USD, EUR JPY flows: USD up strongly after US CPI

USD makes general gains on strong US CPI as US yirlds rise. Risky currencies fall most sharply

Stronger than expected US CPI at 0.4% both core and headline has triggered general USD gains, particularly against the riskier currencies, and weakness in equities. US 2 year yields have risen 15bps in response, and a rate cut is now not fully priced until the September meeting – four meetings hence.

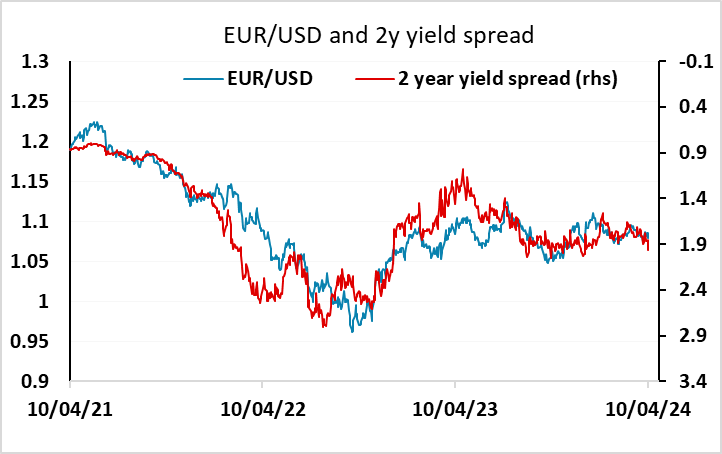

While the riskier currencies have fallen the most, the USD has made gains across the board, with USD/JPY making a new 34 year high above 152. EUR/USD has fallen around 70 pips to below 1.08, but remains in the 1.0695-1.1050 range that has contained it this year. Typically, EUR/USD losses have been limited when US yields have risen because European yields have followed US yields higher. But this time around EUR 2 year yields have only risen 5bps. Unless tomorrow’s ECB meeting fails to confirm market expectations of a rate cut at the June monetary policy meeting, it is unlikely that European yields will follow US yields higher this time around. The bias for EUR/USD should therefore remain to the downside, although it will be hard to break below 1.07.

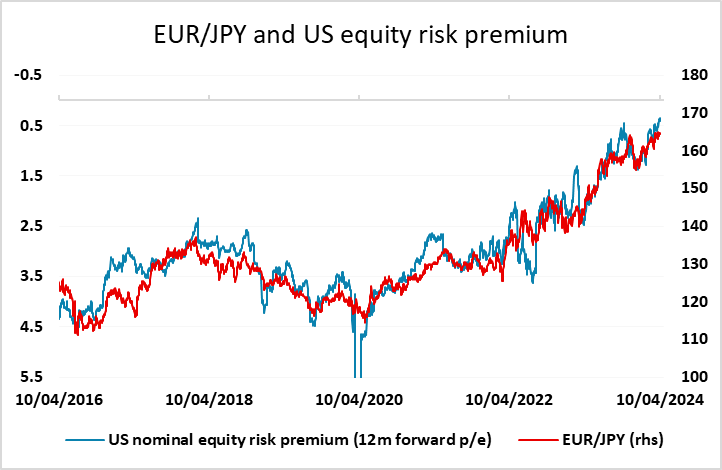

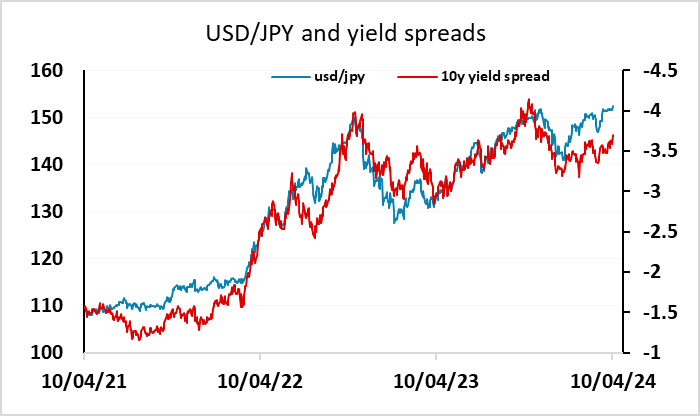

For USD/JPY, the upside is still restricted by some concerns about potential FX intervention from the Japanese authorities. Yield spreads are still not wide enough to really justify the current USD/JPY level based on the correlations seen in the last few years, but we doubt the Japanese authorities will want to get involved in intervention if the US is generally strong due to rising US yields and the JPY is holding up on the crosses. JPY bulls might therefore focus on JPY crosses. However, with rising US yields, it will need substantial declines in US equities to prevent a further decline in US equity risk premia. Declining equity risk premia have up to now been highly correlated with JPY cross weakness. But we suspect that either we see more significant US equity declines, or this correlation is about to break down.