Canada January GDP - Q1 looking much stronger than BoC had expected

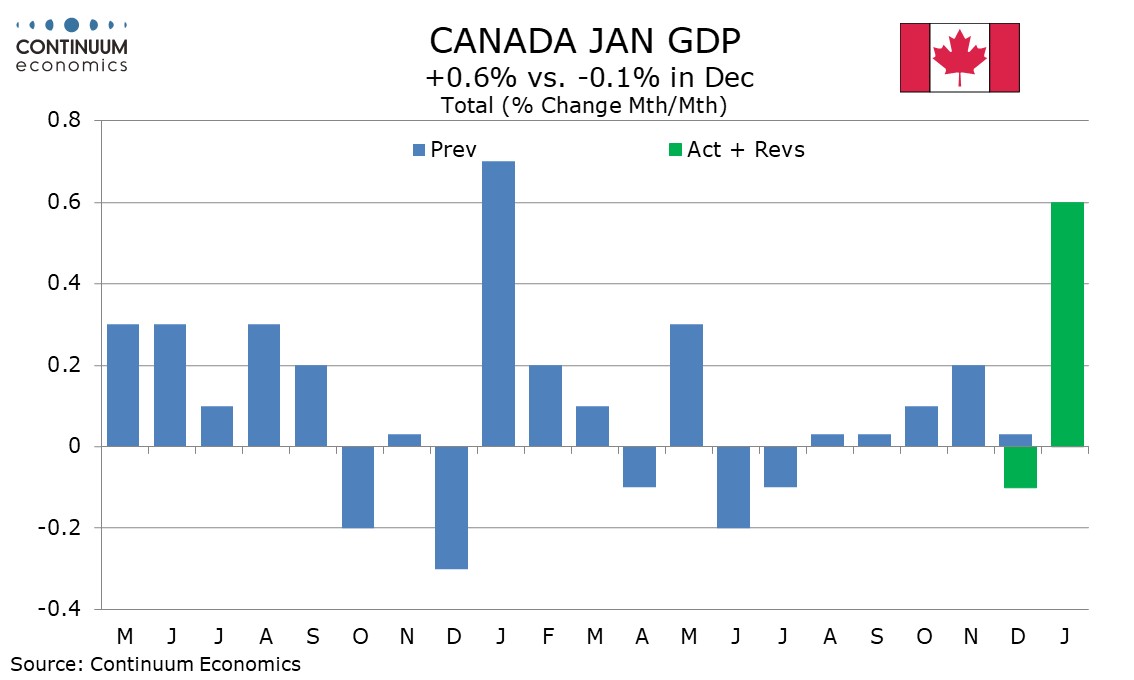

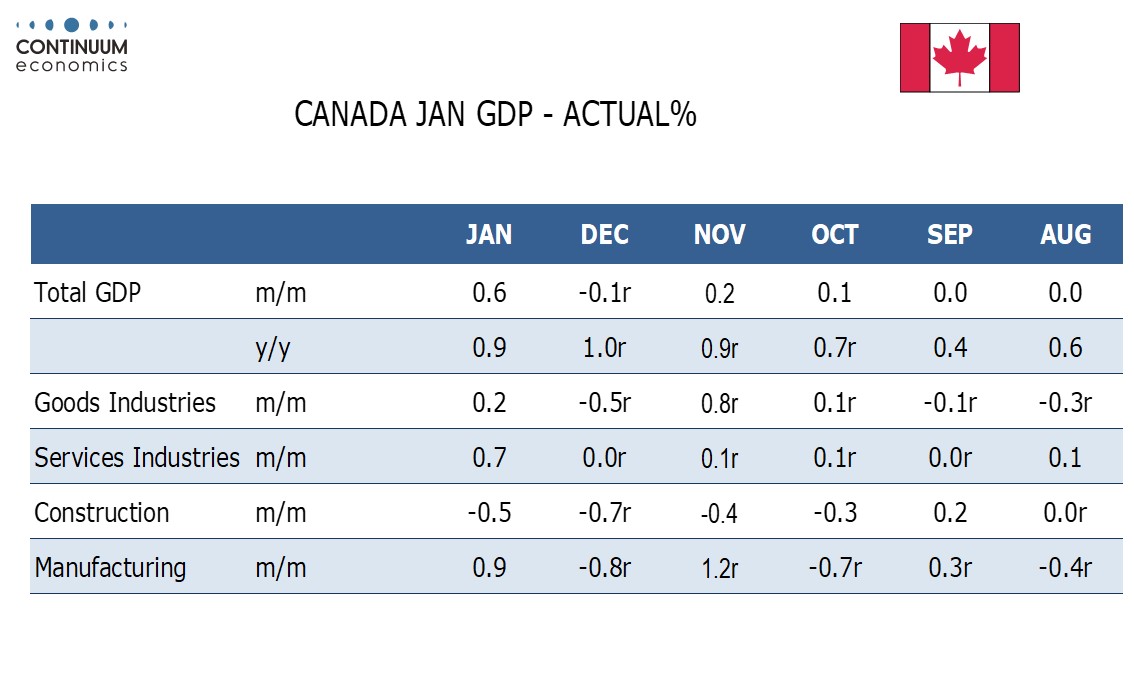

Not only did January Canadian GDP with a 0.6% rise exceed the preliminary 0.4% estimate, in data assisted by the end of a strike, the advance estimate for February is strong too with a rise of 0.4%. If that proves correct even an unchanged March would leave Q1 up by 3.5% annualized, well above the BoC’s 0.5% estimate made with January’s monetary policy report.

This data makes it almost certain that the April 10 Monetary Policy Report will see a substantial upward revision to the BoC’s GDP forecast and the accompanying policy statement will reflect that. Despite encouraging inflation data in January and February (March data will not be seen until April 16) the BoC now seems unlikely to move in a dovish direction at its April 10 meeting.

