Election and U.S. Equities

The multi week reaction will likely swing on the narrow equity market focus of winners and losers and an assessment that a Trump win would be better than Harris for the U.S. equity market. However, multi quarter the actual implementation of policies can spillover to impact the corporate earnings outlook and the Fed policy trajectory, and potentially push U.S. 10yr yields higher, if Trump were to win. This would challenge the U.S. equity market, including from a valuation standpoint.

Uncertainty is high over the outcome of the U.S. elections, but how will the U.S. equity market react multi week and multi quarter?

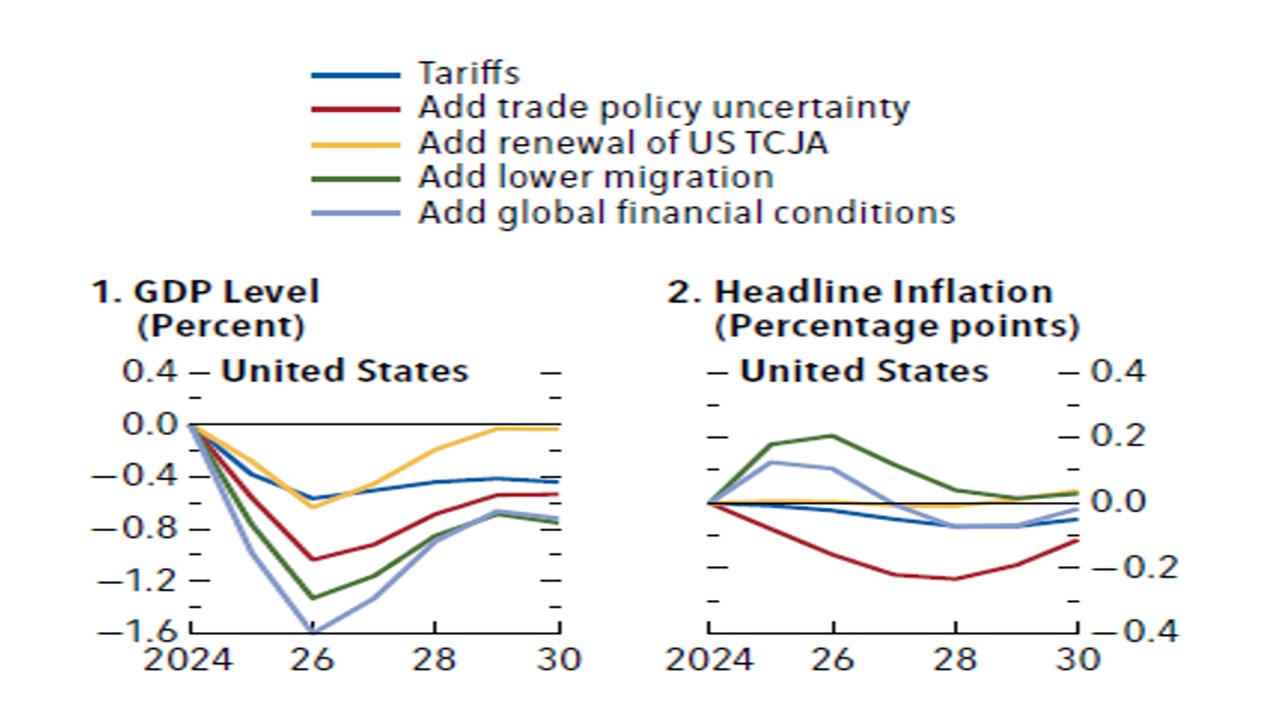

Figure 1: Main U.S. Election Scenarios (%)

Source: Continuum Economics

We have highlighted the main U.S. election scenarios (Figure 1) in a recent article (here). In narrow equity terms, the debate in the U.S. equity market has mainly been focused on sectors winners and losers e.g. Trump favoring less tech and bank regulation. A Democratic clean sweep (10%) would also risk an increase in corporate tax rates, while a Republican clean sweep (30%) would increase the chances of lower corporate tax rates. Part of the reason for this market focus is that the broader macro and Fed policy picture are seen to be supportive of the U.S. equity market, with the goldilocks of a soft landing/slow inflation and Fed easing. The U.S. economic resilience also contrasts with China growth troubles and a very slow recovery in Europe – U.S. exceptionalism remains. Thus the multi week reaction to the election could be shaped by this focus, which would mean a Harris win produces some equity disappointment and a Trump wins trigger a renewed up move – using this viewpoint a Republican clean sweep of Congress would be better for equity market psychology than a Trump victory and split Congress.

However, the multi quarter equity market reaction depends on the scale of policy changes that are enacted and the impact on the economy. Slowing inflation and a small slowdown in growth below trend are not guaranteed. Key economic challenges are

· Larger budget deficits. If Trump wins and congress is split then the policy focus would be on renewing the lapsing 2017 tax cuts (Figure 1), which is feasible given that the Democrats want to avoid most of these cuts lapsing. However, it would still see some deterioration in the budget deficit and government debt trajectory, but this would likely be larger if the Republicans controlled the House and Senate and a circa 8% of GDP budget deficit could be evident. Though Donald Trump would likely be earlier in this scenario in introducing tariff increases to part fund tax cuts, the adverse economic effect from tariffs directly and via trade policy uncertainty would likely more than counterbalance the positive stimulative effect from extra tax cuts – Figure 2 shows IMF simulations of 10% tariffs and other policies. Our biggest concern is funding the budget deficit and associated heavy funding (here), which could require an extra yield premium in mid and long maturities given that the market is already wary over the huge quarterly refunding sales. 2017 had a budget deficit of 3.4% of GDP. This could produce a lagged adverse economic impact. Fiscal stress rather a crisis, as we feel the U.S. reserve status means that government debt/GDP is unlikely to really hurt this decade.

