U.S. January Employment - Labor Market Regaining Momentum

The two numbers that caught the most attention in January’s employment breakdown, a 353k increase in non-farm payrolls and a 0.6% surge in average hourly earnings, may be somewhat overstated. However the labor market is clearly strong with some recent increase in momentum, while historical revisions leave the 2023 picture looking stronger than was previously thought.

Strong if possibly overstated

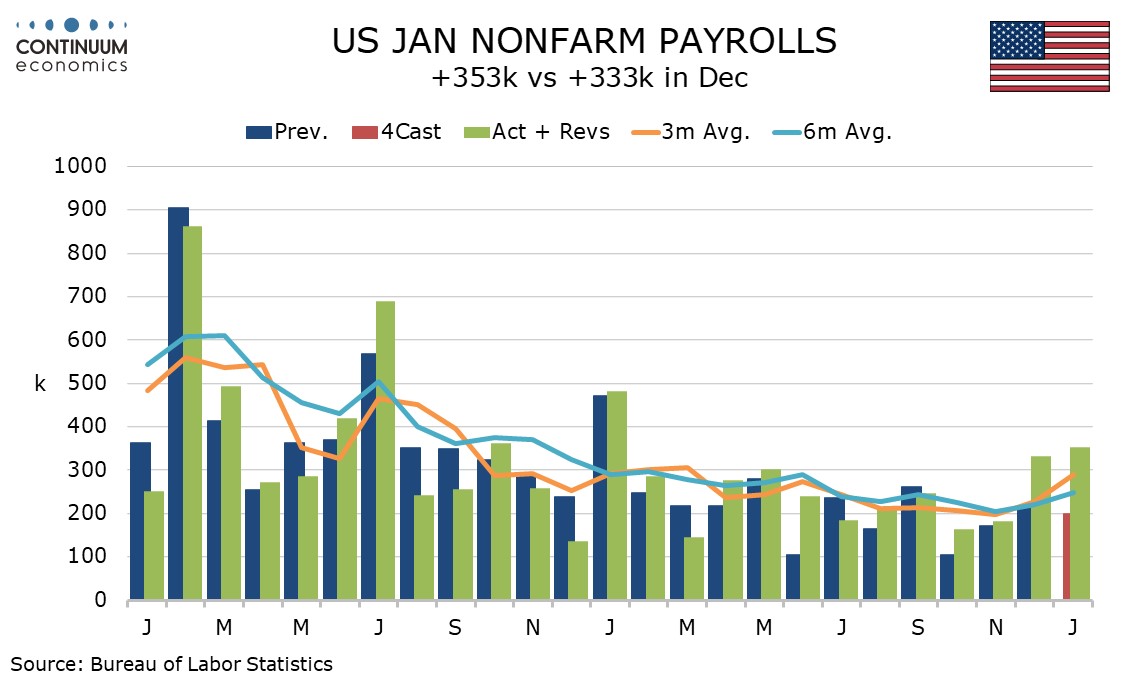

January non-farm payrolls see strong positive seasonal adjustments to compensate for the impact of winter weather. January 2023 with a rise of 482k that was the highest in six months and has not been beaten since was even more clearly above trend than the latest release. However January 2023 saw unusually mild weather which was not the case in January 2024.

