Mexico CPI Review: Slightly Below Expectations, with Concerns in Service

Mexico's March CPI data, released by the National Statistics Institute, shows a slight increase of 0.29%, below the 0.36% expectation. Year-on-year CPI remains stable at 4.4%, above Banxico's 3.0% target. While fruit and vegetable prices dropped, transport costs rose. Concerns arise with Services CPI at 5.8%. Wage inflation may affect future trends, impacting monetary policy decisions.

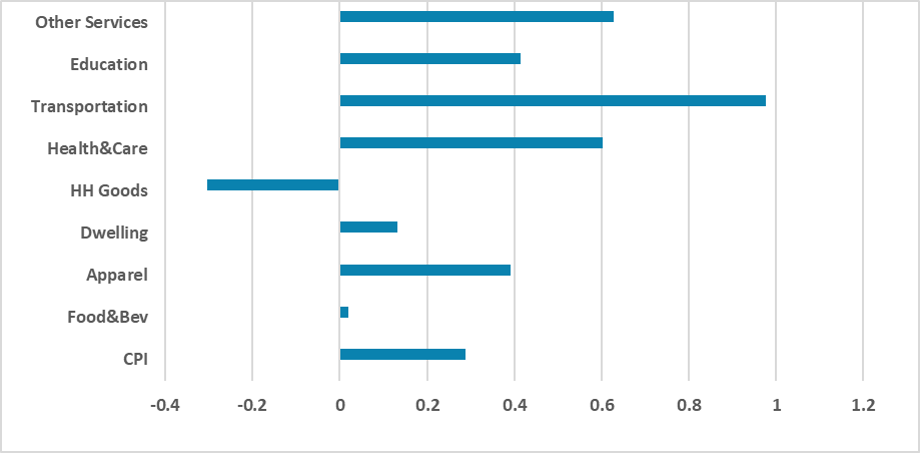

Figure 1: Mexico’s CPI by Groups (%, m/m)

Source: INEGIThe Mexico National Statistics Institutes has released the CPI data for March. The data shows that the headline CPI has increase by 0.29%, slightly below the 0.36% expectations (from Bloomberg Survey). Therefore, YoY headline CPI was stable at 4.4%, still above the Banxico target of 3.0%. Fruit and vegetables decreased strongly during the month, compensating the increase on poultry meat and warranting a 0% growth on the Food and Beverages CPI. Looking at the other CPI groups the biggest increases came from the Transport Group (+1% Y/Y), influences mainly by the rise of the price of gasoline, which in turn responded to higher oil prices.

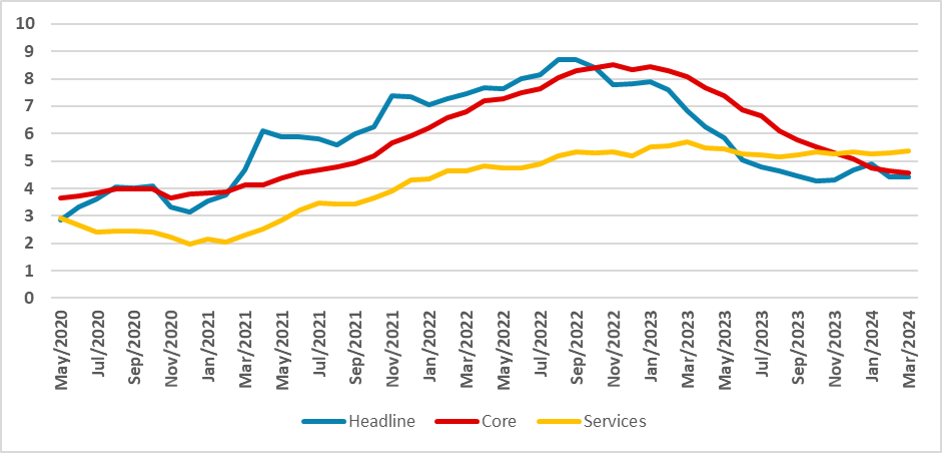

Figure 2: Mexico’s CPI (%, Y/Y)

Source: Banxico

Non-Core CPI has registered negative inflation during March decreasing by -0.15%, responding to lowe electricity prices and the drop on agricultural goods. Looking at the Core CPI some concerns arise. The index has grown 0.5% during March, with core Goods growing by 0.2% while Services have grown by 0.7%. On YoY terms, Goods CPI stands at 3.8% and Services CPI at 5.8%. High wages are keeping Services CPI at high levels while the appreciated Mexico Pesos is being able to keeping the Goods CPI under control.

The overall case for March CPI is slightly worse despite coming below expectations. Wage inflation is somehow materializing on Services inflation and it will add some stickiness to inflation coming forward. As Monetary Policy acts with lags we believe wage inflation is likely to cool in the coming months which will then be translated in lower services inflation. Although convergence is still a bit far, if this scenario of services inflation cooling materializes, convergence towards the 3.0% target is expected to be achieved in 2025. This would occur concomitant with Banxico keeping a 25bps cut.

However, we could see an alternative scenario in which the Mexican economy does not cool enough and labour market tightness converts into an additional spiral of wage hikes which then will keep pressuring services inflation. In this case, which would be clearer in the second half of the year would then see Banxico applying a pause in the cuts and keeping a tighter monetary policy for longer until inflation gives clearer signs of convergence.

ng to decelerate in 2024, ending the year at 4.0%.