Canada August CPI - Strengthens the case for accelerating the pace of BoC easing

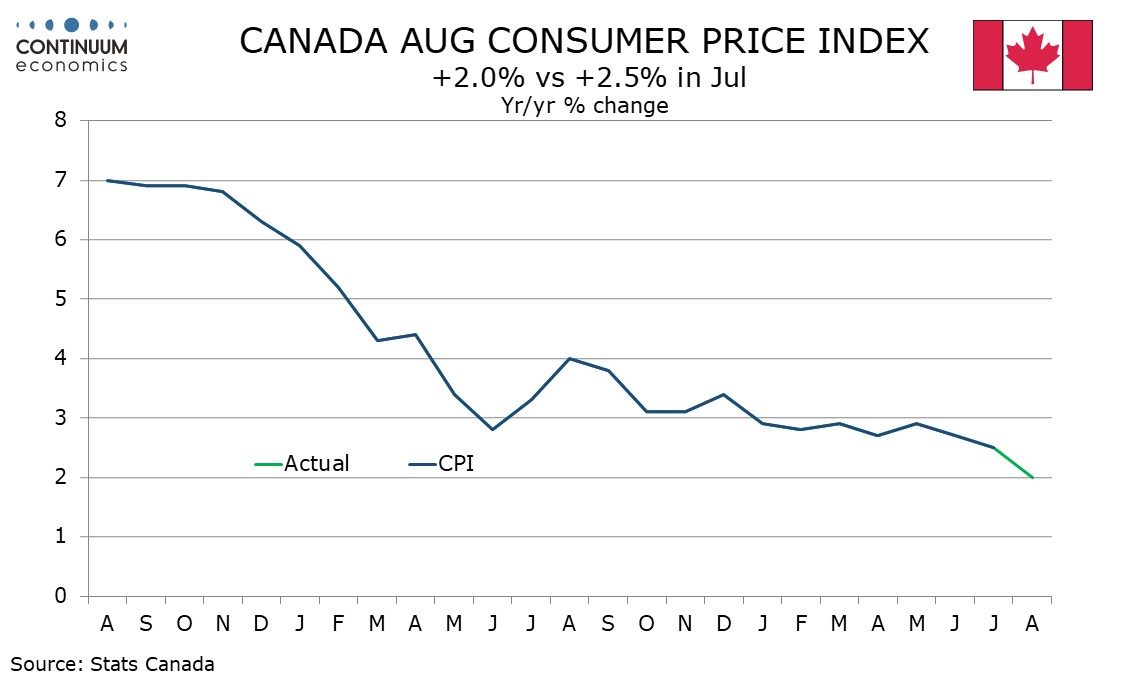

August Canadian CPI looks clearly subdued, with the headline of 2.0% from 2.5% back on the Bank of Canada target and the BoC’s core rates all slowing and now averaging only a little above the target.

This is likely to increase the conviction at the Bank of Canada that as inflationary worries fade focus can move more to downside economic risks, significant following recent reports that BoC Governor Macklem is open to accelerating the pace of rate cuts after three straight moves of 25bps.

