FOMC Minutes from September 18 - Agreement on the economy, some debate on the decision

FOMC minutes from September 18 generated little response from the markets. A substantial majority favored the 50bps easing that was delivered though some would have preferred a 25bps move and a few others indicated they could support such a decision, though there was only one dissenting voter, Governor Michelle Bowman. Others backing 25bps appear to have been non-voting regional Fed presidents.

There was more agreement on the economy, with almost all seeing lower inflation risks and higher risks to the labor market, with risks now seen as roughly in balance. Almost all saw recent monthly inflation readings as consistent with target inflation, and had greater confidence on inflation moving sustainably to 2%. Slowing wage growth was noted by several. The discussion on the labor market was less clearly dovish, with agreement that conditions were at or close to maximum employment, but further labor market cooling was not seen as needed to return inflation to target. The labor market was seen remaining solid under the baseline economic outlook but some noted risk had increased for a more serious deterioration.

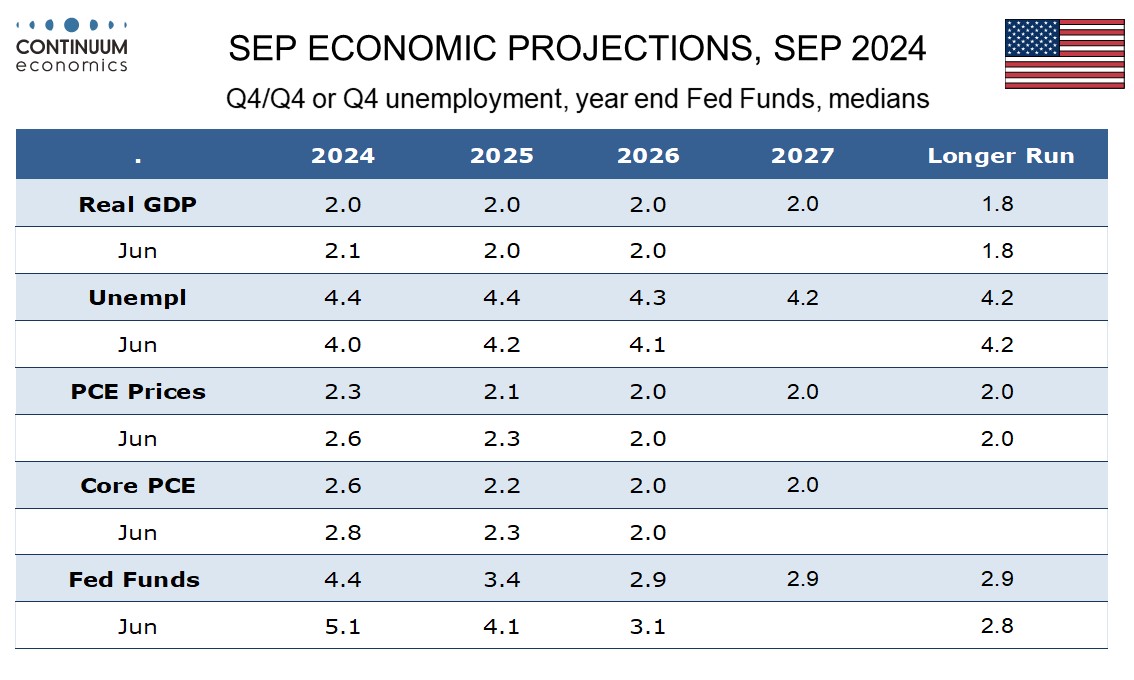

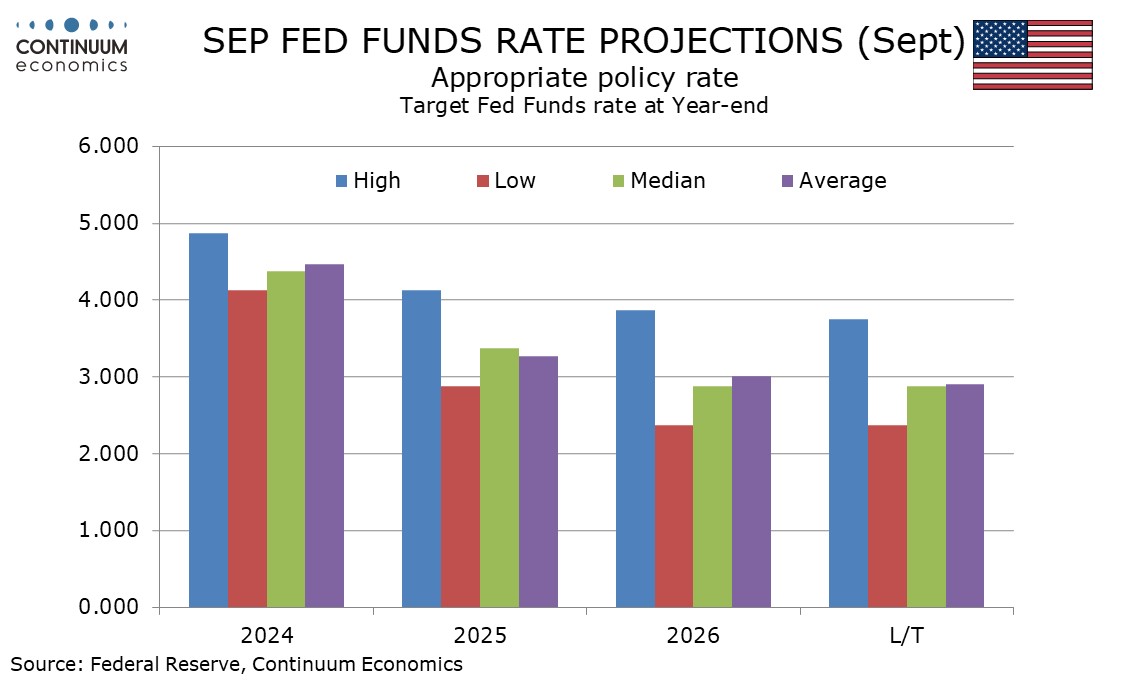

A 50bps move was seen as bringing policy better into line with recent inflation and labor market indicators with some noting that there had been a plausible case for a 25bps move at the previous meeting. Those suggesting a 25bps move noted that inflation was still somewhat elevated, growth was solid and unemployment still low. It was also seen as signaling a more predictable path of easing. Participants emphasized that the 50bps move should not be seen as evidence of a less favorable economic outlook or a signal that the pace of easing would be more rapid than participants’ assessments of the appropriate path. That some emphasized the risks or easing too late or too little but several noted the risks of easing too soon or too much shows that the Fed remained cautious about the pace of future easing.

Since the meeting downside risks to the economy are probably seen as somewhat less given a strong non-farm payroll for September and upward revisions to incomes in the GDP revisions reducing downside risks to consumer spending. There was also relief that core PCE prices for August came in softer than a slightly disappointing CPI. Near term data could be hit by Hurricanes Helene and Milton but the Fed is probably feeling comfortable with both the underlying labor market and inflation pictures. That suggests a gradual pace of easing, around 25bps per meeting, with less requiring unexpectedly strong data and more requiring unexpectedly weak data.