Preview: Due January 30 - U.S. Q4 GDP - Looking weaker after December trade and inventory data

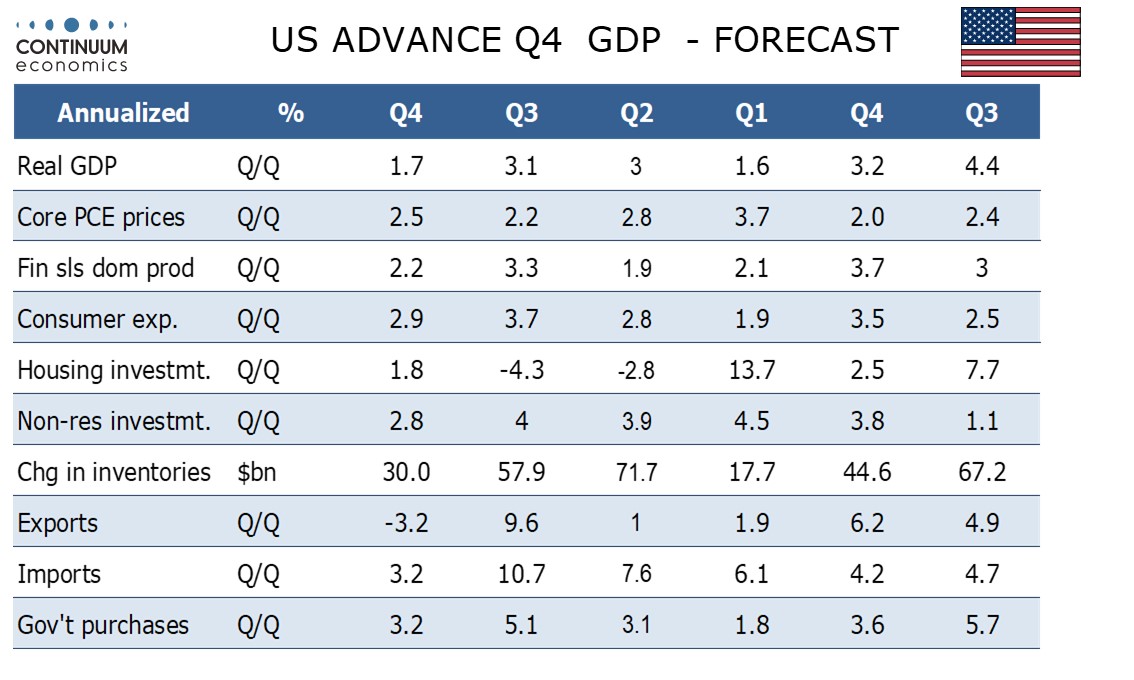

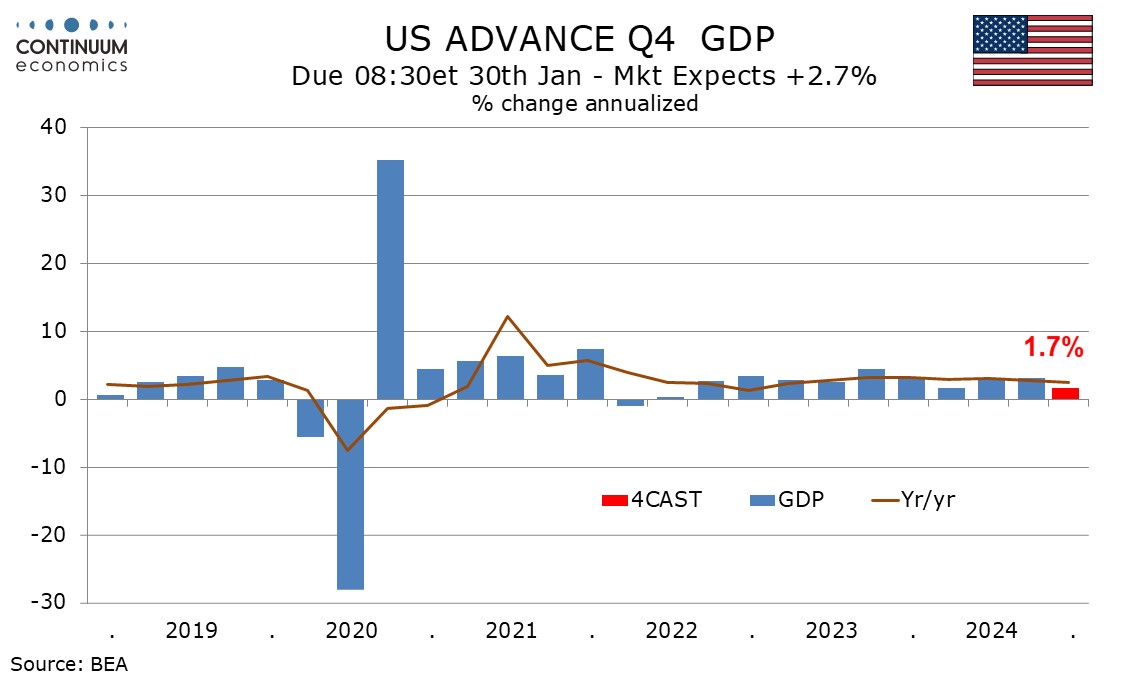

After surprisingly weak December advance goods trade and retail and wholesale inventory data, we have revised our forecast for Q4 GDP down significantly, now expecting a 1.7% annualized rise rather than our previous estimate of 2.6%.