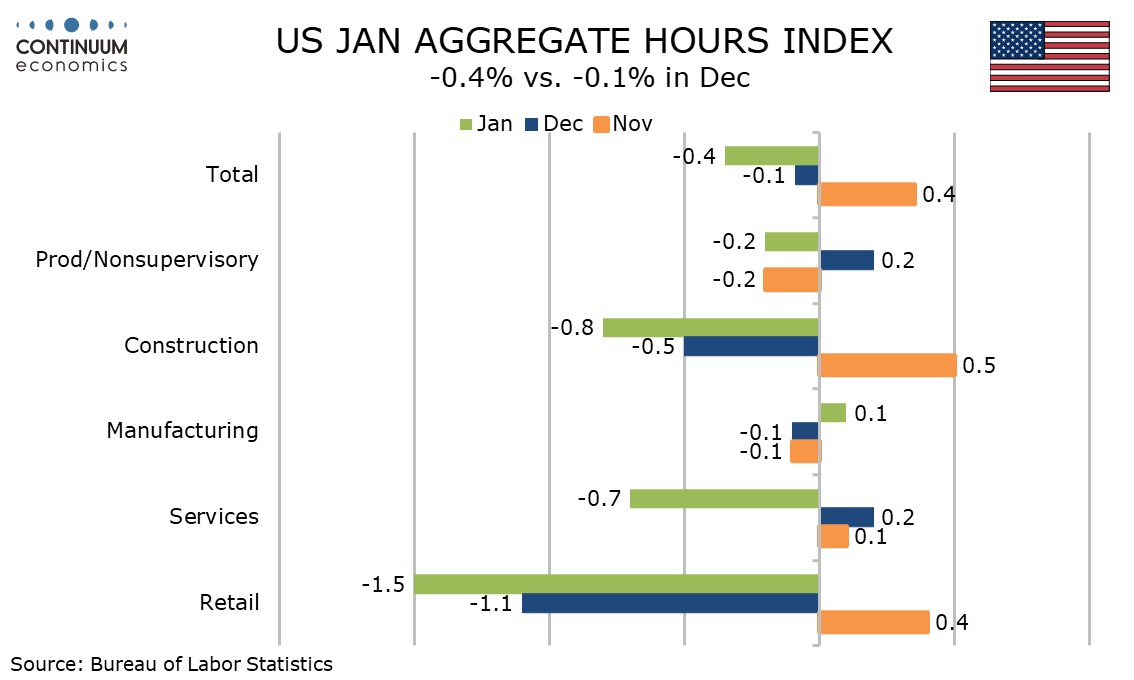

A significantly below trend workweek at 34.1 hours (the preceding ten months were either 34.3 or 34.4) suggests that the latest payroll strength may have come despite harsh weather. The payroll increase was also not inflated by leisure and hospitality, which was actually on the low side of trend with a rise of only 11k. Sectors most clearly above trend are not among the more sensitive to weather, education and health at 112k, professional business at 74k and manufacturing at 23k. The dip in the workweek does show weather sensitive sectors, notably retail and construction, particularly weak. A 0.4% fall in aggregate hours worked suggests that activity data for January will generally not be as soft as the payroll.

