Argentina: Road to stabilization will be bumpy

Javier Milei's administration, despite securing an IMF deal, faces hurdles in stabilizing Argentina. Targeting a $10 billion increase in net reserves, equivalent to a quarter of the country's gross reserves, may prove overly ambitious. Contentious laws in Congress lack consensus, sparking opposition-led protests. Inflation, forecasted near 20%, poses challenges, as does the widening gap between exchange rates. Milei's shock policy aims for economic stability, yet facing opposition and potential impeachment threats, his path remains uncertain.

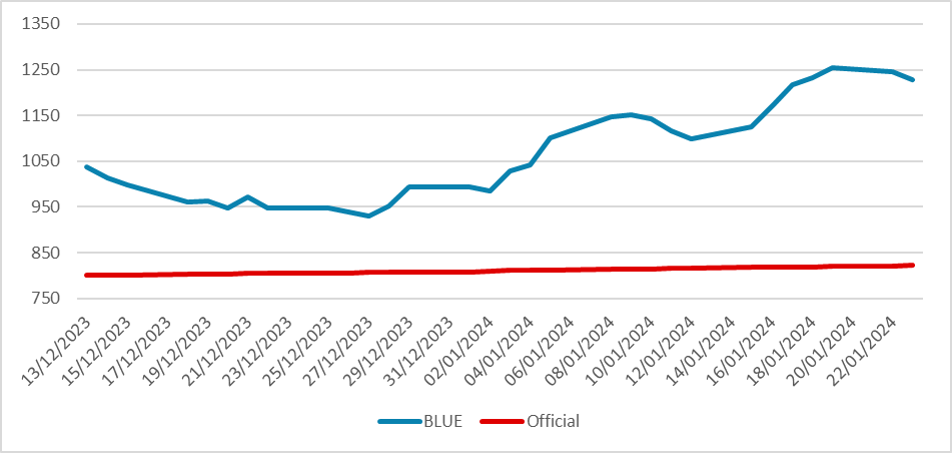

Figure 1: Argentina’s Exchange Rate

Source: BCAR and Refinitv

Despite succeeding in continuing the current deal with the IMF, Javier Milei’s administration will face a bumpy road toward the ultimate goal of stabilizing the Argentine economy. The target to increase net reserves by US $10 billion represents around one quarter of the Argentine Gross Reserve (around USD 40 billion). Although this year's harvest tends to be much better than last year, specialists claim that this target is likely to be too ambitious.

Additionally, two major controversial laws sent to Congress still lack consensus. The ambitious proposals that aim to change over 300 regulations and increase executive power to legislate temporarily over economic laws are currently being discussed in Congress, and it becomes clear that the current government will need to make several concessions for it to be approved, especially the part regarding changing the pensions formula. We add to this cocktail that the opposition is mobilizing social organizations for massive protests against Milei’s government, with a general strike being called for this Wednesday. Although the protests have limited reach, it proves that the opposition will be fierce against Milei's agenda, making the implementation of his policy difficult.

On the inflationary front, preliminary calculations suggest that inflation will continue to rise close to 20% (month over month), and as many public tariffs will be readjusted in February, it is quite possible that Milei will see the CPI rise by 80% in the first three months of his government, affecting especially the poorest. Additionally, the gap between the BLUE (black market exchange rate) and the official exchange rate has widened in recent months, indicating a valuation of the exchange rate. This means that sooner or later, the government will need to apply a new round of devaluation, which in turn causes additional pressure on inflation.

Milei’s administration bets that applying a shock policy rather than the usual gradualism from the past government is the best medicine to stabilize the Argentine economy. However, we argue that those measures are likely to be recessive in the short term, and with an active opposition that will try to undermine the measures of his government, Milei will have a bumpy road toward Argentine stabilization. A situation in which he loses popularity and the Congress tries to impeach him cannot be discarded in the foreseeable future. For the moment, Milei tries to use his fresh popularity to stabilize the Argentine economy at the expense of contraction and an increase in poverty during the first year of his mandate.