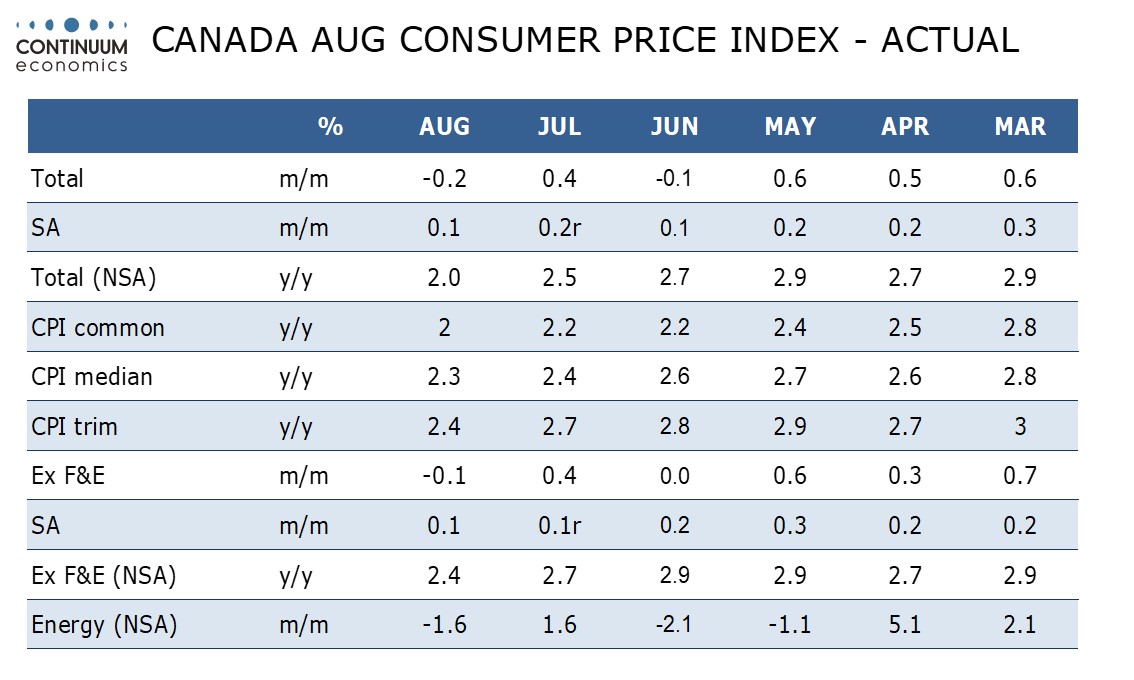

On the month CPI fell by 0.2% unadjusted though rose by a modest 0.1% seasonally adjusted. Ex food and energy CPI fell by 0.1% unadjusted and rose by 0.1% seasonally adjusted, the latter for a second straight month given a downward revision to July. This suggests trend could even be falling below the target pace.

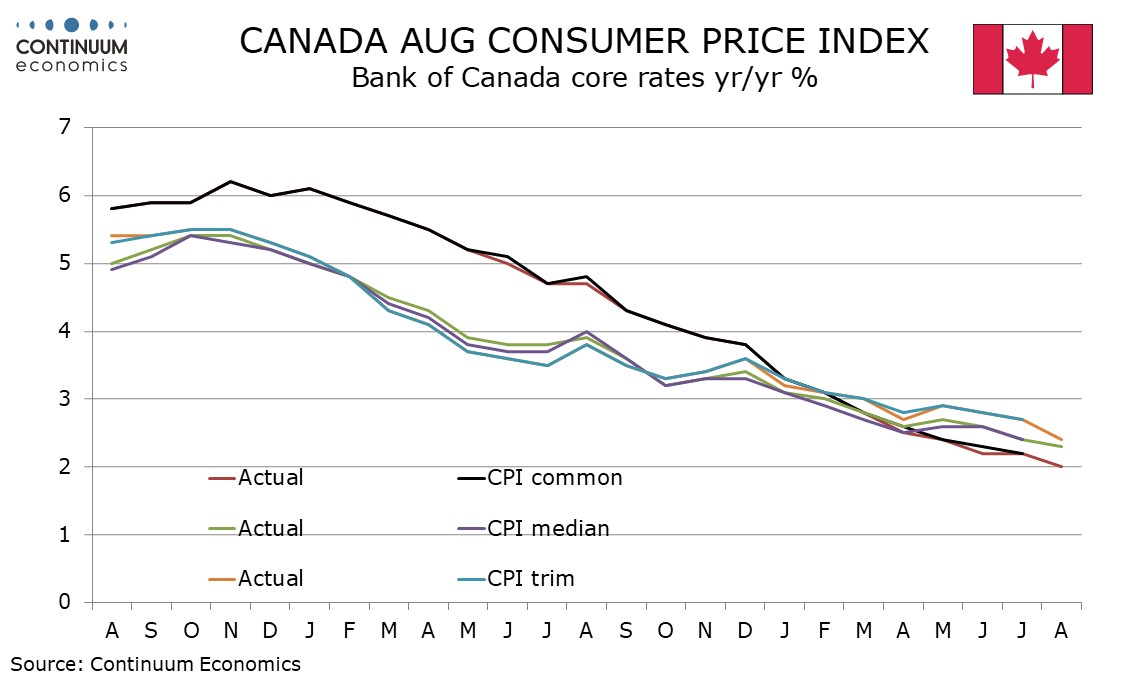

Ex food and energy CPI is not one of the BoC’s core rates, though all of these fell, CPI-common to 2.0% from 2.2%, CPI-median to 2.3% from 2.4% and CPI-trim to 2.4% from 2.7%, CPI-trim consistent with ex food and energy CPI and the others softer still.

Shelter remains an area of relative strength, up by 0.4% in the month seasonally adjusted and by 5.3% yr/yr, which shows that elsewhere the data is looking very soft indeed. Canadian data, be it on prices or activity, is looking softer than that of the US, meaning a stronger case exists for 50bps easings in Canada than in the US.