China: Authorities Views and Policy Changes

Bottom Line: China authorities leave the impression that further policy stimulus will likely be measured rather than aggressive. We feel that they are not pessimistic enough on the medium-term hangover from the residential property sector and this is why we are downbeat on 2024 GDP growth and beyond.

China authorities voice their views in the annual IMF article IV review released earlier in February, which provides some hints on prospective policy changes.

Figure 1: Continuum Economics GDP Forecasts (%)

Source: Continuum Economics

China authorities view on 2024 GDP growth is for continued economic recovery, with a further recovery of consumption and a stabilisation of the residential property sector. The rotation to high quality growth sectors (high tech manufacturing and electric vehicles) was also seen supporting growth. The authorities were most concerned about the external sector, due to slower global growth; rising protectionism and fragmentation of globalisation. Net exports were seen to be a drag on growth.

However, China authorities are not ready to do anything about the weakness in net exports (here). We have previously noted that a significant Yuan deprecation is unlikely as it could cause domestic capital flight, with associated political tensions. Alternatively, signalling no desire for military invasion of Taiwan would help slow the speed of supply chain shifts out of China, but such a policy would be politically impossible for Beijing. On the domestic front, we fear that that hangover from the residential property sector will be a negative drag on GDP in the coming years, as the lagged effects of the construction slump feedthrough the economy. Home sales data suggest that the sector has also not stabilised yet. Even so, China authorities appears reluctant to accelerate resolving non-viable property developers or allowing quicker house price falls to clear the market and the preference is to muddle through. The article IV report also highlighted China authorities view that demand for housing will still be good medium-term helped by continued urbanization and upgraded housing, which we would view as too upbeat.

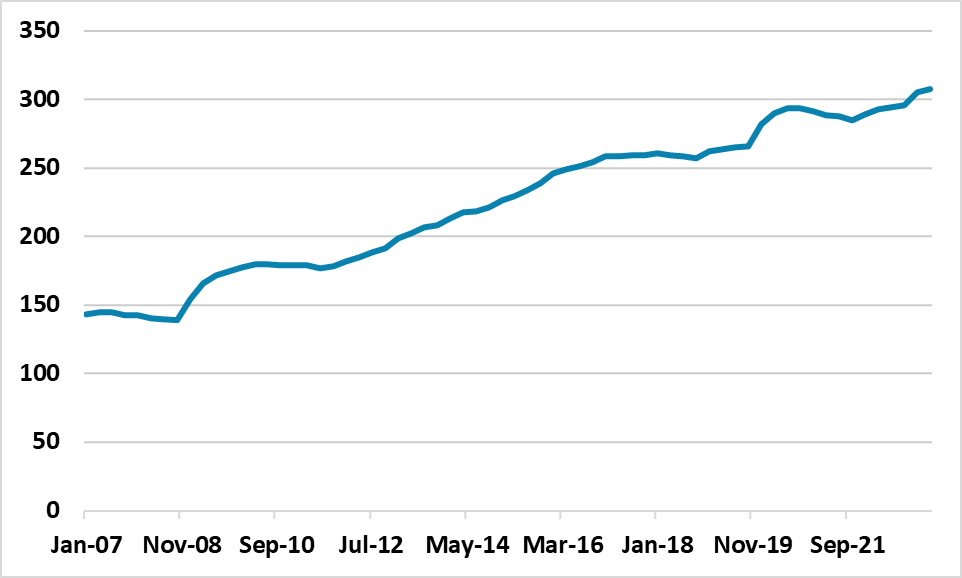

This all leaves us with the view that GDP will likely be around 4.2% in 2024 and undershoot the likely official target of 5% -- due to be announced in March. Additionally, we remain downbeat for 2025 onwards (Figure 1). Population aging is already starting to impact the size of workforce and demand for housing and consumption, but China’s authorities are reluctant to actually raise the retirement age for fear of backlash or increase social security nets to reduce precautionary household savings. Meanwhile, productivity growth is slowing, but structural reforms are insufficient and not market oriented. Finally, though more expansive fiscal policy could boost growth in the medium-term, China authorities are focused on targeted fiscal measures rather than aggressive fiscal policy expansion. This is partially due to the overall size of debt in China economy (Figure 2) and fears of a Japan style bust. Households are unlikely to get a big windfall from government to accelerate a shift towards consumption and the focus is on targeted tax cuts to boost high quality growth sectors. Intermittently this will likely be supplemented with old fashioned government investment spending, with reports earlier in the year suggest consideration of a Yuan1trn special government bond issue for investment spending.

