Canada February CPI slows, BoC's Gravelle to speak on QT on Thursday

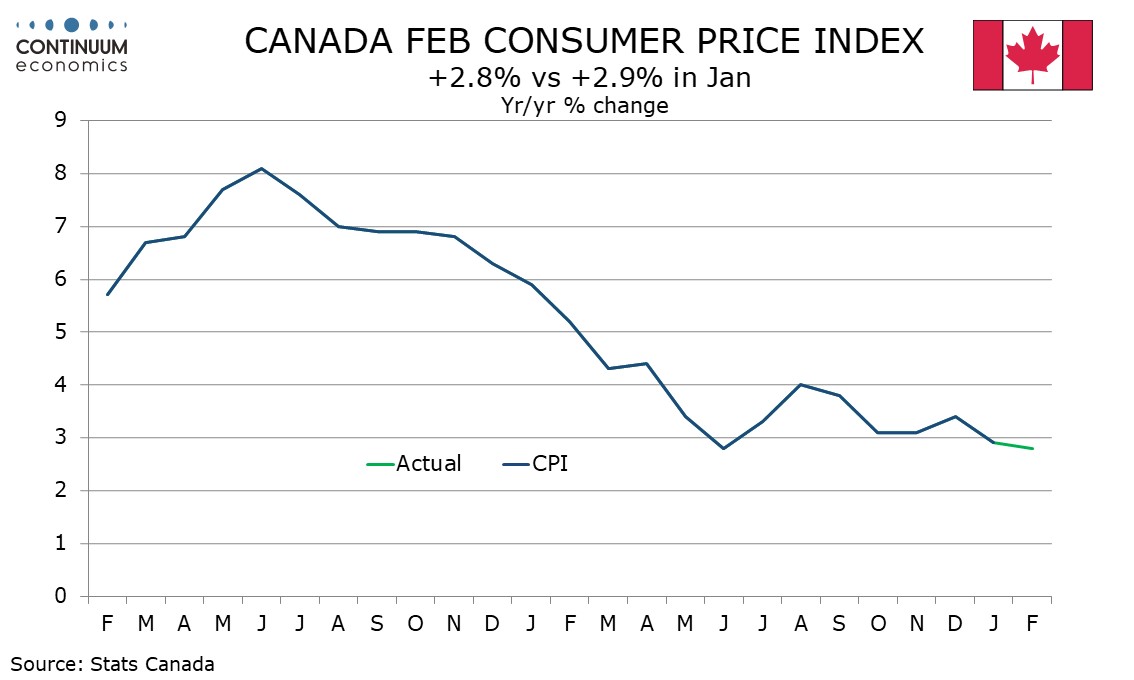

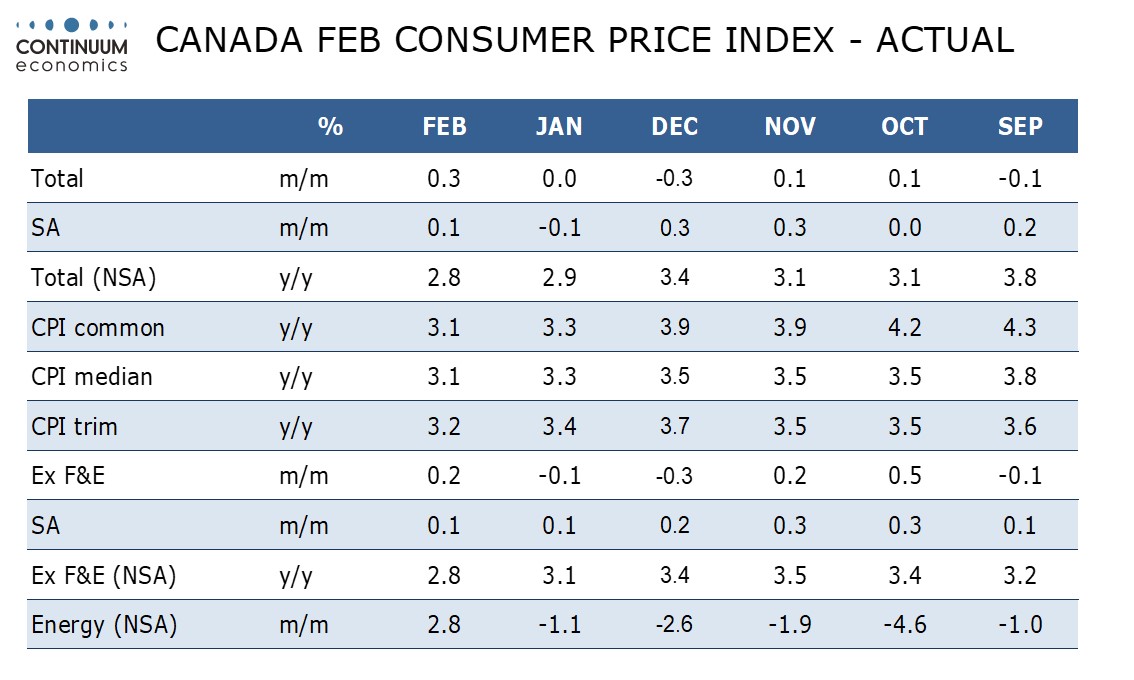

February’s Canadian CPI has seen an unexpected fall to 2.8% yr/yr from 2.9% in January and 3.4% in December, putting the series at its lowest since March 2021. While the Bank of Canada cannot claim victory yet, the data will provide encouragement that inflationary pressures are now fading. A speech from BoC’s Gravelle on QT on Thursday should be closely watched.

While on the month CPI rose by 0.3% overall and 0.2% seasonally adjusted the seasonally adjusted data showed gains of only 0.1% in both series, with the ex food and energy gain being the second straight 0.1% outcome, the softest pair of months since February and March of 2021.

The Canadian data marks quite a contrast to the US, with Canadian data having disappointed in late 2023 but being impressively soft in early 2024, while US data has followed a soft end to 2023 with a disappointingly firm start to 2024. There may be differing seasonal adjustments as well as differing economic pictures behind the contrast.

