Preview: Due December 11 - U.S. November CPI - Progress showing signs of stalling

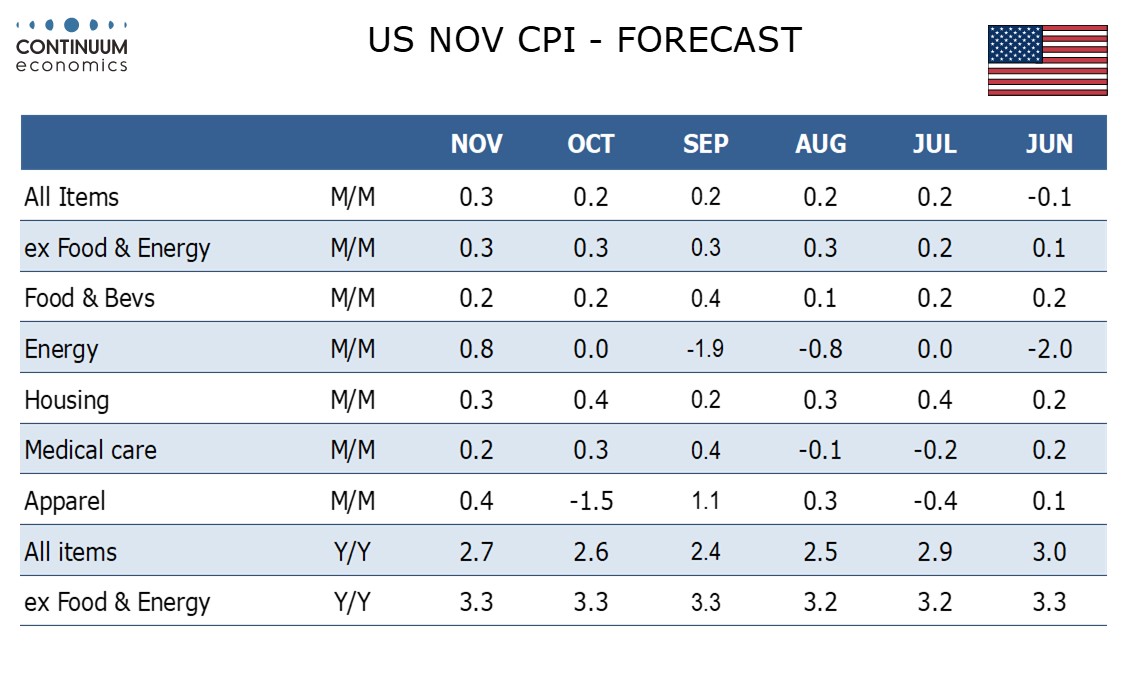

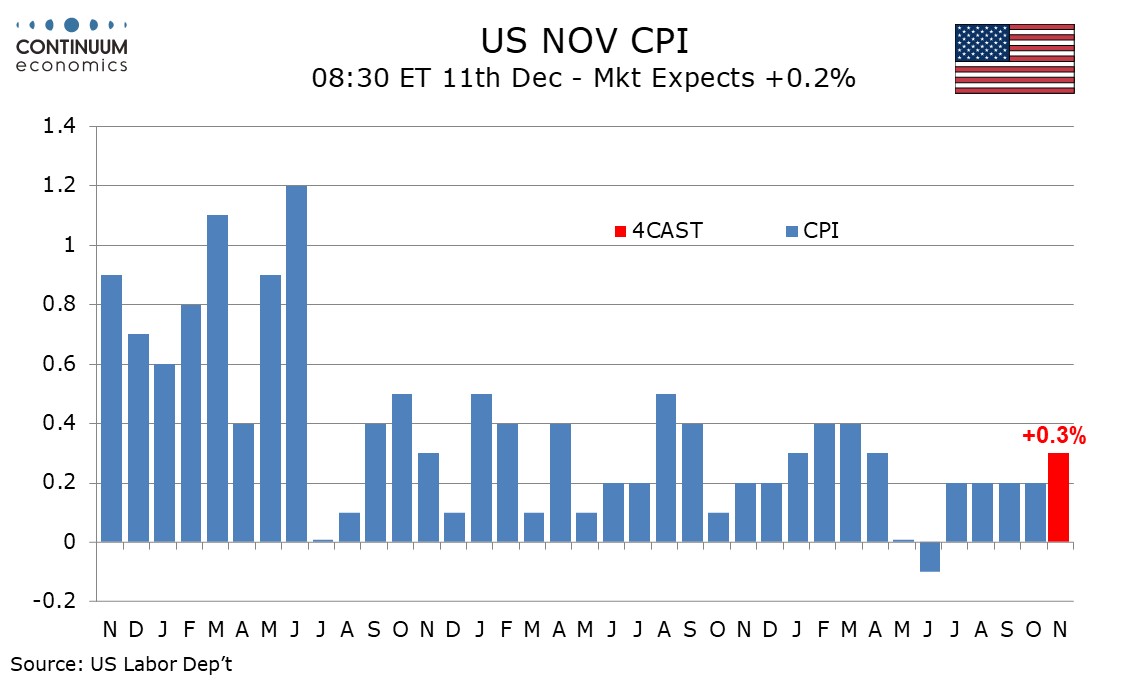

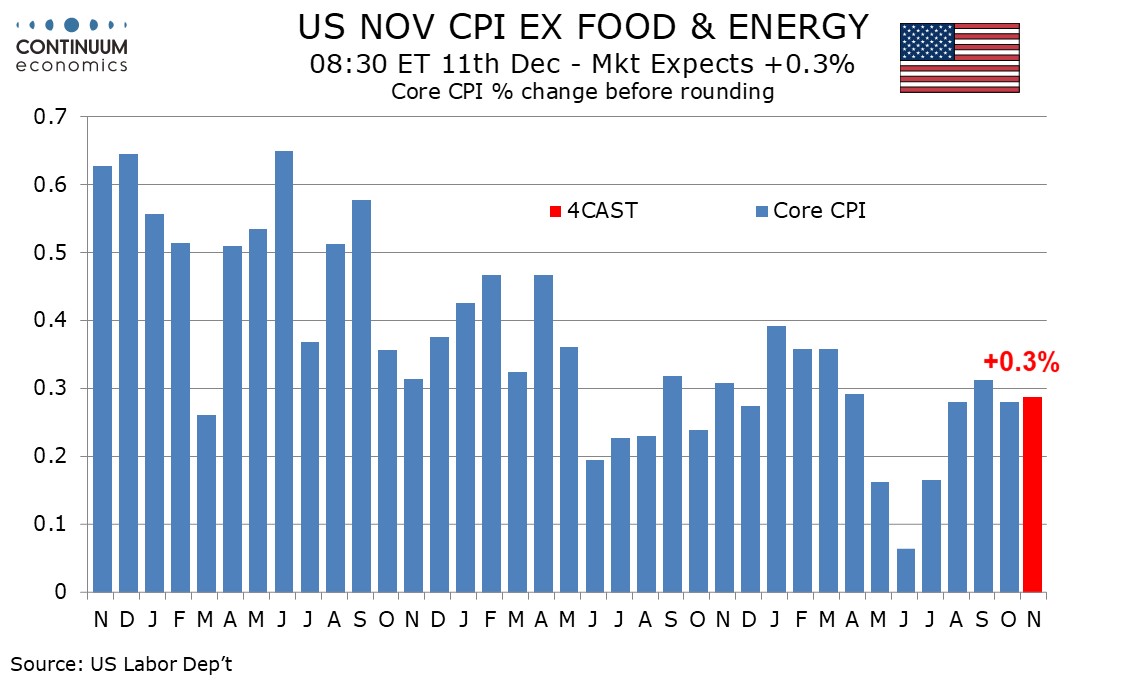

We expect November’s CPI to increase by 0.3% overall after four straight gains of 0.2% while the ex food and energy rate increases by 0.3% for a fourth straight month. Such an outcome would support concerns that progress in reducing inflation is stalling.

Gasoline prices continue to fall before seasonal afdjustment but after seasonal adjustment a modest increase in gasoline is likely. Food is likely to remain subdued with a rise of 0.2%. Before rounding we expect overall CPI to rise by 0.31%, whule the ex food and energy rate rises by 0.29%, similar to October’s 0.28%.

We expect most core CPI components to be marginally slower in November than October, but apparel is unlikely to repeat a 1.5% October decline, while indications are that used auto prices, a cause of deflation earlier in the year, are now increasing. This reduces downside risk.

We expect yr/yr CPI to edge up to 2.7% from 2.6% overall, but this will remain below the yr/yr ex food and energy pace, which we expect to remain at 3.3% for a third straight month.