Preview: Due November 15 - U.S. October Retail Sales - Trend still solid

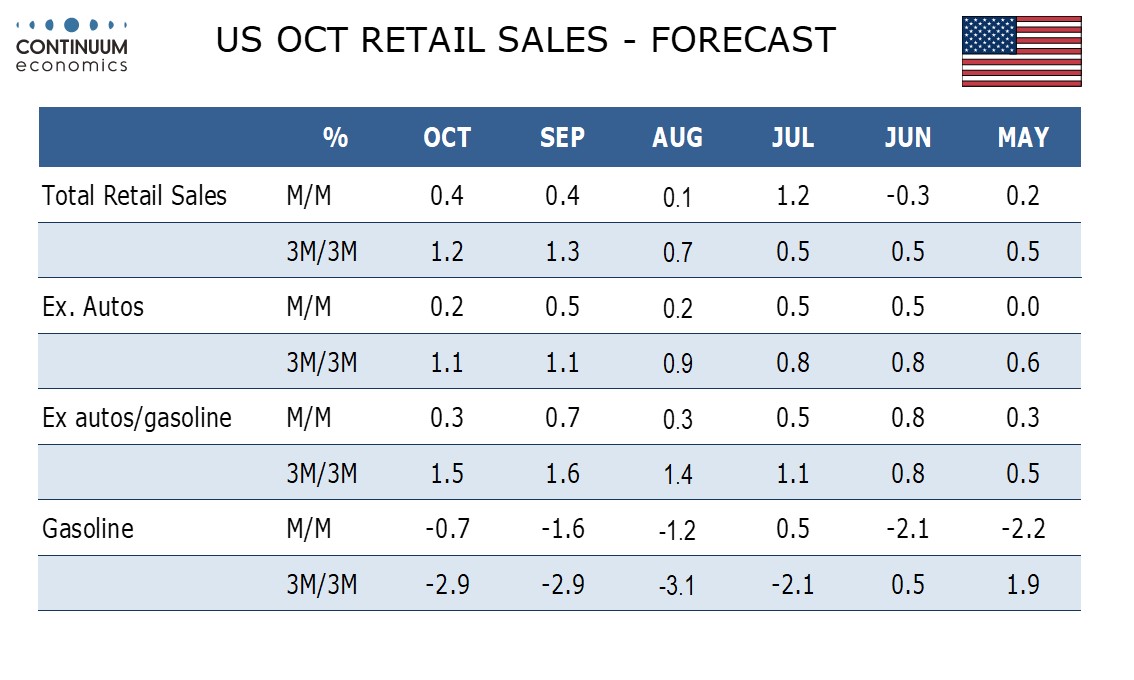

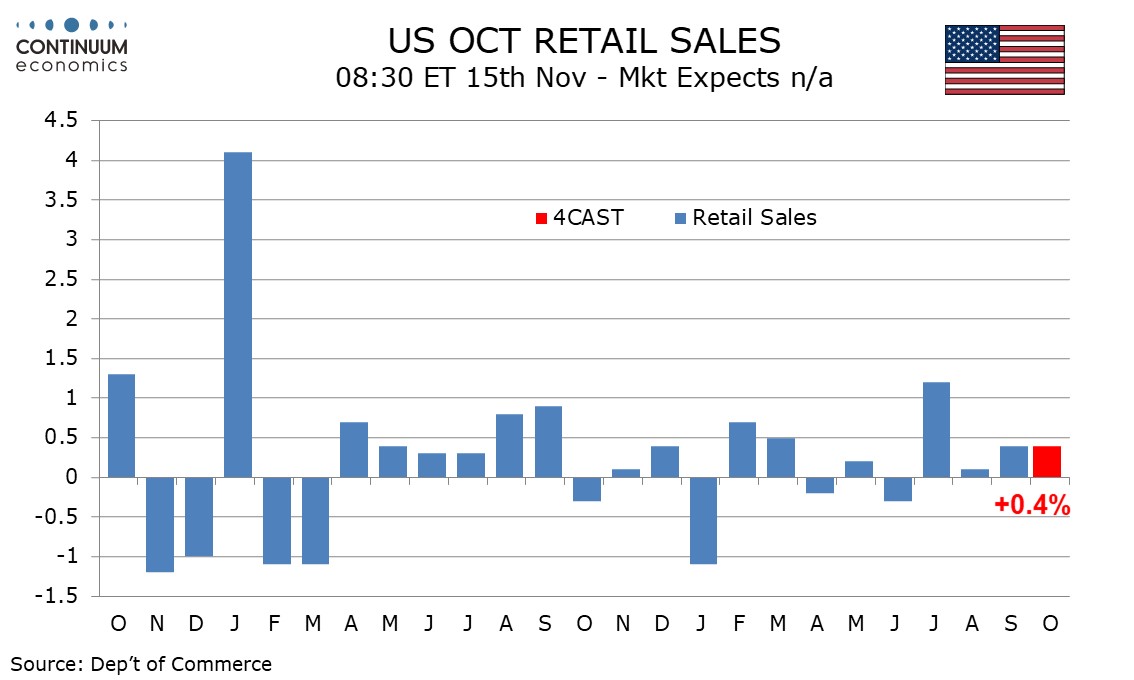

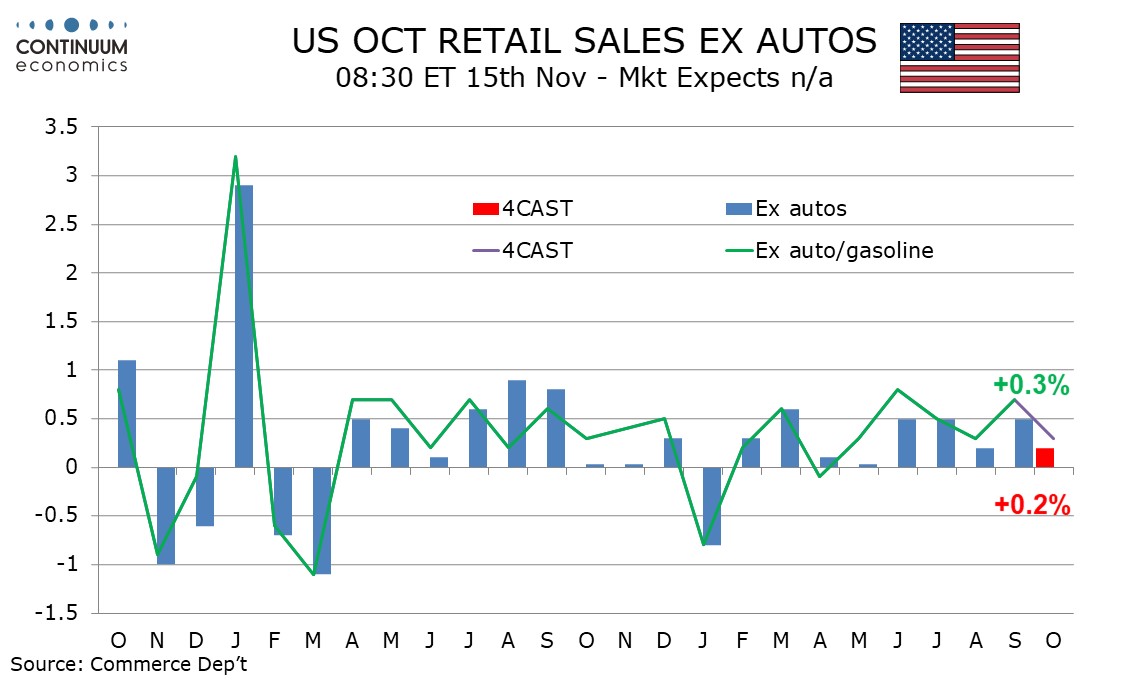

We expect US retail sales to maintain momentum in October, with a 0.4% increase overall matching that of September. However gains of 0.2% ex autos and 0.3% ex autos and gasoline would see some loss of momentum from surprisingly strong respective gains of 0.5% and 0.7% in September.

The consumer saw a strong Q3 outperforming growth in real disposable income, but with consumer spending and real disposable income consistent on a yr/yr basis we do not see a slower Q3 from the latter as signaling a sharp slowdown in spending.

Hurricane Milton will impact the composition of spending, lifting non-durables and depressing durables, more than it impacts the overall level. The net impact may prove a modest negative, but the main reason we expect a slower October in the core rates is because September outperformed a healthy underlying trend. A weak non-farm payroll probably overstated the impact of Hurricane Milton, as the hurricane came in the week payrolls were surveyed.

Auto sales improved in October and with September retail auto data underperforming industry data October’s retail auto data may outperform. Gasoline prices look set to be a modest negative, though less so than in September.