Brazil: The Case for a Hike?

Despite the market's push for a rate hike by the Brazilian Central Bank (BCB), we believe the current policy rate of 10.5% is sufficiently restrictive to ensure inflation converges. However, de-anchored inflation expectations, fiscal concerns, strong economic activity, and a new BCB president desiring to show commitment to the inflation targets could potentially push for a hike. We maintain that no further tightening is needed, anticipating that market expectations will shift once global conditions ease.

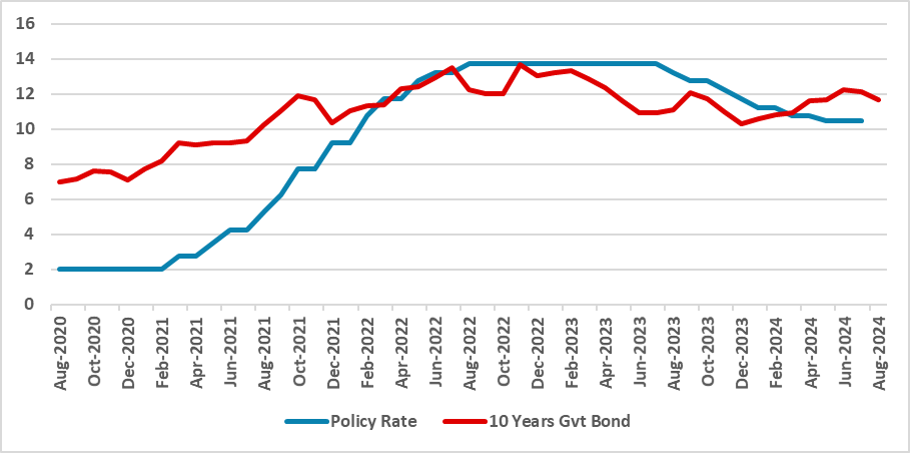

Figure 1: Brazil Policy Rate and 10 Years Government Bonds (%)

Source: BCB and Refinitiv

In recent weeks, there has been some noise in the markets, with some important banks advocating for the Brazilian Central Bank (BCB) to actually hike the policy rate. The BCB has already changed its communication, stating that in the next meeting on September 18, the discussion of a rate hike will be on the table. Below, we highlight the main reasons for a potential hike.

First of all, it is important to state that, in our view, the policy rate is sufficiently restrictive at 10.5%. With the neutral rate varying around the 7.5% mark and inflation running at 4.5%, we believe keeping the policy rate at these levels would be sufficient to ensure inflation converges. However, it seems the market differs from this view.

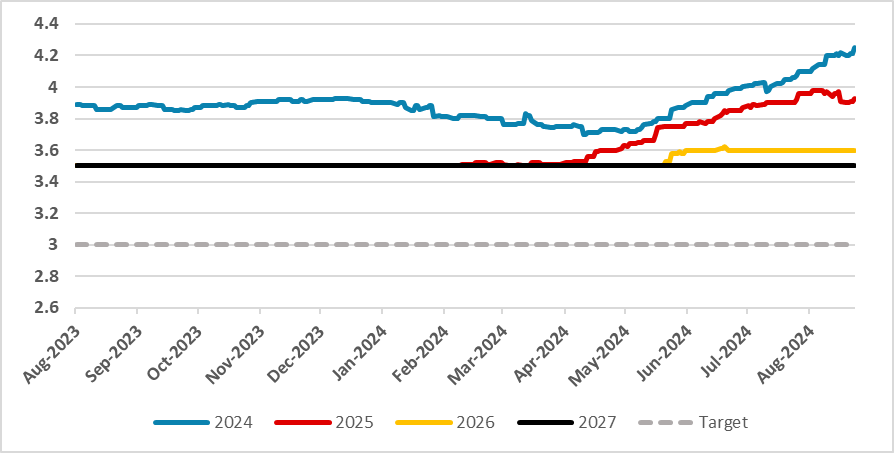

Expectations are clearly de-anchored, even if we look at the long term. The market seems to have never fully embraced a 3.0% long-term target and instead bets on 3.5%. Still, this situation hasn’t changed much in recent months, and considering a hike now, when just three months ago cuts were being proposed, indicates a substantial change in the outlook. What has actually increased are the inflation expectations for the end of 2024 and the end of 2025, which could be viewed as just a response to higher oil prices, with little influence from monetary policy.

Figure 2: Brazil Inflation Expectations (%)

Source: BCB

Source: BCB

Fiscal policy has also been an area of concern as it increases long-term premiums. Internally, there has been a lot of noise around the sustainability of fiscal policy. Clearly, the government has some aversion to applying cuts, although some contingency measures were seen this year. However, we view the situation as far from catastrophic. The government has been making efforts to increase revenues and achieve the proposed target, and expectations now are that a 0.5% of GDP deficit will be seen in 2024, aligned with the upper bound of the government target.

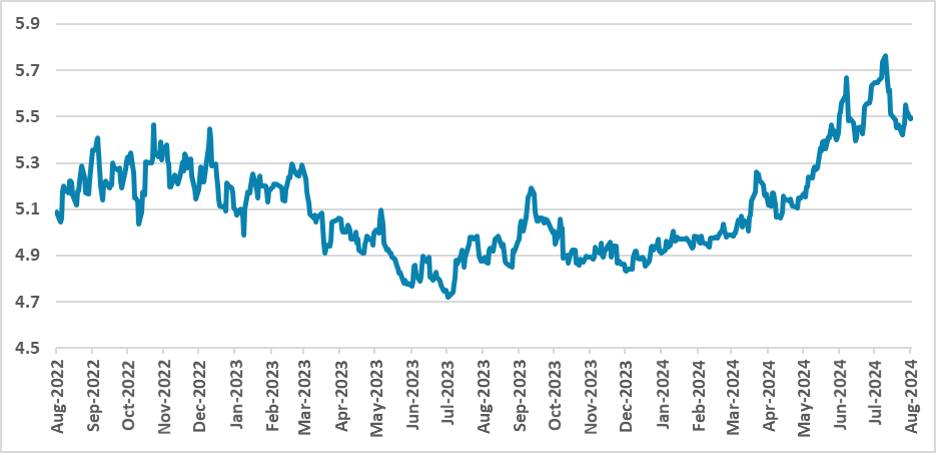

Figure 3: BRL/USD

Source: BCB

The most critical issue has been economic activity. The Brazilian economy is once again surpassing expectations, with the unemployment rate falling and growth expectations being revised upward. With the economy heating up, a situation of mismatch between supply and demand could emerge, which, of course, might necessitate some rise in the policy rate. Another critical factor is the recent devaluation of the exchange rate, which could prompt inflationary pressures. However, the mechanisms through which exchange rate devaluation and higher growth pass through to inflation are not automatic, and the pace of this transmission is unclear. We still believe more time is needed to evaluate these risks.

Finally, another important factor is the appointment of the new BCB President. Gabriel Galipolo, a member of the board, is currently the favorite to assume the post, and there have been some market fears that he could be seen as a representative of the government, which favors lower interest rates at the expense of controlling inflation. In recent interviews, however, Galipolo has taken a more hawkish view on inflation, and a possible hike could be seen as a way to demonstrate his commitment to maintaining low inflation rates.All in all, we still hold the opinion that the policy rate is already sufficiently tight and that there is no need for further tightening to lower inflation within the relevant horizon. However, views are changing, and the market is moving toward the expectation of higher policy rates. We believe some of these views will be reassessed once the Fed begins easing and general conditions in the global markets are less tight, supporting our view of no hikes in 2024.