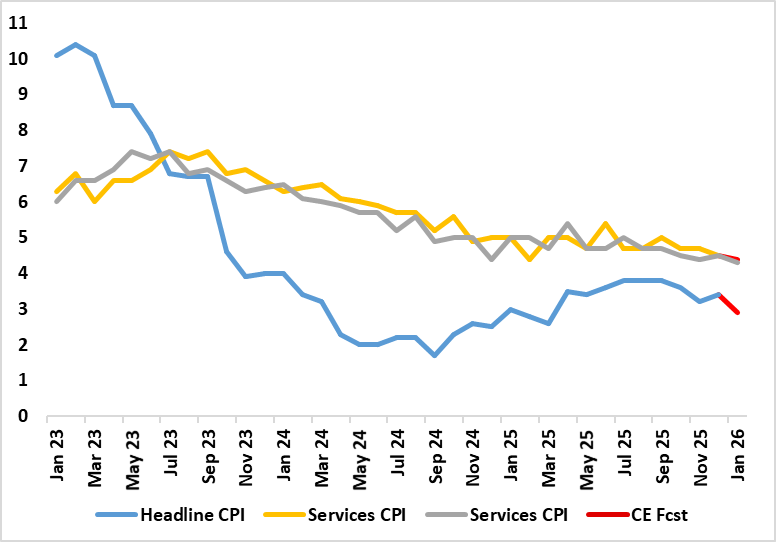

UK CPI Preview (Feb18): Fresh and Marked Fall to Resume as Core to Hit New Cycle-Low?

UK policy makers may not be able to say they have won the war against inflation, but a clear victory may be seen in the batter likely in the next few months with a likely return to the 2% target by April These projected falls are likely to commence with the looming January numbers (Figure 1) where airfare distortions which pushed up the December outcome should unwind, and where base effects may reduce food inflation. As a result, we see the headline CPI rate falling from December’s 3.4% to 2.9% (as does the BoE) and also where services and the core should fall by around 0.3 ppt to 4.2% ad a new cycle low of 2.9% for the latter. Notably such declines have been signalled for some time by adjusted m/m data (Figure 2), with already-soft wage figures likely to result in lower underlying inflation ahead (Figure 3). Such data should encourage further speculation that the BoE will ease afresh next month.

Figure 1: Headline and Core Further To Fall Clearly

Source: ONS, Continuum Economics

Although we have been flagging a fall in CPI headline inflation rate down to the 2% target sometime in the spring, this line of thinking is becoming more widespread, helped by some recent Budget measures. Notably the BoE is now suggesting that inflation will fall to 2.1% by April, partly reflecting base effects and largely stay there through Q2. We see a similar drop but (unlikely the BoE’s anticipated more modest drop) also that this will be accompanied by a fall in the core rate to just over 2% by mid-year.

For some time and for a variety of reasons, UK CPI inflation has been higher than other parts of Europe and often higher than expected. At the current juncture, that in part reflects unusually large increases in administered prices such as Vehicle Excise Duty and higher water bills last April, thereby creating favourable base effects for later this year as they are contributing around 0.5 percentage points to current inflation. Moreover, food, and tobacco inflation is estimated to be contributing a further 0.5 percentage points to current inflation and this should unwind although PPI data do not yet suggest this is likely to occur imminently.

Other factors are also likely to weigh on inflation, and only partly due to the weak demand backdrop that we think is currently evident. Indeed, partly reflecting the energy bills package announced in last November’s Budget, which, alongside a fall in wholesale gas prices, is expected to result in a decline in the Ofgem price cap by up to 8% in April, enough to knock some 0.3 ppt off the headline rate.

