Preview: Due January 31 - U.S. December Personal Income and Spending - Core PCE Prices to match Core CPI

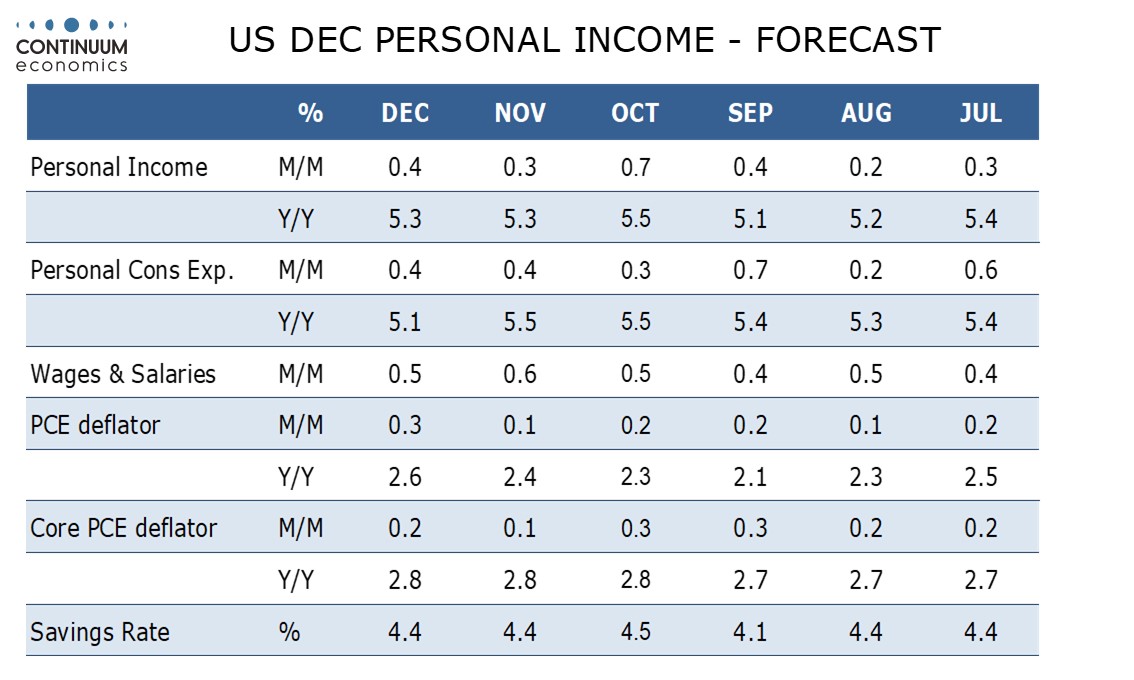

December’s personal income and spending report will be largely old news, with Q4 totals seen with the GDP report on January 30. Our pre-GDP forecasts for a 0.2% rise in core PCE prices and a 0.4% rise in personal income still look valid, though the GDP data is consistent with a 1.3% rise in personal spending, for which our original forecast was for a 0.4% increase. December is unlikely to rise so sharply, which suggests upward revisions in October and November.

