Brazil GDP Preview: 1% Growth in Q2 is Good News

Brazil's Q2 2024 GDP is expected to grow 1.0%, driven by strong domestic demand and recovery in Services, Construction, and Mining. Despite analysts predicting a slowdown, fiscal stimuli and election-related spending have fueled growth. However, concerns remain whether this growth is sustainable or temporary. The Central Bank may face challenges in resuming the rate-cutting cycle.

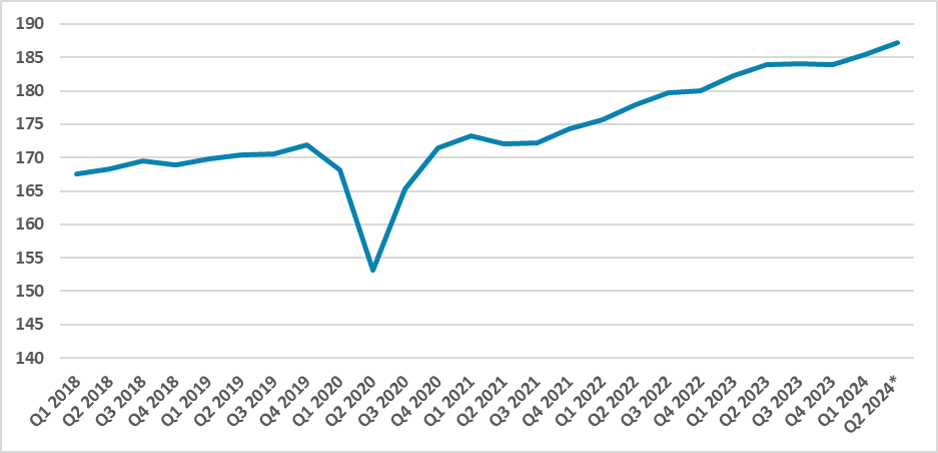

Figure 1: Brazil GDP (Chained Index, Seasonally Adjusted)

Source: IBGE and Continuum Economics

On September 3, the Brazilian National Statistics Institute (IBGE) will release the GDP data for the second quarter of 2024. We expect the Brazilian economy to surprise again, with GDP growing 1.0% (q/q), driven especially by the Services sector and a recovery in Construction, as well as some growth in the Mining and Extractive Industry. Agriculture is likely to be stagnant as a consequence of intense floods in the southern region of the country.

We believe the main driver of growth in Q2 will be strong domestic demand. Although most analysts expected the economy to decelerate during 2024, it seems that many underestimated the impact of the strong fiscal push seen in recent years, with increases in social transfers, a rise in the minimum wage, and the payment of judicial obligations (Precatórios). Unemployment is also reaching historical lows at 6.9%. Additionally, the fiscal push was likely intensified by subnational spending, as municipal elections will be held in October, leading several mayors to increase their spending during the first half of the year.

The question that arises now is whether this higher-than-expected growth was mainly due to the fiscal push or if there has been a structural change that has increased Brazil's potential GDP. It is true that since the 2015-16 crisis, there has been considerable slack in the economy, and only now is this gap closing. This would mean that once the gap narrows, Brazil might return to the slow growth of 1.2-1.5%. Another interpretation is that the effects of structural reforms implemented in recent years are only now materializing. We are still a bit wary of this interpretation, as most of the reforms were related to the fiscal framework, and at the moment, we see little improvement in market confidence in the stabilization of the debt/GDP ratio. Additionally, the labor reforms that were implemented focused on labor flexibility.

In terms of monetary policy, this means that the economy is heating up, which makes it more difficult for the Central Bank of Brazil (BCB) to resume the rate-cutting cycle, although we see no reasons for a hike at this time (here).