U.S. Budget Proposal Shows Fiscal Policy Scope is Limited

While there is still a long way to go before legislation is passed, passage of a budget proposal in the House makes the fiscal policy outlook look clearer, and reduces negative risks such as a government shutdown or a debt default. The package is will probably be a mild negative for economic growth, even when lifting the deficit and making politically difficult spending cuts. That reflects the fact that fiscal policy scope is limited.

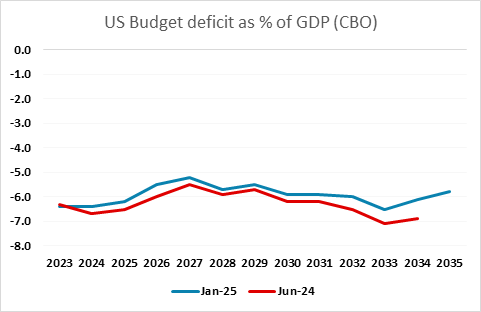

In January 2025 the Congressional Budget Office (CBO) revised its estimate of the 10-year budget deficit lower, to 5.8% of GDP from 6.3%, assuming no policy changes, which assumed the tax cuts from Trump’s first term expired as scheduled. The 10-year deficit was revised down by $991bn. Economic changes took $2534bn off the deficit, largely from $2153bn in extra revenues. Technical changes added $1272bn to the deficit, led by Medicaid costs being revised up by $817bn. Legislative changes were minor in comparison, adding $271bn to the deficit.

This reduction to the 10-year deficit is likely to be more than fully offset by the bill passed by the House, where legislative changes mean $4500bn in tax cuts, which is 1.2% of projected GDP. The legislation does not make the source of these tax cuts clear but if the previous Trump tax cuts are extended there will be little room left to meet Trump’s promises to exclude Social Security, overtime and tips from taxes. There will be $300bn in extra spending (largely for immigration control) and $2000bn in spending cuts. The package still needs Senate approval and the details of the spending cuts need to be worked out, and that will be difficult. If the spending cuts are not found, the tax cuts may need to be scaled back. With tax cuts largely maintaining existing rates and spending set to be cut the net impact will be mildly contractionary for GDP growth, though the negatives may be offset by reduced uncertainty.

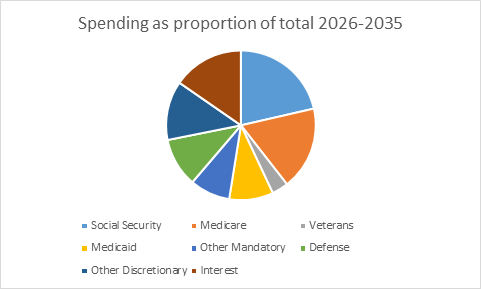

$2000bn in spending cuts will make up 2.2% of projected spending over the 10 years, though with large sections of the budget excluded from cuts significant reductions will be needed elsewhere. Social Security (23.9% of spending), Medicare (15.0%) and Veterans (3.6%) leave over 40% of outlays off limits for cuts while interest on the debt makes up 15.5% of projected spending. Defense makes up 10.7% and is seen getting a modest increase in the House plan, though Defense Secretary Hegseth has suggested it could see cuts as the US scales back its global commitments. Medicaid (9.6% of spending) is getting the most attention as to where the spending cuts will fall as what look like difficult to avoid cuts will hit many working class Trump supporters. The budget deficit is simply too large already to mean hard choices can be avoided.