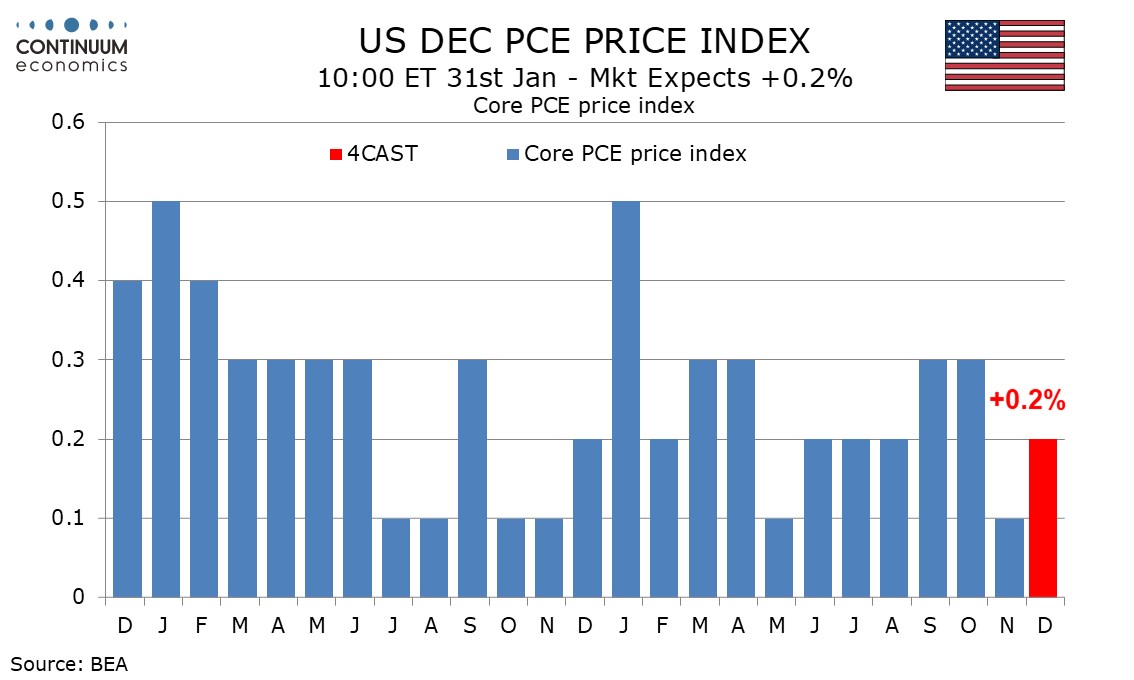

PCE prices trend a little lower than the CPI but after a significant November underperformance, when core CPI rose by 0.3% but core PCE prices rise by only 0.1%, we expect December’s core PCE price index to match a 0.2% core CPI increase. This would leave core PCE prices at 2.8% yr/yr for a third straight month.

PCE prices are less sensitive to gasoline then CPI, and we expect overall PCE prices to rise by 0.3% in December, slightly less than a 0.4% increase in overall CPI. This would see yr/yr growth in overall PCE prices rising to 2.6% from 2.4%, a third straight acceleration from September’s 2.1% but still lower than the core rate.

