ECB Review: Policy Still Restrictive

It was always likely that the ECB verdict at this month’s Council meeting would be less resounding than that seen in December. A fifth 25 bp discount rate cut did occur, to 2.75%, but may not have seen any demand to at least consider a larger move as was the case last month. But the door is left open for further cuts as the disinflation process remains on track so that inflation will settle at around the target on a sustained basis. Moreover, the ECB stressed monetary policy remains restrictive – the latter may not be something the hawks would agree with! Little was made of the weaker real economy, with it not being acknowledged that an inflation backdrop that was in line with expectations had actually come about amid a much weaker growth backdrop in the last few months. Given that weakness and the economic headwinds the ECB sees existing implies around three more 25 bp cuts in H1 this year, with an ensuing around-neutral 2% policy rate resulting.

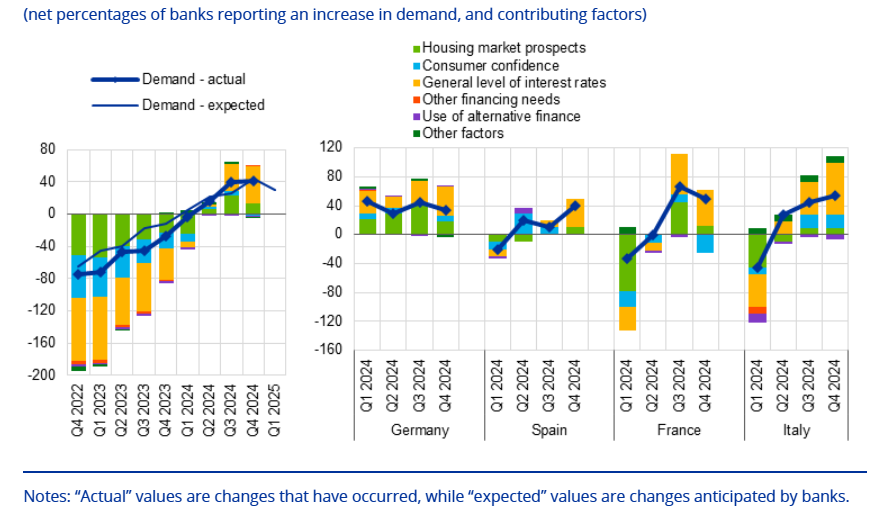

Figure 1: Improving Household Loan Demand Reflecting Better Interest Outlook?

Source: ECB Jan 2025 Bank Lending Survey

Considerations for Next ECB Meeting

As the account of the December 11-12 Council meeting noted, a minority of the Council wanted a 50 bp move. Such demands were seemingly not repeated this time around. Regardless, given the highlighting of policy still being restrictive, a further move at the next meeting March looks even more on the cards. At that juncture, and extrapolating from recent less-soft survey data and assuming further improved credit demand signs suggesting policy easing is filtering through (Figure 1), the ECB may possibly then consider changing its rhetoric. It may then suggest additional rate cuts will arrive either slower and/or have to be more data driven. The potential presentational problem with any such shift in guidance is that the ECB may have to pare back its growth projections once again in March and maybe markedly and durably so. This would reflect the risks of tariffs and an ensuing trade spat as well as economic divergences with the EZ accentuated by political uncertainty that could yet lead to financial market tensions, all meaning economic risks remain to the downside.

ECB Assessing Neutrality More Openly

However, the ECB may respond by being more explicit that policy after an assumed 25 bp March cut would be hardly restrictive but this too poses presentational problems as the Council would have to be more explicit as to what constitutes a terminal if not a neutral outcome. It is clearly the case that the ECB is discussing what constitutes a neutral rate and more openly. Indeed, earlier this month President Lagarde overtly described a neutral rate as being between 1.75% and 2.25%, a little lower than she had hinted previously and at odds with what some Council hawks have suggested – ECB economists are due to publish a paper regarding where so-called r-star ranges may currently be according to various models on Feb 7.

Regardless, we still think that the economy will undershoot ECB thinking and inflation (even for services) is already behaving as it is at target – if not below. But if the ECB regards the Q4 data as being history and merely short-term stagnation, we suggest that the flat quarterly reading reflects actual m/m declines in late Q4, thereby highlighting a clear loss of momentum into the current year that chimes with weak business survey data. Moreover, GDP numbers continue to suggest an EZ economy that is still diverging as Germany and now France stutters while Spain prospers, with EZ survey data suggesting that political uncertainty is now affecting economic prospects and accentuating growth disparities

All of which implies around three more 25 bp cuts in H1 this year, with an ensuing around-neutral 2% policy rate. But as suggested above it is possible that amid a continued sub-par growth outlook into 2026, then further easing may be on the cards into 2026, especially if the policy stance remains restrictive as the ECB if forced to continues to review and pare back estimates of policy neutrality.