Medium Term Budget Policy Statement Foresees Wider Budget Deficit but a Better Growth Prospect

Bottom line: The coalition government announced its first Medium-Term Budget Policy Statement (MTBPS) on October 30, setting government policy goals and forecasts over the next three years. According to MTBPS, South African Treasury sees consolidated deficit at 5% of GDP in the fiscal year ending in March 2025, and gross debt stabilising at 75.5% of GDP in 2025/26. GDP growth is anticipated to stand at 1.7% in 2025, versus previous forecast of 1.6%, particularly due to improved electricity supply and investor sentiment. We think that government’s ability to implement needed fiscal and structural reforms will be key in 2025, while suspension of power cuts (load shedding) will also be critical both for growth prospects and fiscal trajectory.

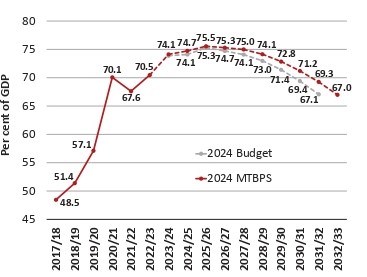

Figure 1: Gross Debt-to-GDP Outlook (% GDP, 2017/18-2032/33)

Source: MTBPS

The coalition government announced its first Medium-Term Budget Policy Statement (MTBPS) in Parliament on October 30, setting policy goals and forecasts over the next three years.

According to the MTBPS document circulated, the consolidated deficit is projected to stand at 5.0% of GDP in the fiscal year that ends in March 2025, wider than the 4.5% deficit forecast in February. MTBPS showed that the main budget deficit is anticipated to decline from 4.7% of GDP in 2024/25 to 3.4% in 2027/28, with the primary budget surplus rising to 1.8% of GDP. South Africa's gross debt is forecasted to stabilise at 75.5% of GDP in 2025/26. (Figure 1) (Note: Debt service costs are estimated to surge at a nominal annual average rate of 6.9% over the next three years while 5.2% of the budget is anticipated to go towards servicing debt).

It was interesting to see that MTBPS clearly explained that fiscal consolidation measures have limited, but not prevented, the widening of budget deficits and debt. "In the absence of faster growth and in the face of external risks, tax revenue will remain under pressure, forcing us to make difficult decisions," Finance Minister Enoch Godongwana said.

On the GDP growth front, South Africa’s national treasury predicts that GDP growth will hit 1.1% for 2024, which is lower than the estimate of 1.3% in the February budget. Growth is anticipated to come in at 1.7% in 2025, versus a previous forecast of 1.6% (Note: We see GDP growth to stand at 0.8% and 1.5% in 2024 and 2025, respectively). Over the medium term, GDP is envisaged to average 1.8%.

We syncretize with the new MTBPS that the medium-term prospects are improving considering the continued suspension of load shedding and improved investor sentiment. (Note: South Africa’s national electricity utility company, Eskom announced on October 18 that load shedding remained suspended for 205 consecutive days since March 26, reflecting an improvement in the reliability and stability of the power generations coupled with new investments. This marked the longest stretch of uninterrupted power supply in five years).

We are of the view that the MTBPS is well-designed in prioritizing fiscal consolidation efforts to decrease public debt despite rising long-term debt and interest costs remain bad news for South Africa. The country should continue to focus on enhancing revenue (tax) collections, decreasing cost of servicing the public debt, and improving the institutional fiscal framework. Within this framework, we think that government’s ability to implement needed fiscal and structural reforms will be key in 2025 while suspension of load shedding will be critical both for growth prospects and fiscal trajectory.