The gain may have been stronger without strikes and hurricanes in early October. Q1 data is also likely to see some adverse weather effects early in the quarter.

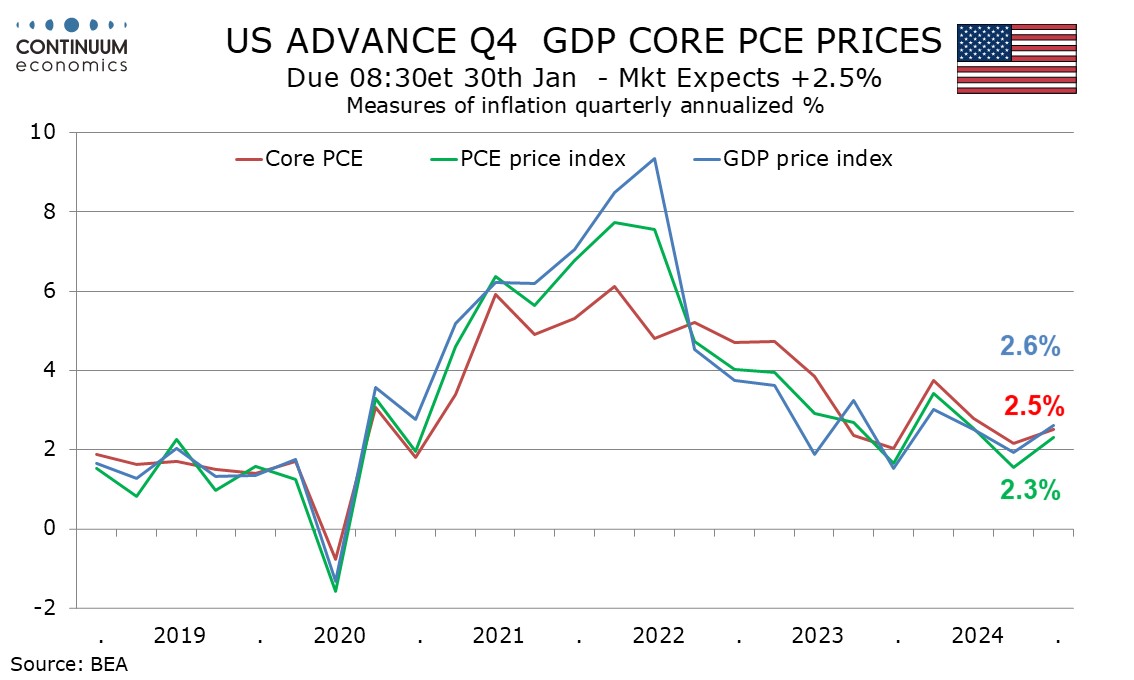

We expect core PCE prices to see a modest acceleration to 2.5% from Q3’s 2.2%, assuming a 0.2% rise in December. Overall PCE prices will be slightly slower at 2.3% but the overall GDP price index slightly firmer at 2.6%, lifted by subdued export prices marginally outperforming import prices.

