Brazil CPI Preview: 0.7% in February will likely be only a Transitory Problem

IBGE will release February's CPI data on Mar. 12, forecasting a 0.7% increase, driven mainly by education and food sectors. While some rises may persist, they're not indicative of a general price surge. Despite a 0.7% rise, Y/Y CPI is expected to drop to 4.4%, aligning with BCB targets. Forecasts suggest a gradual decline in CPI, with a slight rebound later in 2024 due to seasonal factors.

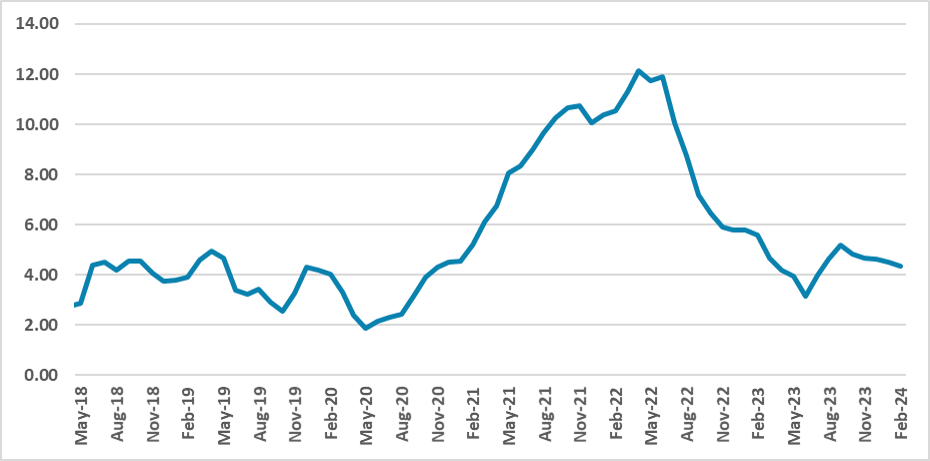

Figure 1: Brazil CPI (Y/Y, %)

Source: IBGE and Continuum Economics

The Brazilian National Statistics Institute (IBGE) will release the CPI data for February on Mar. 12. We forecast the CPI to have increased by 0.7% in February. Most of the rise will be concentrated in the Education group. Most educational institutes readjust their tuition in February, coupling with the past 12 months' inflation. We forecast the education CPI to grow by 5% during the month. Another significant rise is likely to occur in the food and beverages groups, which are expected to grow by 1.0% in the month, and Transports, which are likely to grow by 0.5%.

Most of the rise in February could be considered transitory. Some impact of El Niño is likely to affect the harvest of rice and bananas, influencing the rise in food and beverages. Although some increases in this group could possibly continue in the next months, we don’t see this trend as indicative of a generalized rise in prices. The effects of monetary policy will continue to be felt in the economy, contributing to a better-behaved CPI.

Despite the 0.7% rise, the year-over-year (Y/Y) CPI is likely to drop to 4.4% from 4.5% in January, which is just inside the BCB target bands (1.5% - 4.5%). We forecast the Y/Y CPI to continue falling in the next months, which corroborates our view that the BCB will not conduct any sort of pause in the cuttings, but rather will reduce the pace to 25bps from 50bps. In the second half, the CPI is likely to rebound a bit due to seasonal and basis effects. Our year-end forecast for the CPI in 2024 stands at 4.1%, slightly above market expectations (3.8%), as we see the rise in wages putting some pressure on consumer prices during the year.