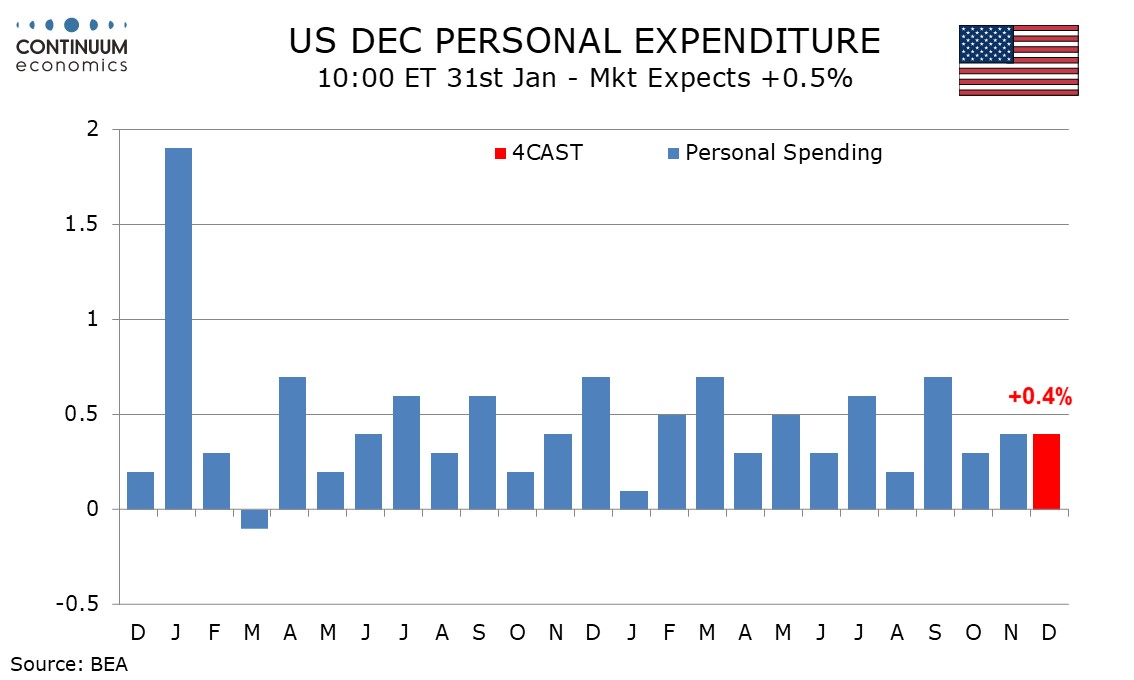

Retail sales rose by in December 0.4% but industry auto sales suggest autos may outperform the retail auto data. We originally expected a 0.3% increase in services, up from 0.2% in November but well below October’s 0.6%. Eating and drinking places, counted as services but included in the retail sales report, slipped in December. December consumer spending may rise by more than 0.4% but most of the Q4 beat looks likely to come from back month revisions.

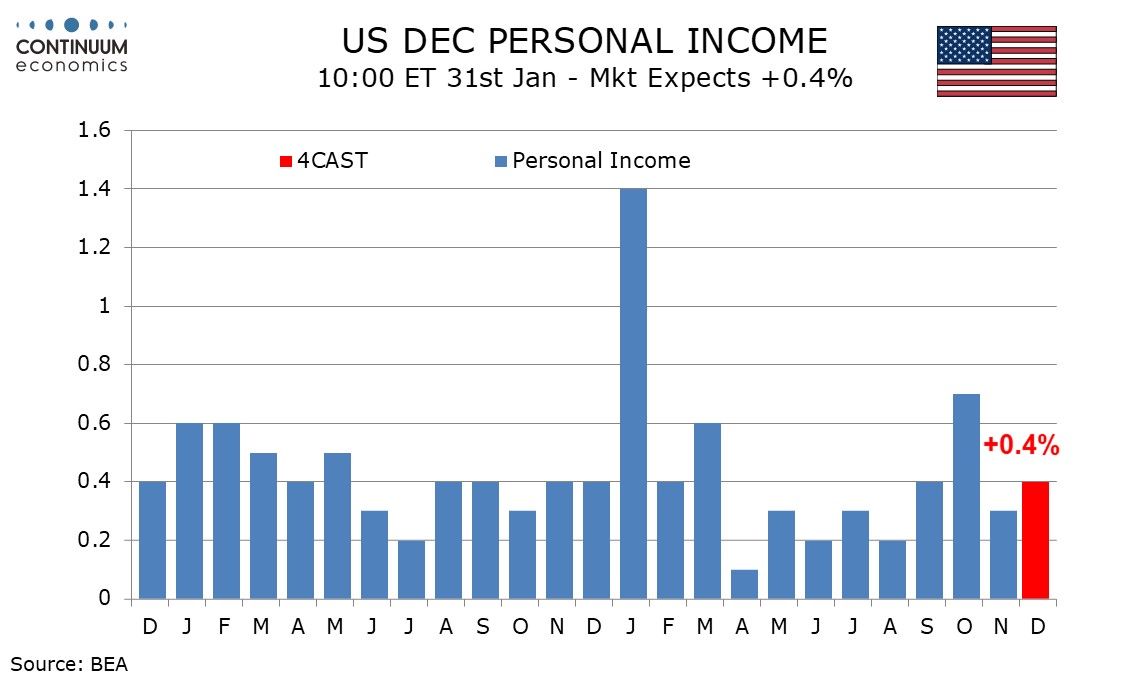

The GDP detail is consistent with a 0.4% rise in December personal income. A strong non-farm payroll but more subdued average hourly earnings imply a 0.5% rise in wages and salaries. We expect the other components of personal income to moderately underperform, as is trend, though this follows a more substantial underperformance in November that corrected a rare outperformance in October.