U.S. March CPI - Surprise not dramatic but picture is clearly too high

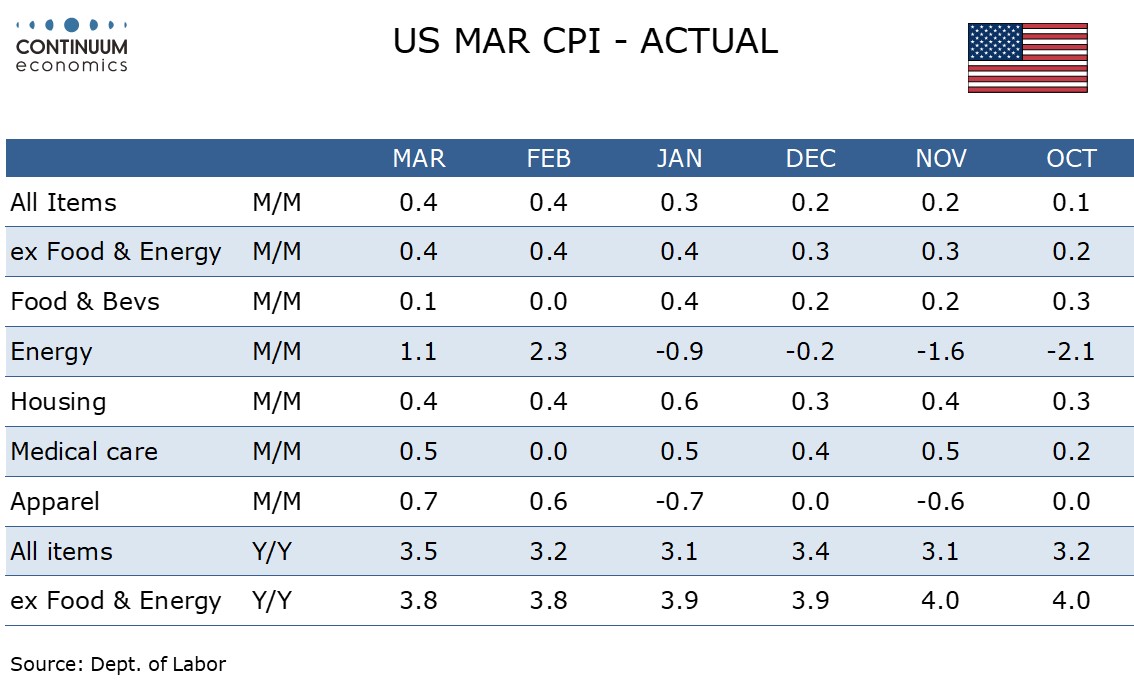

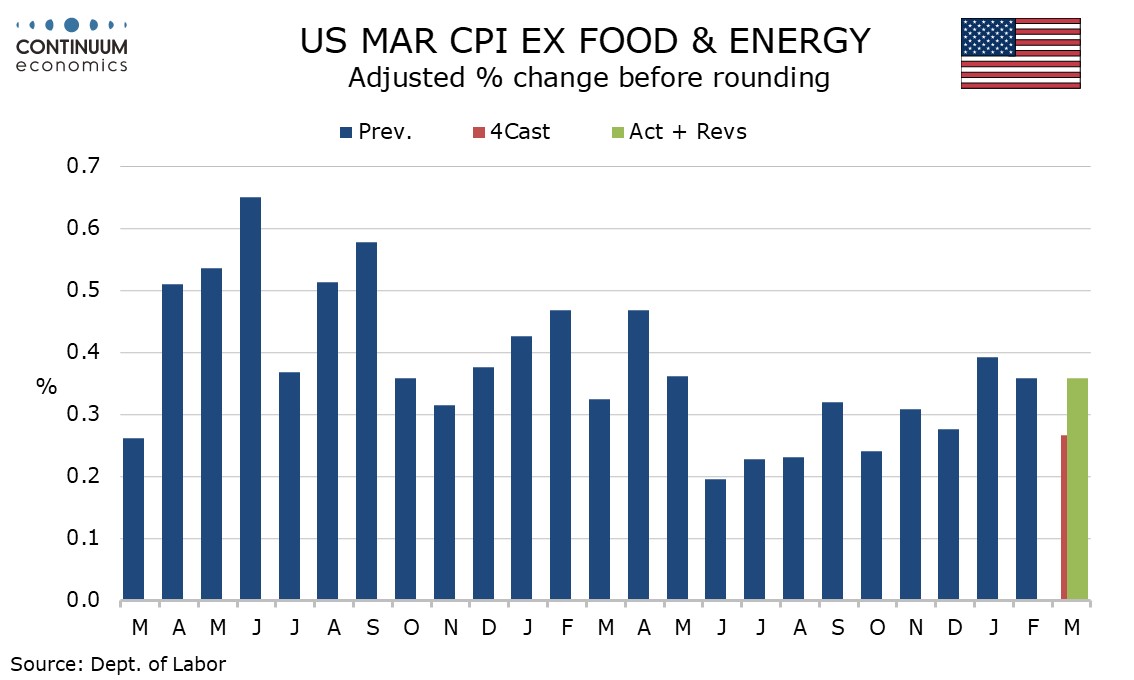

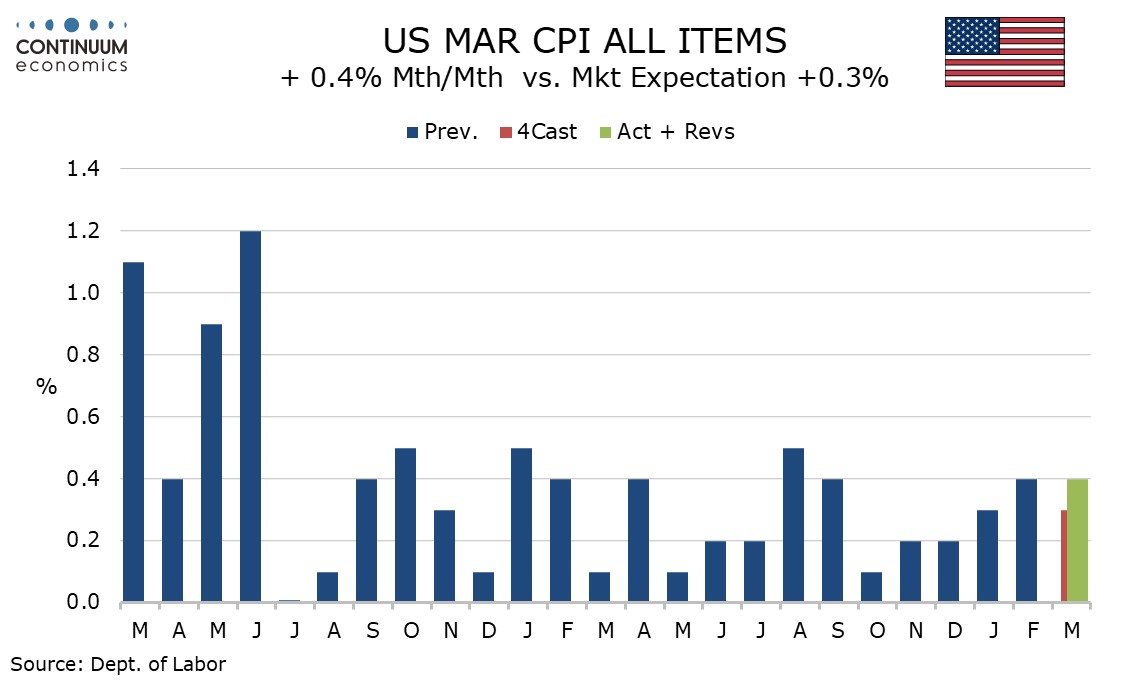

March CPI has shown a third straight disappointing month at 0.4% overall and ex food and energy, and this suggests that with the economy’s strength persisting, inflation has not yet been defeated, despite the encouraging data seen through the second half of 2023. Still, the market surprise was not dramatic, with the core rate at 0.359% before rounding, the third straight month to be rounded up to 0.4%.

