Sweden Riksbank Review: Stable Policy Rates for 2026

· Once again the Riksbank kept policy on hold with the key policy rate left at 1.75%. The Riksbank Board remains pleased with the data flow since its last rate cut on Sep 23, though vigilant on both sides. The Board promise of no change for some time to come was repeated, though we feel that the Riksbank projections for GDP and unemployment are too optimistic. Regardless, we still do not see any looming policy reversal, as we see this current policy rate (1.75%) staying in place through 2027, i.e. a little longer than the Riksbank.

· Meanwhile, the SEK has had a good start to the year appreciating against the EUR as well as a weaker USD. Part of the 2026 story is that some fund managers feel that undervalued currencies can catch up with the EUR/USD move last year. However, we continue to prefer the higher yielding NOK and forecast EURNOK to 11.00 by end 2026 and NOKSEK close to parity.

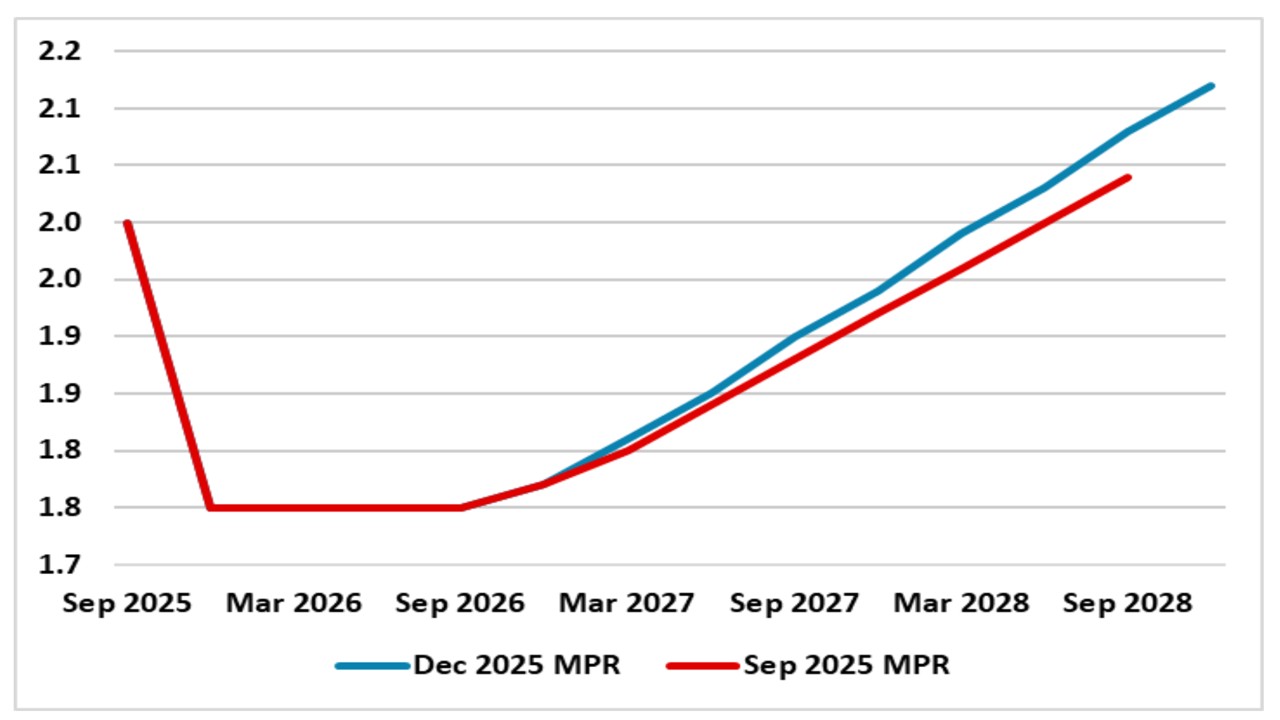

Figure 1: Sweden Policy Rate Projection (%)

Source: Riksbank

The unchanged Riksbank policy rate was very much as expected, but a number of points are worth noting.

