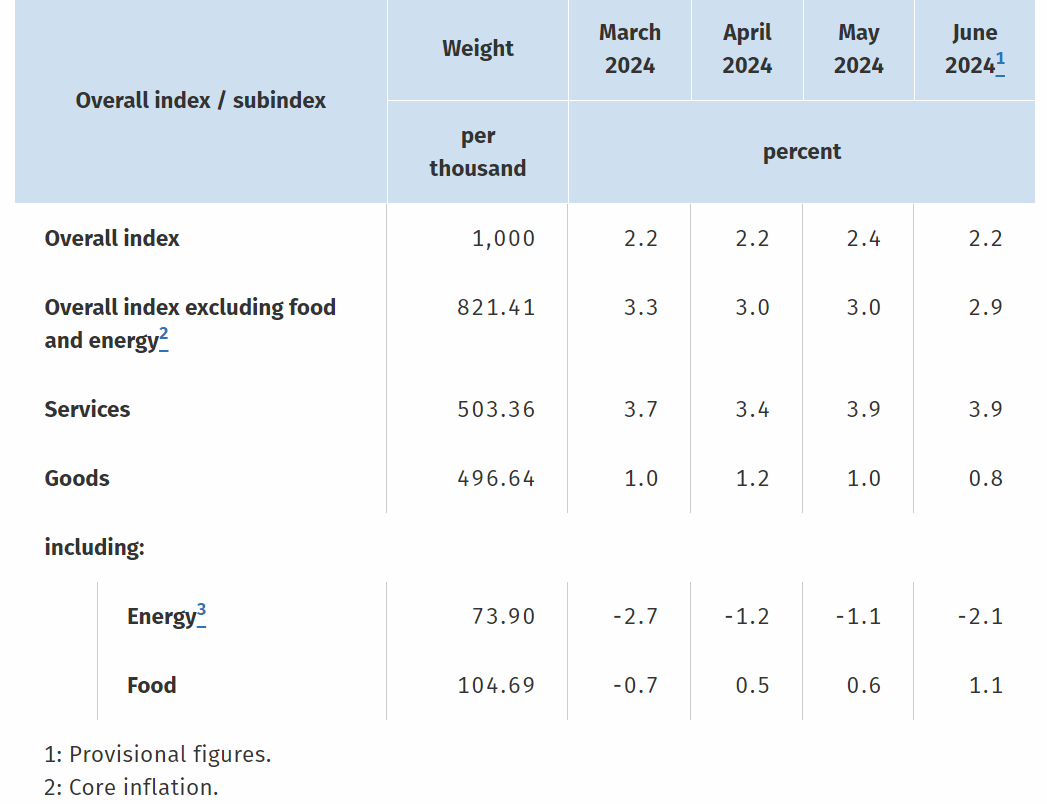

German Data Review (Jul 1): Inflation Moves Back Down

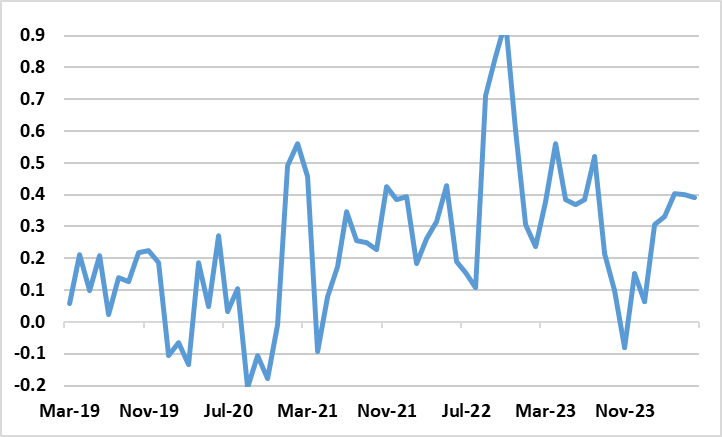

Base effects have caused the German disinflation process not to be smooth and this was even more clearly the case in the May numbers where a second successive and slightly larger rise in the headline HICP rate occurred rising 0.4 ppt to 2.8%, albeit a rise half that size seen in the accompanying CPI data. There was an even larger jump in core, also based around base effects within transport services. But as petrol prices fell afresh last month and with no adverse base effects, headline HICP inflation fell back down to 2.5% (Figure 1) but with only a 0.1 ppt fall for the core CPI reading with more signs of service sector price resilience. Translating this into HICP terms (Figure 2) suggested the adjusted core having remains above circa-target strength, something we regard more as noise than fresh trend.

Figure 1: Inflation Down Despite Services Resilience

Source: German Federal Stats Office, CE

It is unclear to what extent recent services price resilience is due to distortion caused by the early Easter and recent fiscal developments as well as adverse base effects. But adjusted m/m readings for recent months and even our June projection suggest that core rate disinflation may have stalled, albeit at a pace still down from previous rates and largely consistent with 2% target (Figure 2). Indeed, services inflation remained at 2.9% in June with hr fall in the headline more a result of energy.

Regardless, looking ahead, the disinflation trend is seen continuing, mainly due to slower core goods and energy prices. As a result, headline inflation is likely to fall below 2% in the autumn but perk back to possibly above 2.5% by end-year due to energy base effects.

As for the EZ HICP data due tomorrow, recent numbers showed inflation also moderated last month in France and Spain, but rose a notch, while picking up a touch in Italy. We see the EZ number seeing slowdown to 2.4% from 2.6%.

Figure 2: Adjusted Core Rate No Longer Falling?

Source: German Federal Stats Office, CE