Turkiye’s Foreign Trade Deficit Increased in 2025 Despite TRY Slide

Bottom Line: According to the preliminary annual figures announced by the Ministry of Trade on January 6, Turkiye’s foreign trade deficit increased to USD92.2 billion in 2025 from USD82.2 billion in 2024, partly due to higher purchases of investment goods and raw materials. According to preliminary analysis, the current account deficit (CAD) is projected at around 1.4% of national income by the end of 2025, which will be announced by the Central Bank of Turkiye (CBRT) in February 2026. We think increasing geopolitical risks, weak global demand, trade tensions and volatile food and energy prices will continue to put pressure on Turkish current account balance in 2026 as we expect CBRT to resume its easing cycle.

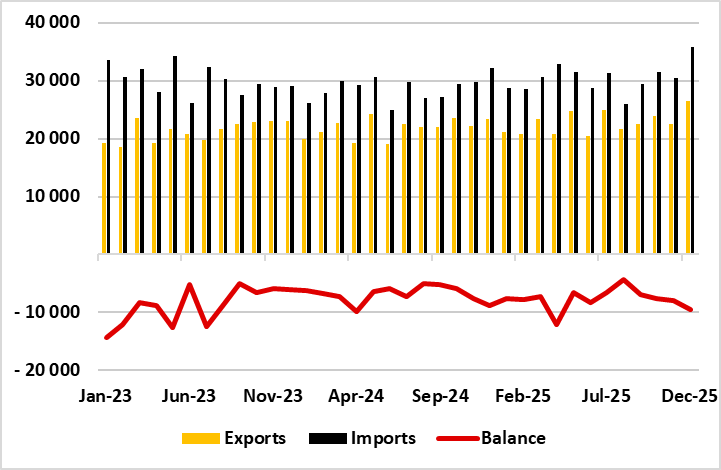

Figure 1: Turkish Foreign Trade (Million USD), January 2023 – December 2025

Source: Continuum Economics

According to the preliminary annual figures announced by the Ministry of Trade on January 6, Turkiye’s foreign trade deficit (FTD) stood at $9.4 billion in December 2025, which surged from $8.8 billion deficit in the same month of the previous year, marking the largest trade shortfall since April 2025.

Ministry of Trade’s preliminary data demonstrated that total value of exports in 2025 increased by 4.5% when compared to 2024 to reach USD 273.4 billion, marking the highest in country’s history aligning with the target set in the Medium-Term Program (MTP) released in late September. Total value of imports grew at a faster pace of 6.3% in 2025, amounting to USD 365.6 billion resulting in a trade deficit of USD 92.2 billion in 2025 when compared to USD 82.2 deficit in full year 2024.

According to preliminary analysis, the current account deficit is now projected at around 1.4% of national income by the end of 2025 partly owing to moderate increases in the exports of goods and services. CBRT announced on December 12 that Turkiye's current account posted a surplus of USD 457 million in October 2025, marking the fourth straight monthly current account surplus, while the current account excluding gold and energy showed a surplus of around USD 7 billion. We think CAS in October was temporary relief to external finances since we expect current account deficit to return back to country’s agenda as of December 2025 since the trade deficit increased remarkably in December coupled with expected decrease in services income driven by decelerating tourism and transportation revenues in winter season.

Speaking about trade figures, Treasury and Finance Minister Mehmet Simsek wrote on X that "Gold, whose price has increased and which plays an important role in savings preferences, contributed to the wider trade deficit."

We think increasing geopolitical risks, weak global demand, trade tensions and volatile food and energy prices will continue to put pressure on Turkish CAB in 2026 as we expect CBRT to resume its easing cycle. Regional tensions in Ukraine and in the Middle East will be critical for Turkiye's CAB.

The government hopes to fill in any gaps in the CA by tourism revenues or via a possible hike in the export revenues following the devaluation, but these would likely have limited impacts. We think attracting consistent FDI inflows, winning back investors’ credibility and cutting persistent trade deficit will remain the key agenda items for Turkiye in 2026 to reach permanent CAB.