· Recent data/Developments. The Riksbank have a view that growth will accelerate in 2026 and the November retail sales/household consumption certainly helps this projection, though the December GDP indicator was -0.6% after the good 0.9% in November. However, this is counterbalanced by the further slowing in the CPIF from 2.3% to 2.1% in November, which was lower than expected. The estimate for CPIF excluding energy (CPIFXE) also surprised to the downside at 2.3% Yr/Yr. To us, the underlying picture is even more reassuring as smoothed adjusted m/m figures (not as prone to volatility via base effects) show most measures of underlying inflation are consistent with the inflation target or below (Western Europe Outlook here). Meanwhile, the U.S. tariff threat over Greenland has been defused for now, but Trump could threaten extra tariffs if as seems likely that the U.S. supreme court will rule partially against reciprocal tariffs.

· Forward guidance. The Riksbank statement recommitted to keeping policy rates unchanged for some time (Figure 1) and money market have a flat policy rate expectations for the remainder of 2026, with close to 50bps discounted in 2027. The Riksbank want the lagged effects of previous easing to feedthrough and we would highlight that credit growth remains soft. Additionally, though the dip in inflation is expected to be partially temporary (VAT cut), the Riksbank will want to watch the underlying inflation and economic picture – we would highlight that some surveys have been less confident about a 2026 GDP acceleration. They will likely lean against any late 2026 rate speculation in the future.

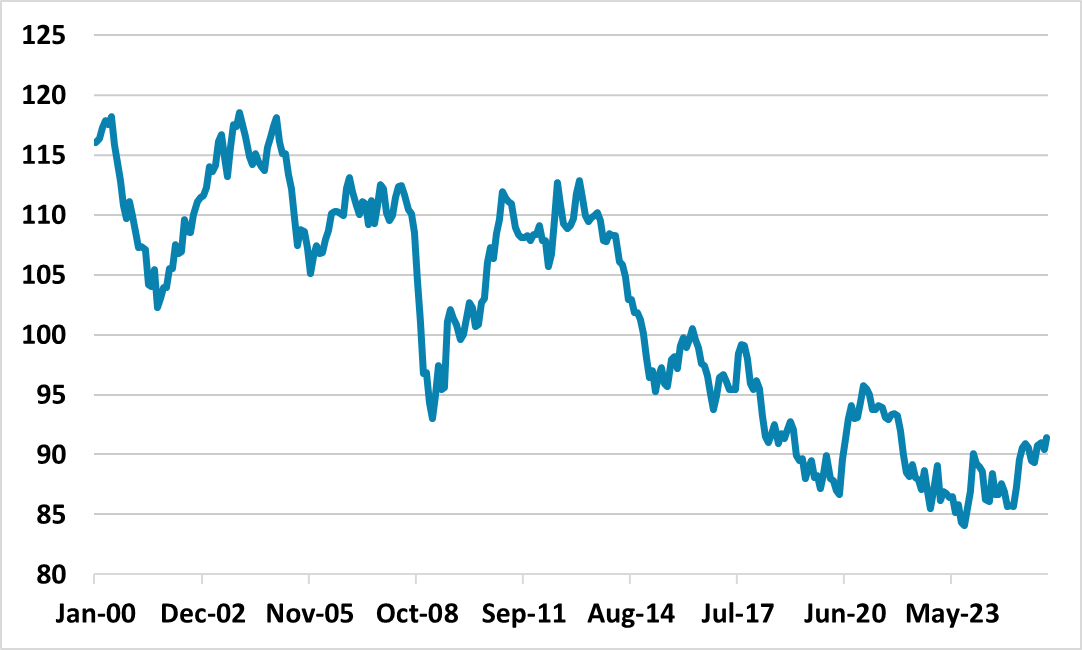

· Rising SEK. The SEK has had a good start to the year appreciating against the EUR as well as a weaker USD. Part of the 2026 story is that some fund managers feel that undervalued currencies can catch up with the EUR/USD move last year. However, though the SEK has been undervalued on a real exchange rate basis (Figure 2), this has tended to be the case in recent years and versus PPP (see DMFX Outlook here). We continue to prefer the higher yielding NOK and forecast EURNOK to 11.00 by end 2026 and NOKSEK to parity.

Figure 2: Swedish Krona Real Exchange Rate (2010=100)

Source: Datastream/Continuum Economics