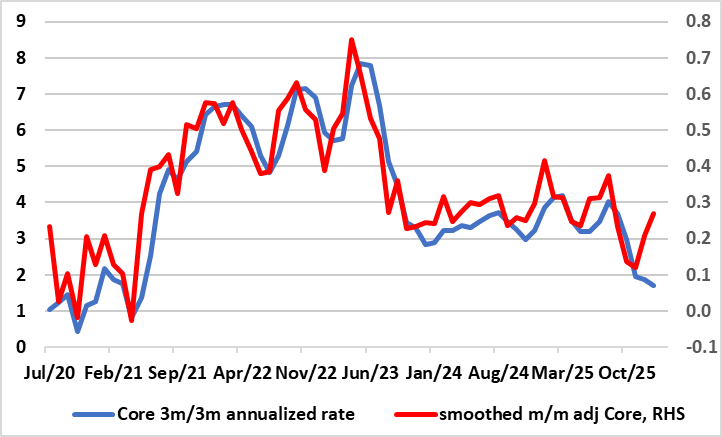

Figure 2: Short-Term Core Inflation Already Consistent with Target?

Source: ONS, Continuum Economics

Against this backdrop, headline CPI inflation is projected to slow sharply, to 2.0% in Q226, our view being a notch softer than BoE thinking. And we see it largely staying there though the rest of 2026. Perhaps more notably we also see core CPI inflation falling to around the 2% target in Q2 and then staying there, this being a softer outlook than that of the BoE. Partly this reflects nothing more than an extension of what recent adjusted m/m data have been suggesting with core rates on this basis already consistent with the 2% target (Figure 2). But is also reflects more fundamental factors. Firstly, is the expectation that currently soft non-energy goods inflation (currently around 1% y/y) may soften even further as weak global demand and probable dumping of goods by China produce once destined for the U.S.

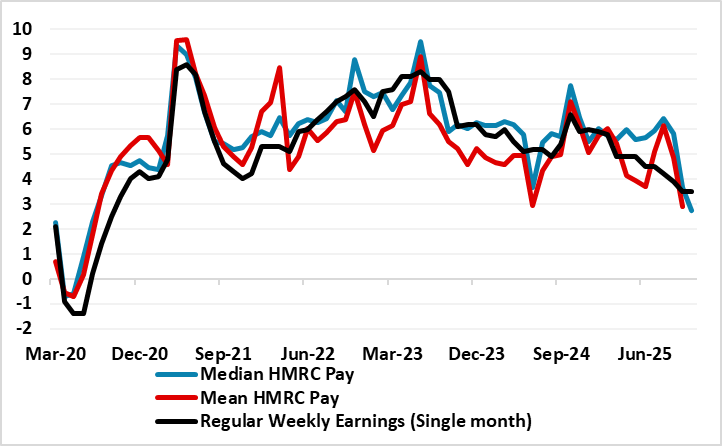

But secondly there is also the labor market backdrop. Elevated labour cost growth has been pushing up inflation, particularly for services which tend to be labour intensive. However, BoE analysis suggests that there is little evidence for their having been a structural change in the characteristics or size of wage-setting clusters in the UK economy – although Chief Economist Pill may disagree! Instead, the BoE suggests that the pandemic and the subsequent period of high inflation have not induced many UK firms to fundamentally change their approach to wage-setting. Admittedly, elevated labour cost growth has more clearly pushed up aspects of CPI inflation, particularly for services which tend to be labour intensive. However, while wage growth has fallen back significantly for reputational firms and incentive payers, it remains elevated for cost minimisers and bargaining employers. For the former, that can at least partly be explained by their large exposure to the national living wage, which has increased materially in recent years. For the latter, it probably reflects longer lags in bargaining employers’ responses to macroeconomic conditions in the face of large shocks.

Figure 3: Wage Pressures Also Consistent with CPI Target?

Source: ONS, Continuum Economics

But the BoE now suggest that wage growth of around 3-3.25% is consistent with the 2% CPI target, this assuming productivity growth of 1% per year. We think that wage inflation may already be around this rate as labor market numbers (Due Feb 17) may highlight. Admittedly using ex-bonus private sector earrings data (which are not a pure wage measure as they are affected by overtime/hours worked too), such wage pressures are nearer 3% on an adjusted three-month annualised basis. But pay data from HMRC are even weaker, already showing wage readings running below 3% (Figure 3).

Such data should encourage further speculation that the BoE will ease afresh next month and that Bank Rate should even get down to 3.0% by year end; after all, in the weak demand/more spare capacity scenarios in the latest BoE Monetary Policy Report, Bank Rate is seen moving below 3%!