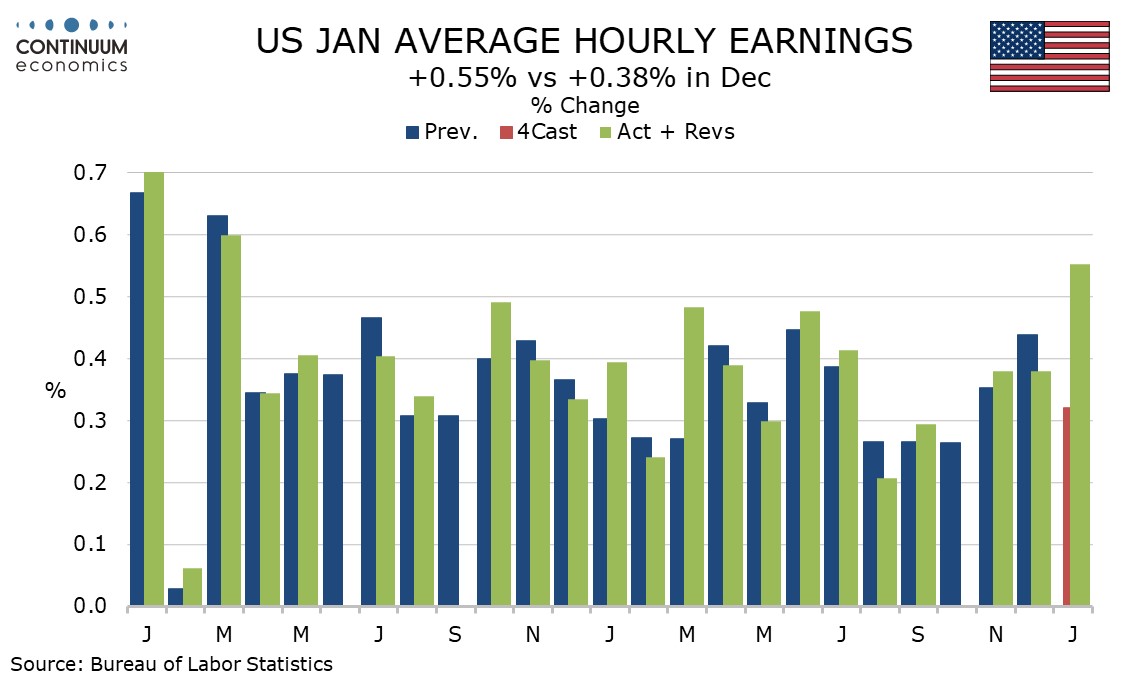

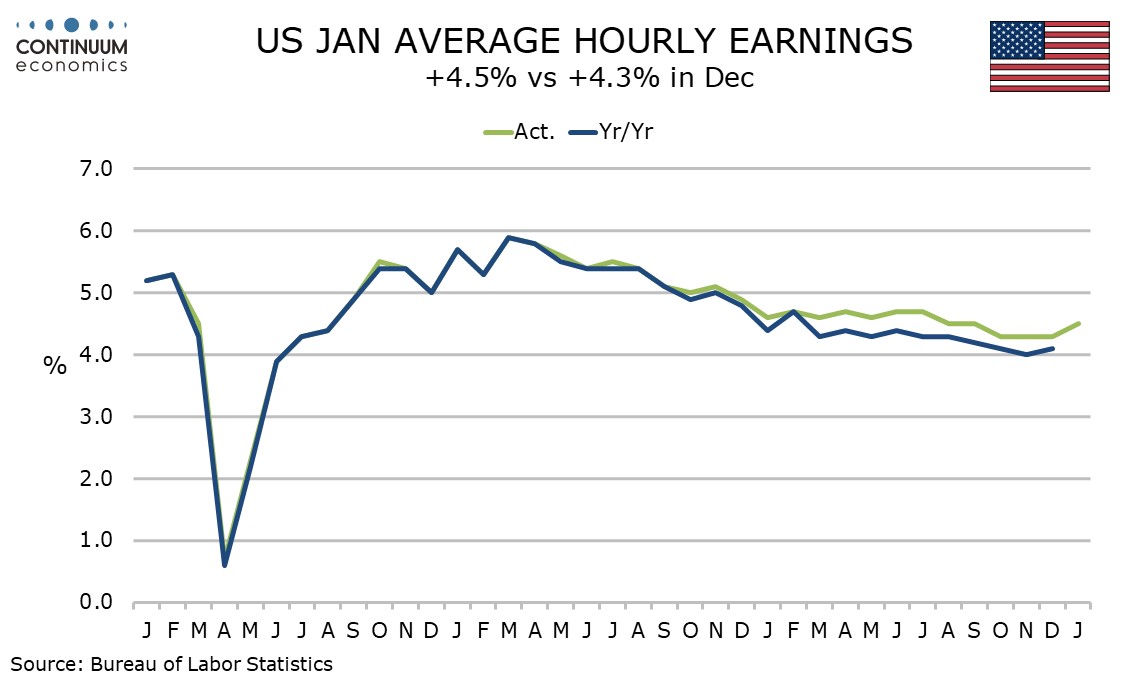

The fall in the workweek may have inflated the average hourly earnings figure, which was up by 0.553% before rounding, still the highest since March 2022. The details show services at 0.64% outpacing goods at 0.20%. Construction was relatively strong within the goods breakdown but retail was relatively weak in the service sector detail, where professional and business and education and health, both of which saw string employment gains, were the strongest sectors. This detail suggests the weaker workweek is not the full story behind the strong average hourly earnings gain.