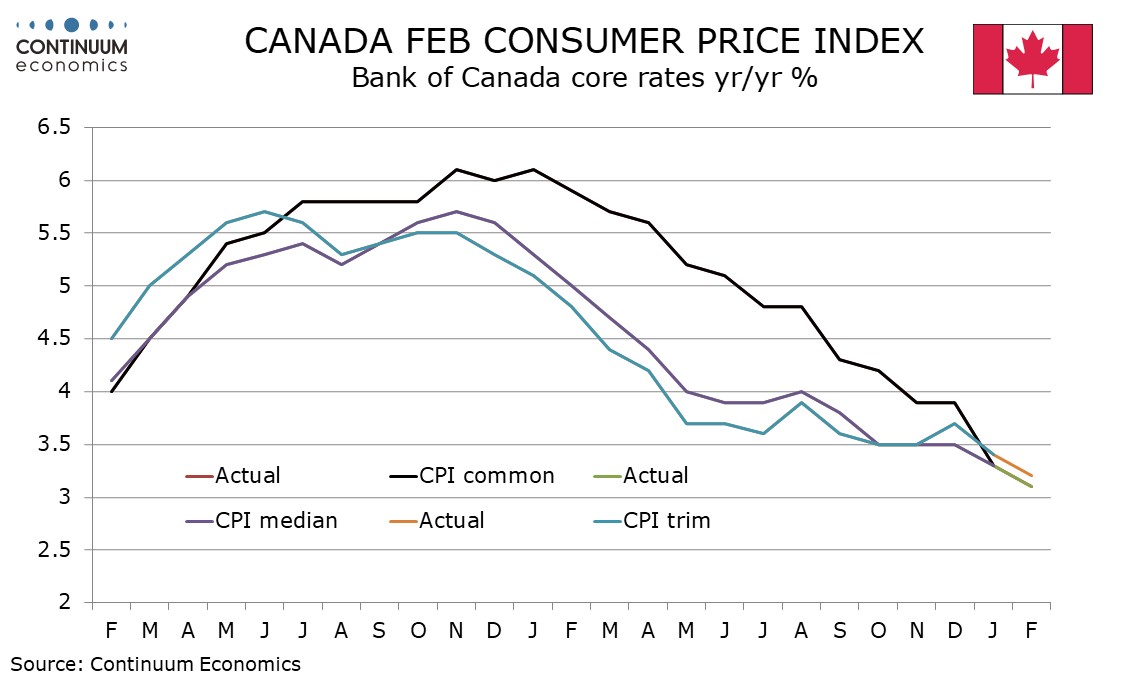

The ex food and energy data is not one of the BoC’s three core rates, all of which lost momentum, CPI-common and CPI-median to 3.1% from 3.3% and CPI-trim to 3.2% from 3.4%, all measured yr/yr. These are all still well above the 2.0% target but moving in the right direction.

The data raises the prospects of the April 10 BoC meeting signaling that easing is close, though there is more key data to watch before then, including what is likely to be a stronger January GDP report and March employment data, where February’s outcome was strong. That the April 16 budget will make the fiscal position clearer may discourage the BoC from moving on April 10 even if we see more soft data. Thursday sees an important speech from BoC Deputy Governor Gravelle who will speak on the outlook for QT, with some tapering expected to be signaled once the BoC starts to ease the policy rate.