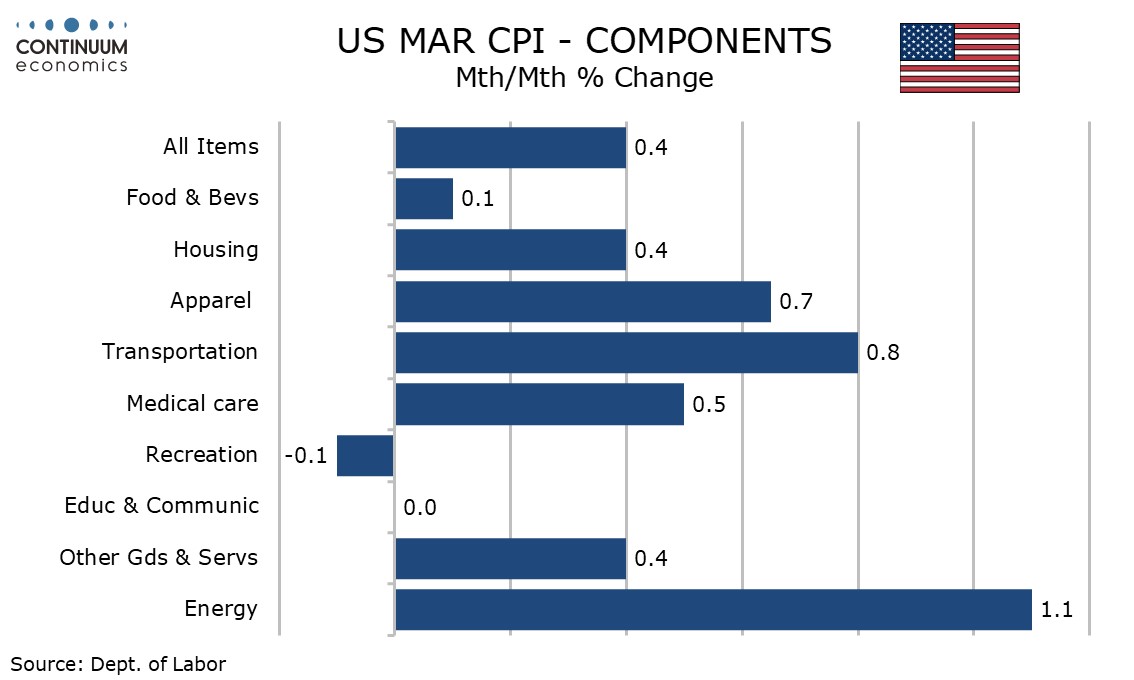

Overall CPI was only marginally stronger than the core, up 0.378% before rounding. Food was subdued with a 0.1% increase but energy rose by 1.1%, led by a 1.7% increase in gasoline.

Commodities less food and energy were weak with a decline of 0.2%, used autos resuming a downtrend with a 1.1% decline after a correction higher in February, though apparel saw second straight strong month with a rise of 0.7%.

Services less energy services rose by 0.5% for a second straight month. This outperformed gains of 0.4% in shelter and owners’ equivalent rent. Medical care services rose by 0.6%. Transportation services were particularly strong at 1.5% despite a marginal dip in air fares led by sharp gains in motor vehicle insurance and motor vehicle repair. Other personal services rose by 0.8%.

Yr/yr core CPI is unchanged at 3.8% while the headline nudged up to 3.5% from 3.2%.

The disappointment in the data is not extreme, and with core CPI being almost identical to February’s core PCE prices might, as in February, come in on the low side of 0.3% before rounding. However to be consistent with the Fed’s 2.0% target we need monthly core PCE prices to trend on the low side of 0.2%.

Some progress has been made in reducing inflation, but it is still too high, with strength in services still worryingly broad based. The Fed does not yet have a strong case to ease.