Upward revisions matter too

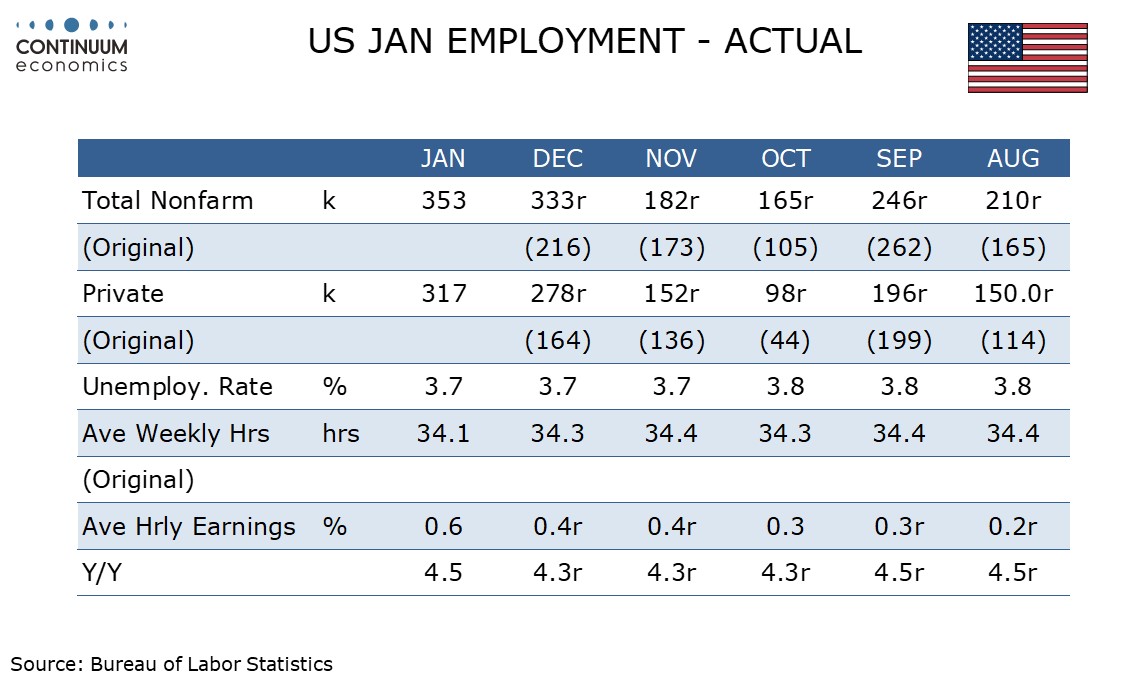

The January report sees historical revisions, and the March 2023 level was revised down by 266k, a slightly smaller negative benchmark revision that the -306k that had previously been signaled. Since March however the revisions have been mostly upwards, with November’s level almost unrevised, and December’s payroll seeing particularly sharp upward revision to 333k from 216k. The upward revisions came as a surprise to us, given that through 2023 before the revisions most reports had seen a bias for downward revisions to the preceding two months, usually the only months that see revisions.

Back month revisions to average hourly earnings are also positive, with December’s yr/yr pace revised up to 4.3% from 4.1% and January stronger still at 4.5%. On a monthly basis it was mid-2023 that saw the strongest upwards earnings revisions.

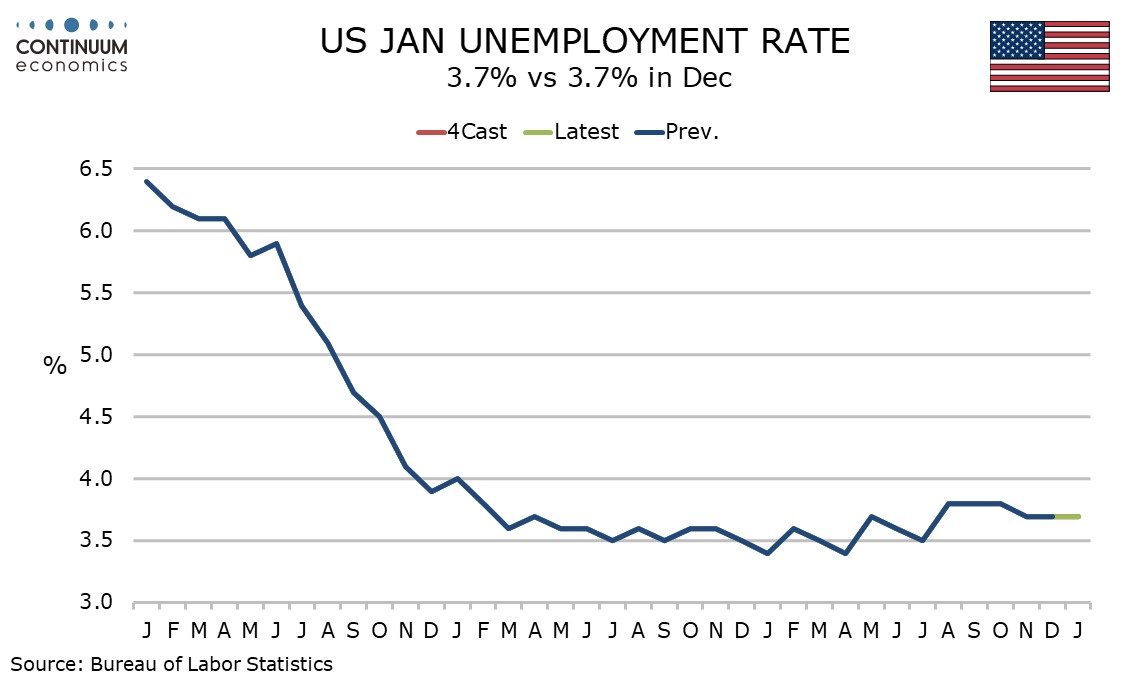

Unemployment saw its historical revisions with December’s report, which were minimal. January’s unemployment rate came in at 3.7% for a third straight month, these coming after three at 3.8%, and was lower than expected. Detail, after adjustment for population control adjustments, showed the labor force up by 124k and employment up by 239k, the latter not as strong as the non-farm payroll though with employment outpacing the workforce the rate fell to 3.66% from 3.74% before rounding, reaching a 6-month low.

Fed will note but need not rush to judgement

At this week’s post-FOMC press conference, Chairman Powell put more emphasis on falling inflation and did not express concern about strength in activity. However the strength seen in the data does suggest that the Fed’s shift towards a less hawkish stance may be giving the economy support that it does not need, and could even call the further improvement in inflation that the Fed wants to see into question. The Fed has one more non-farm payroll to look at before it meets in March, as well as two CPIs and historical revisions to 2023 CPI data on February 9, so it need not rush to judgment on this data. We are aware that the FOMC focused less on the unexpectedly strong Q4 GDP increase than we had expected at its latest meeting. Easing is however likely to require signs of labor market acceleration fading as well as continued progress on inflation.