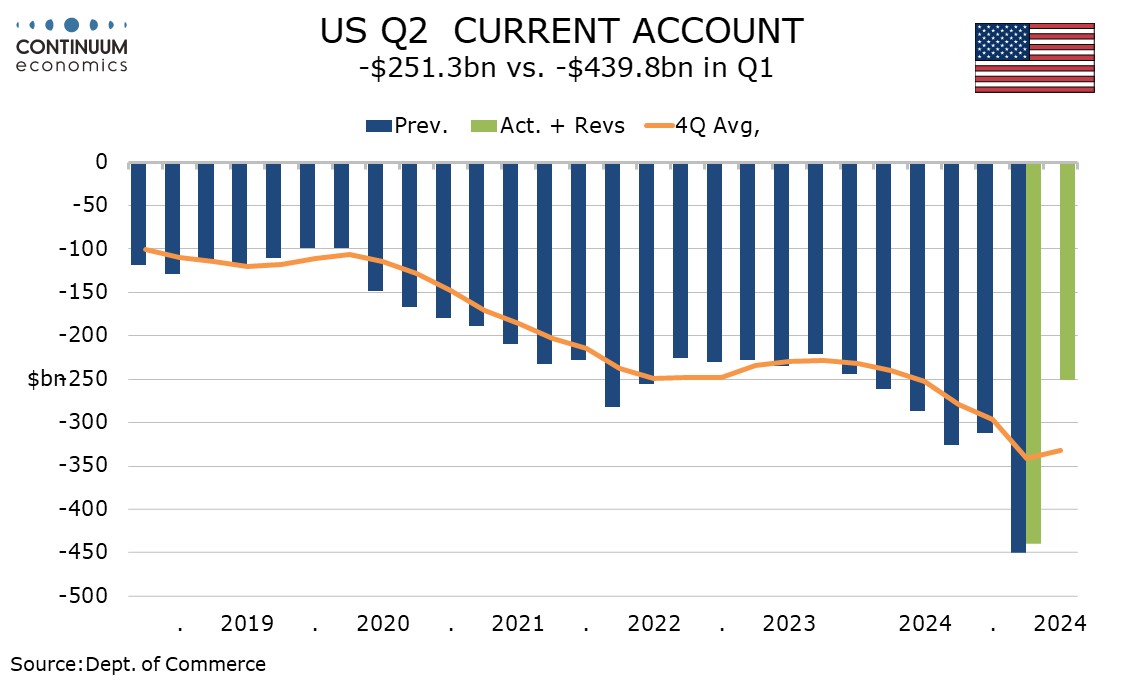

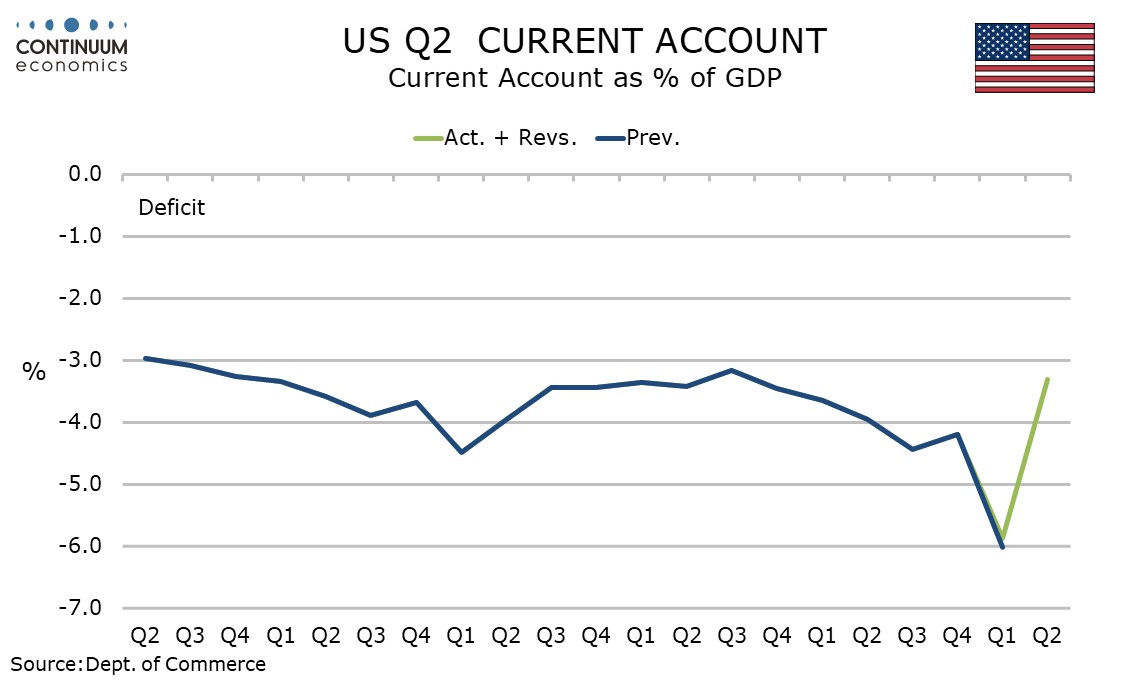

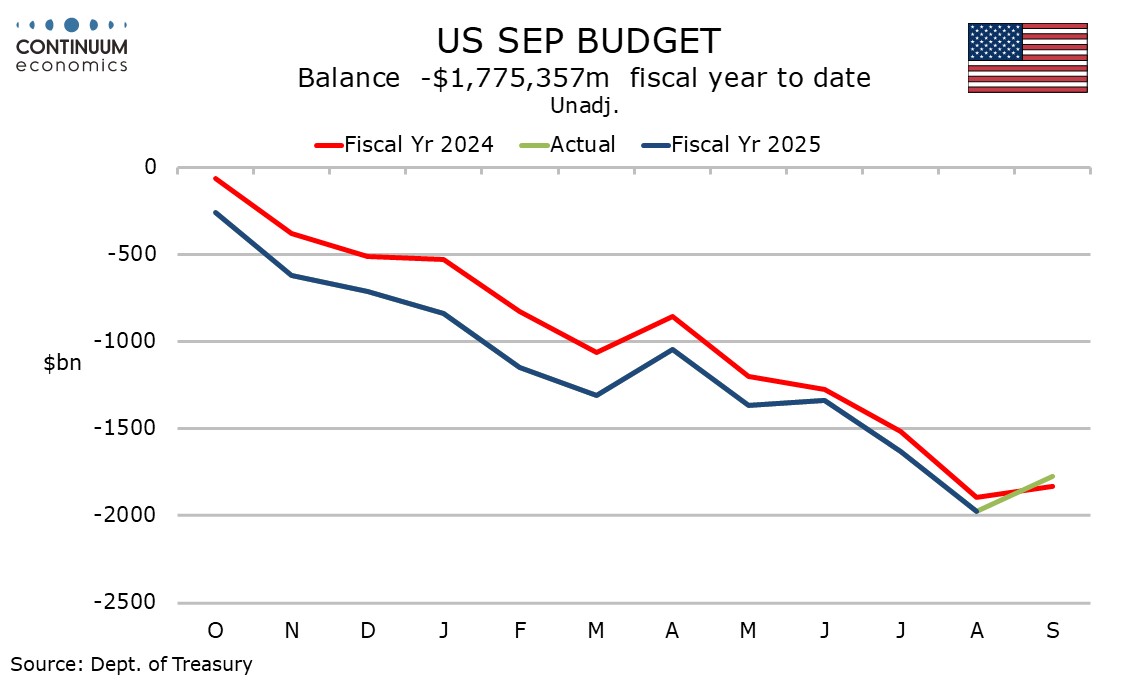

This leaves us with a central scenario of tariff revenues being cut by around a half of where they are now. Tariffs are now running over USD20bn per month ahead of where they were a year ago or around 0.9% annualized of GDP. A downward adjustment in revenues of near 0.5% of GDP could imply a similar or slightly smaller downward adjustment in likely inflation. Lower expected inflation would be supportive for consumers, but there would probably not be much positive impact overall on the economy, given the almost certain scenario of Trump trying alternative measures and the uncertainty that would bring. If broad based tariffs were removed, tariffs on strategically important sectors would probably increase from already elevated levels. The damage to U.S. manufacturers dependent on imported supplies is likely to outweigh the benefits to those industries enjoying enhanced protection.

Should the Supreme Court rule against Trump’s reciprocal tariffs, those collected may have to be repaid, adding to the budget deficit but if sent to importers, probably not delivering much of a boost to spending. Trump is suggesting that if the tariffs survive, he could send rebate checks to U.S. families. This could, while undermining recent progress in trimming the budget deficit, deliver a short term bounce in consumer spending, just as was the case with checks consumers received during the pandemic.

For financial markets, any supreme court ruling against most of the reciprocal tariffs would likely cause a risk off move in financial markets. While less reciprocal tariffs can help temper inflation, the fear of Trump starting new 232/301 or 122 tariffs would be greater. With the U.S. equity market already overvalued, this could be an excuse for a correction (here). The U.S. Treasury market would be disappointed, but the supply picture has improved with the Fed’s decision to start growing the balance sheet again that could mean USD25-30bln of monthly U.S. Treasury purchases (here). In FX, the JPY is oversold against the USD and EUR and any risk off move could provide a temporary boost for the JPY.