Mexico CPI Review: 0.2% Growth in April

April's CPI data, despite a 0.2% m/m growth, reveals a significant y/y uptick to 4.6% from March's 4.4%, challenging norms due to electricity tariff adjustments. Core CPI maintained stability with a 0.2% increase, while Core Goods CPI rose by 0.3% and Services CPI by 0.1%, accumulating a 5.2% y/y growth. However, Food and Beverages saw a 1% increase, potentially impacting year-end CPI, prompting cautious monitoring by Banxico amidst economic cooling. Projections suggest a 4.5% year-end CPI for 2024.

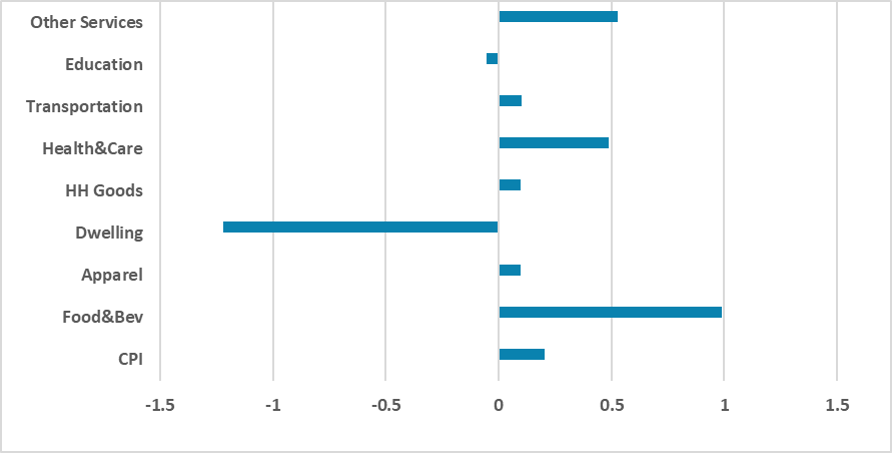

Figure 1: Mexico’s CPI by Groups (%, m/m)

Source: INEGI

Mexico's National Institute of Statistics has released CPI data for April. It shows a 0.2% (m/m) growth, but it's important to remember that April usually experiences negative inflation due to electricity tariff readjustments stemming from lower electricity consumption as the colder season ends. Therefore, y/y CPI has seen an uptick, rising to 4.6% from 4.4% in March.

Figure 2: Mexico’s CPI (%, y/y)

Source: INEGI

Despite the rise in headline inflation, Core CPI exhibited good behavior, increasing only 0.2% for the month. Core Goods CPI grew by 0.3% for the month and 3.6% y/y. The positive news came from Services CPI, which only grew by 0.1% in September but accumulated a 5.2% y/y growth. However, the negative news came from the non-core side, with Food and Beverages growing by 1%, a consequence of adverse weather impacting agricultural output. Fruits and vegetable have grown around 2.1% in the month. We will closely monitor the next agricultural goods data. Although currently seen as a transitory spike, this shock could persist into the future and, in a situation of a heated labor market, could spread to other components of the CPI.If this uptick in food prices does not reverse, as seen in February, it could add an additional 0.3 p.p. to the year-end CPI, prompting some worrying signs for Banxico. With the Mexican economy cooling, we see no problem for Banxico to continue cutting rates cautiously, but we cannot rule out a pause followed by resumed cuts in the coming months. We now project the CPI to end the year at 4.5% in 2024, and it is highly likely that expectations will increase slightly in Mexico.