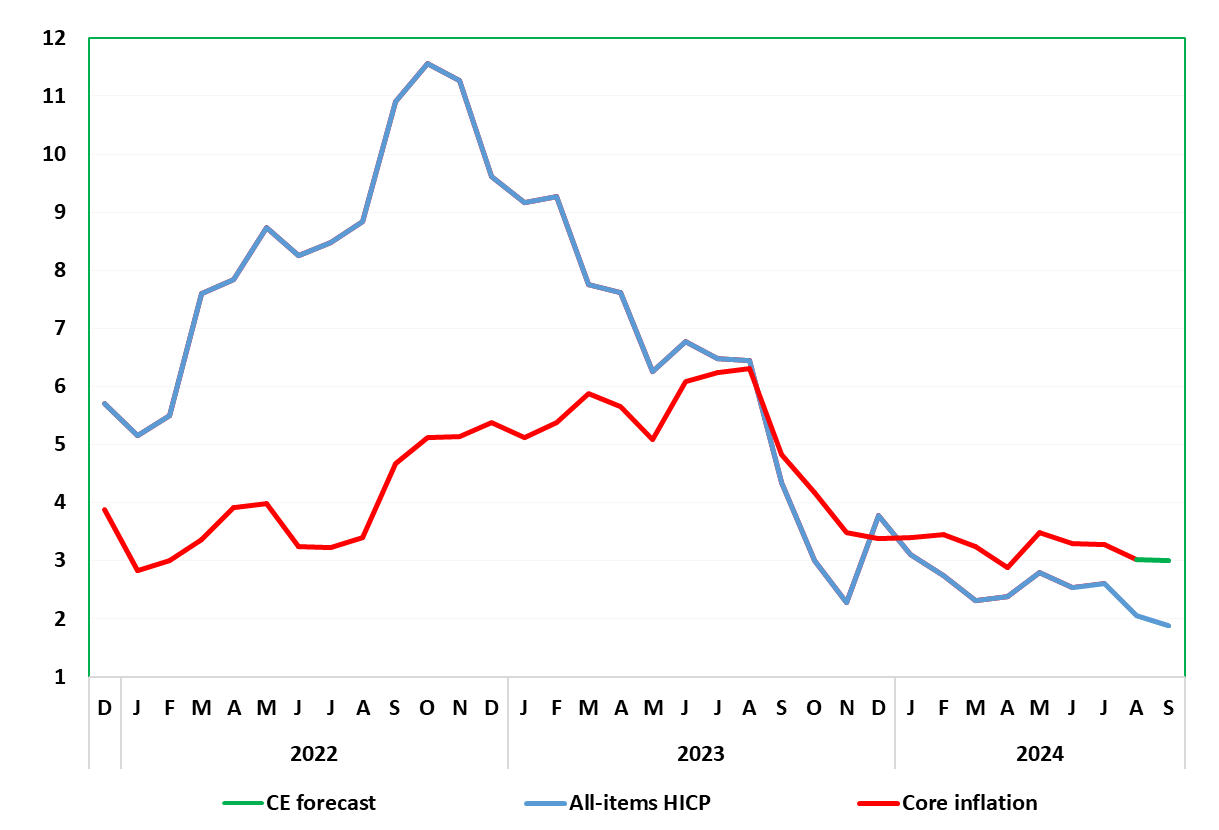

German Data Preview (Sep 30): Inflation Under Target?

Germany’s disinflation process continues. After July saw the headline HICP rate rise and unexpected 0.1 ppt to 2.6%, unwinding a third of fall seen in June, it plummeted this month to a 41-month low of 2.0% in August, ie consistent with the ECB target and well below expectations. Indeed, the CPI counterpart actually fell a notch below 2%, albeit with the core rate on this basis down just 0.1 ppt. We see the HICP rate echoing this fall in September with a drop to 1.9%, helped by lower fuel prices. This may be short-lived but even amid what may be another month of resilient services inflation and no further fall in the core rate, survey data are pointing not only to more real economy weakness but significant falls in cost and output price pressures.

Figure 1: Inflation Under Target?

Source: German Federal Stats Office,

Details show stable services but with more negative energy and slightly higher food inflation all consistent with the core rate falling 0.3 ppt in August to 3.0%. Regardless, looking ahead, the disinflation trend is seen continuing in the next 2-3 months, mainly due to slower core goods and energy prices. Even so, while headline inflation is now at 2% it may perk back towards 2.5% by end-year due to energy base effects. The ECB will have to take note although the hawks on the Council will point to still apparently resilient services inflation, but where the doves may counter by pointing to recent much softer wage inflation news and real economy signals. Indeed, PMI survey data pointed to both.

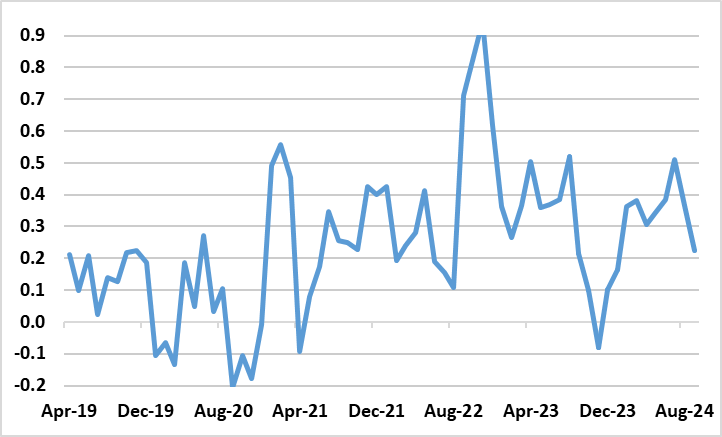

Figure 2: Adjusted Core Rate Falling Afresh?

Source: German Federal Stats Office, CE

The September survey noted a considerable softening of cost pressures across the German private sector. Input price increases in the service sector slowed notably to the weakest in over three-and-a-half years and only just exceeded the long-run average seen before the pandemic. Manufacturing purchasing costs meanwhile fell at the quickest rate for six months, driven down by weaker demand for inputs and lower commodity prices, particularly steel. Similarly, a slower rise in service sector output prices – the weakest since April 2021 – was seen alongside a solid and accelerated reduction in factory gate charges. Measured across the two sectors combined, the rate of output price inflation was at a 44-month low and broadly in line with the pre-pandemic trend. Such signs echo the softer signs seen in adjusted HICP terms (Figure 2) suggested the core is back around circa-target strength (Figure 2).