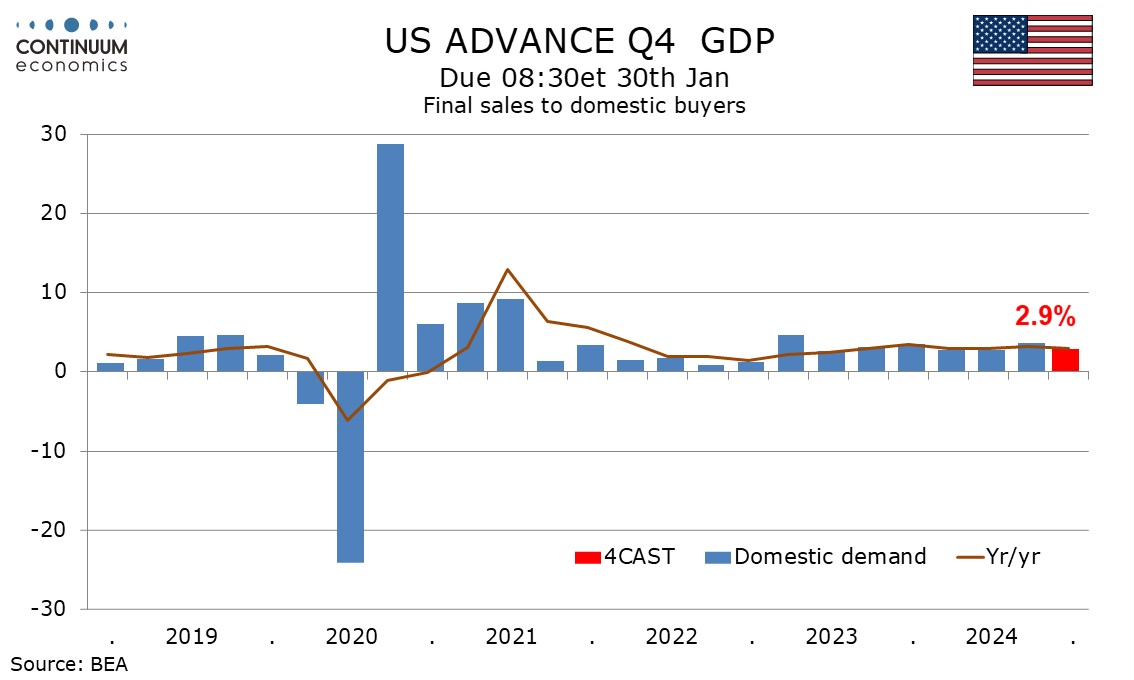

We expect final sales to domestic buyers (GDP less inventories and net exports) to rise by 2.9%, with consumer spending also at 2.9%. Consumer spending will be led by durables, autos in particular, with a rise of 9.2%. We expect non-durables and services to see modest gains of 2.3% and 2.2% respectively. We expect consumer spending to marginally underperform a 3.2% increase in real disposable income, correcting a more significant outperformance in Q3.

Housing activity has picked up modestly with the start of Fed easing and we expect a 1.8% rise in residential investment after two straight declines. We expect business investment to rise by 2.8%, a forecast we actually revised slightly higher after positive details in December’s durable goods orders report. For government we expect a rise of 3.2%, similar to Q2 but a slowing from Q3’s 5.1% when defense was particularly strong.

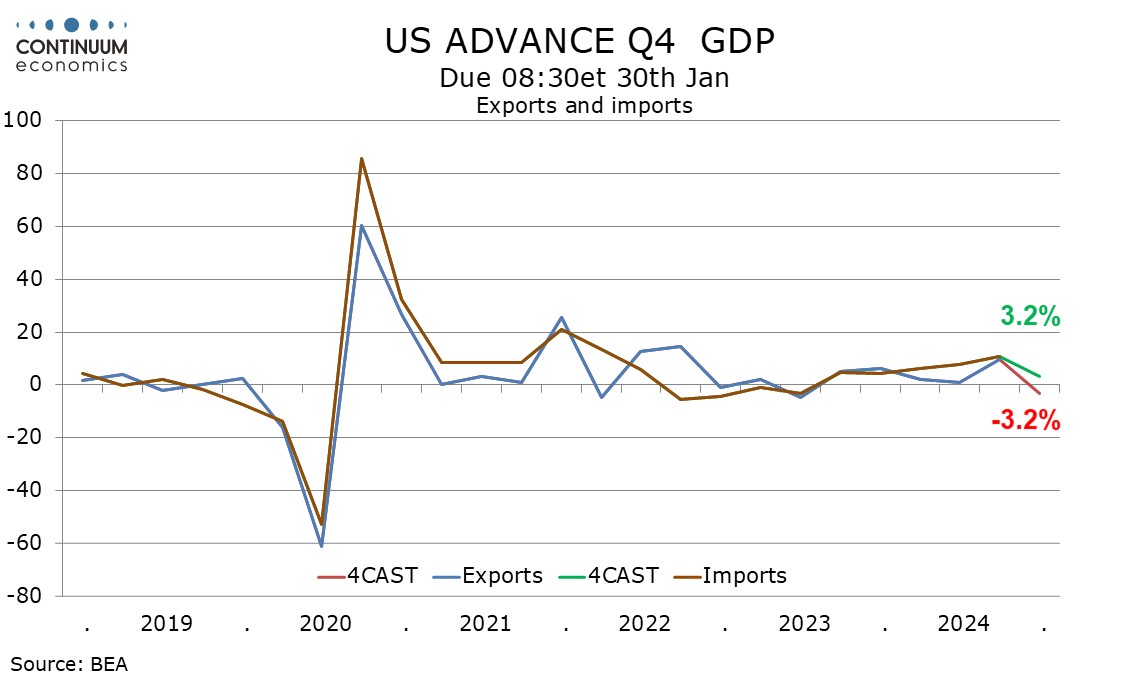

We now expect exports to fall by 3.2% while imports rise by 3.2%, leaving final sales (GDP less inventories) at 2.2%, meaning a negative contribution of 0.7% from net exports. Both series will slow from Q3 restrained by a ports strike in October, but exports finished the quarter weak while imports finished strongly. December’s rise in imports surprisingly did not bring a similar rise in inventories, which now look set to slow from Q3, taking 0.5% off Q4 GDP.