GBP, USD flows: Little impact from UK GDP, USD steady

GBP marginally softer after August GDP comes in as expected. USD stable

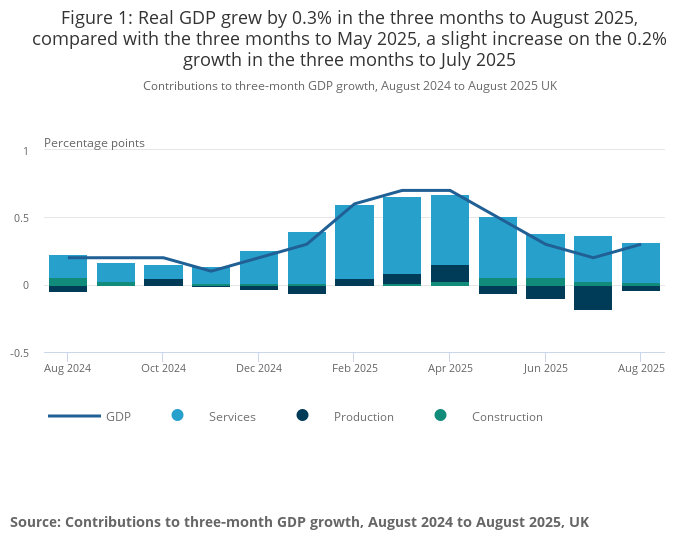

EUR/GBP is very slightly firmer after this morning’s August GDP data came in in line with consensus at 0.1% m/m. The 3m/3m trend remains fairly solid at 0.3%, and a flat number in September would see Q3 growth at 0.2% q/q. This is still stronger than the Eurozone performance, and is unlikely to convince the BoE that there is any urgent need for rate cuts, with inflation still well above target. EUR/GBP has edged a little higher, but is struggling to move far away from the 0.87 level. The year’s high above 0.8760 remains out of reach for now.

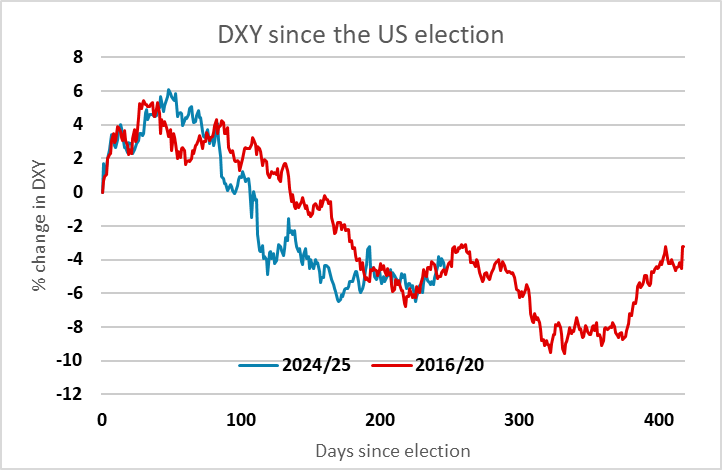

FX markets in general remain fairly quiet, with the USD edging a little lower over the past couple of days following the gains of the last few weeks. The path since the November election remains very similar to the path in the first Trump term starting in 2016. The central bank meetings at the end of the month look like the most likely disruptor of the current calm, although there will be US CPI data released next week despite the government shutdown which could influence market expectations of the Fed. The Japanese political situation is also a potential market mover, with the make-up of the next government still uncertain.