Januarys GDP increase was assisted by a 1.9% rise in the public sector that reversed two straight declines due to a strike in Quebec, and this added 0.4% to the GDP gain, making the overall rise less impressive, though also showing that the 1.0% annualized gain in Q4 was misleadingly low.

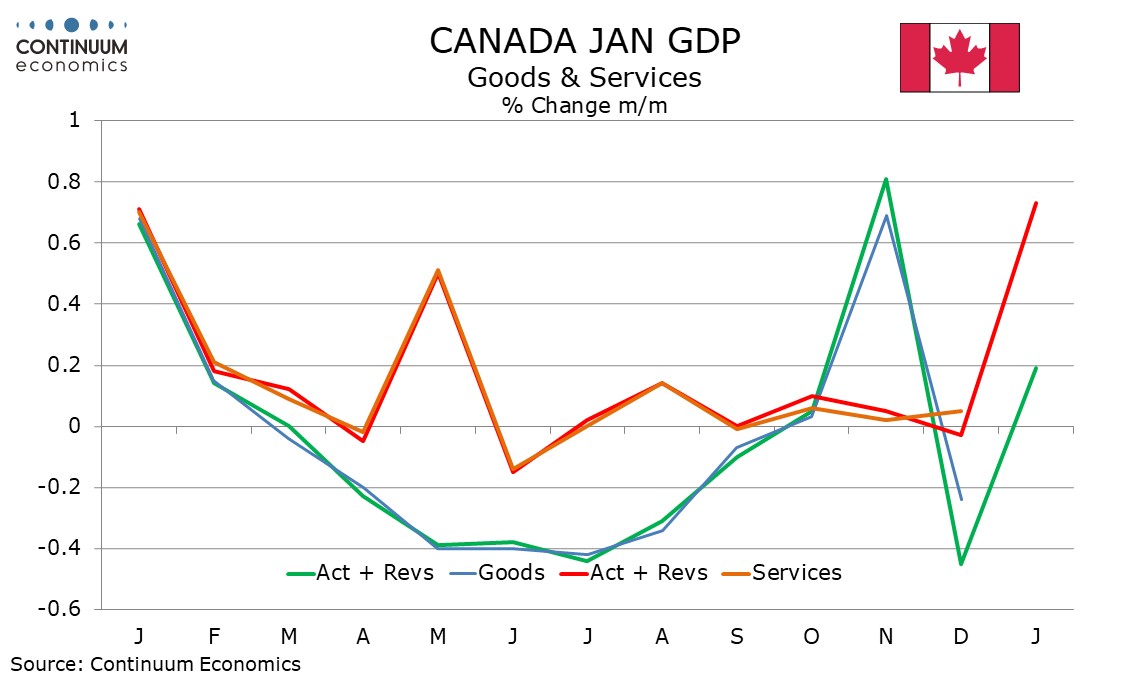

Goods GDP rose by 0.2% led by utilities which may reflect cold weather. Manufacturing reversed a December decline but mining and construction were weak. Services GDP rose by 0.7% but 0.4% of that came in education and 0.1% in health, sectors that were impacted by the Q4 strikes. It appears that GDP rose by 0.2% outside the strike impacted sectors. The February increase is seen as broad based outside a decline in utilities, and that is a more positive signal than the January detail.