Figure 2: China Non-Financial Sector Debt/GDP (%)

Source: BIS

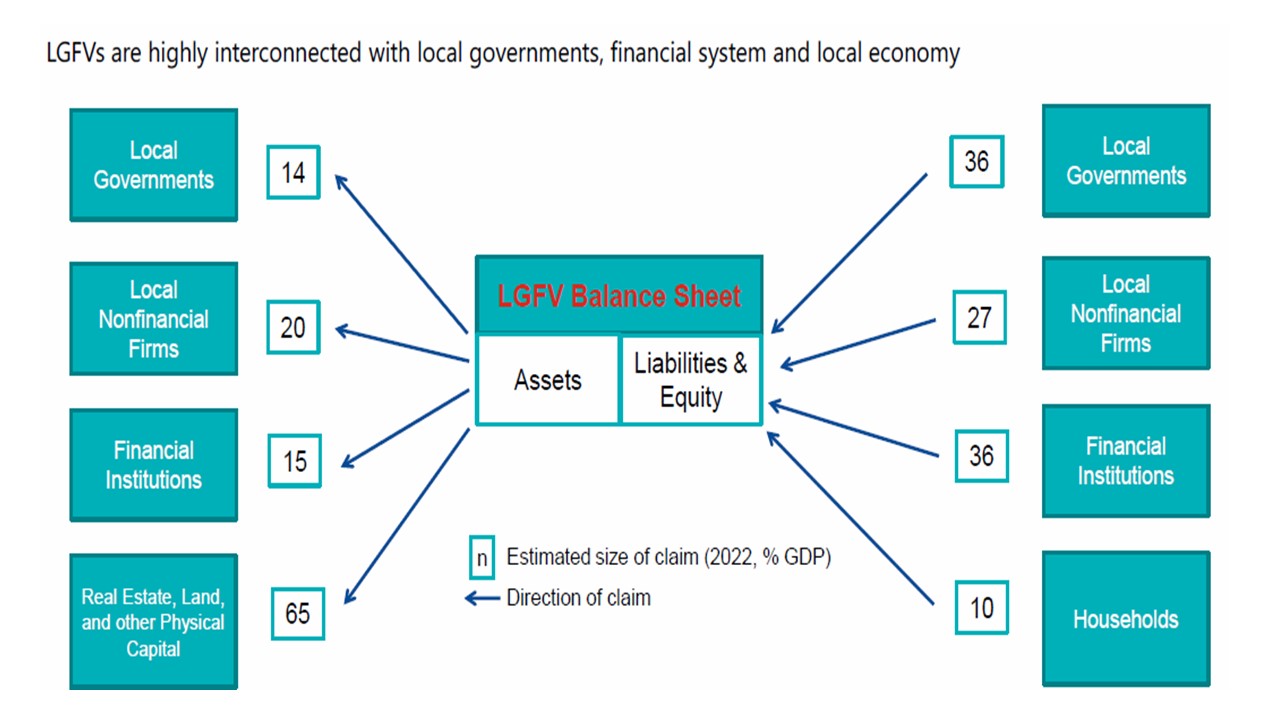

Elsewhere, China authorities noted a desire for local government to be responsible for their own debt and that of LGFV’s, while also expressing the view that growth would help control LGFV debt long-term. We would see this as being too optimistic (Figure 3), as some LGFV’s debt is unsustainable and will likely have to be swapped for central government debt like 2015. Increased transfers from central government to local government though are less likely, as Beijing wants to sustain the image of low to medium central government debt/GDP – this could be difficult to sustain multi year however.

Figure 3: Local Government Economic Interlinkages

Source: IMF Article IV Feb 2024

Finally, on financial stability China’s authorities argue that overall the system is controllable, despite specific institution financial stability risks. We would tend to agree. The major banks remain reasonable strong, while the China financial system means unstainable debt are easing to extend than in a western style system. Unstable financial institutions will likely be merged; forced to sell assets or in the worst case resolved. However, we would still be watchful, as any major problems at a high profile 2 tier institution could cause adverse temporary impacts of consumer confidence.