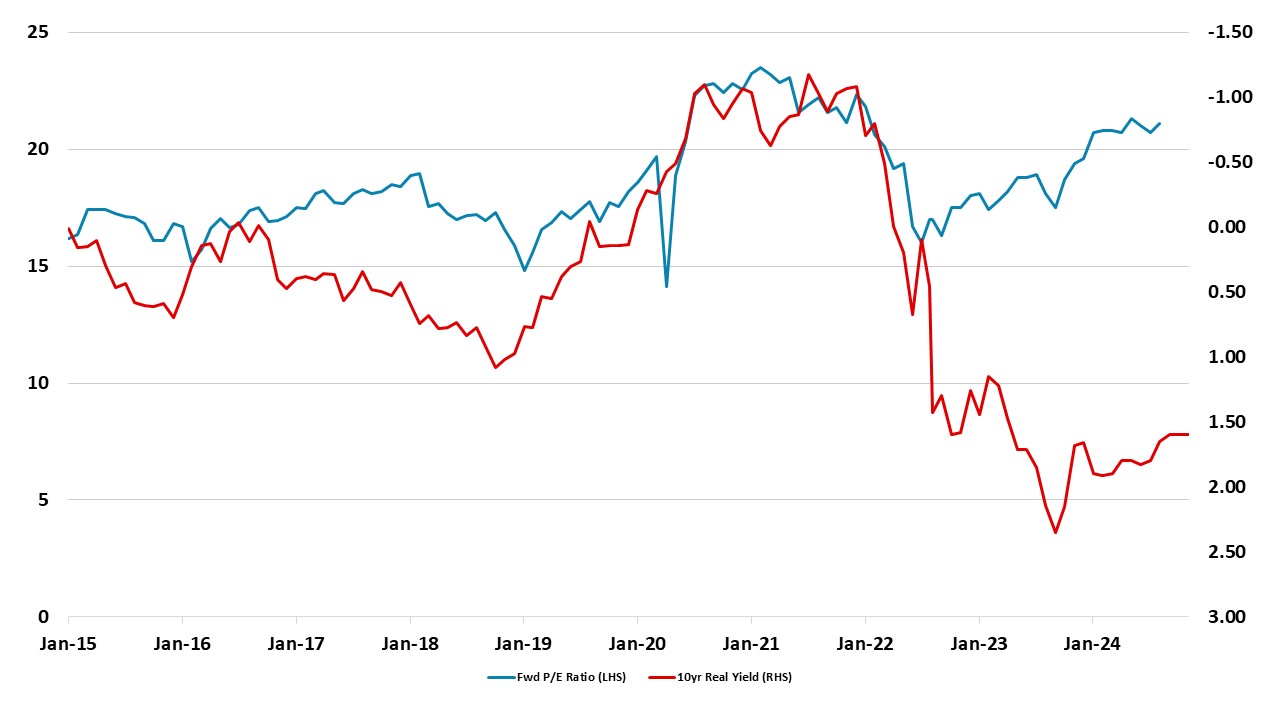

Figure 2: IMF Simulation for U.S. GDP and Inflation

Source: IMF WEO October 2024 (TCJA is 2017 tax cuts and jobs act)

· Tariff threats and implementation. A Harris presidency would see a multilateral cooperation, though this could still see some extra modest tariffs on China to increase technology restraints. However, Donald Trump on the campaign trail has increased threats of universal tariffs from 10% to 20%. Huge uncertainty exists over timing and scale of tariff implementation, but a split Congress and a more international focused Republican Senate could see a process of threats in 2025 and targeted implementation in 2026. Compromise options could involve taking action against a few countries, China and Mexico being particularly vulnerable. The impact on inflation is also uncertain, but could be less than some fears of an extra 2% on U.S. CPI inflation in 2026 (Figure 2). A clean sweep for the Republicans increases the odds (though does not provide certainty) that Trump could be more aggressive on tariffs.

· Immigration. If Trump wins then extra efforts to control new illegal immigration would be a priority, given his and GOP long run concern on the issue. Accelerating deportations beyond the 1.5mln achieved in Trump’s first term would be more difficult legally and to implement, though picking a fight with Mexico on trade could be one point of leverage to try to get deportations increased. Our view is that the adverse impact on the labor market and hence Fed policy would be multi-year rather than the next 6-24 months.

· Policy uncertainty. Whether Trump does on tariff policies is highly uncertain, though tax changes depend on the Congress results. He has the authority to do so on tariffs if he invokes national security concerns. Some Republicans will warn him that aggressive tariffs would weigh on equities, which Trump cares about, and would boost inflation, a rise in which was very damaging to Biden. If Trump inherits a growing economy with falling interest rates he may simply decide to take the credit for a healthy economy and avoid high risk policy actions on the tariff front.

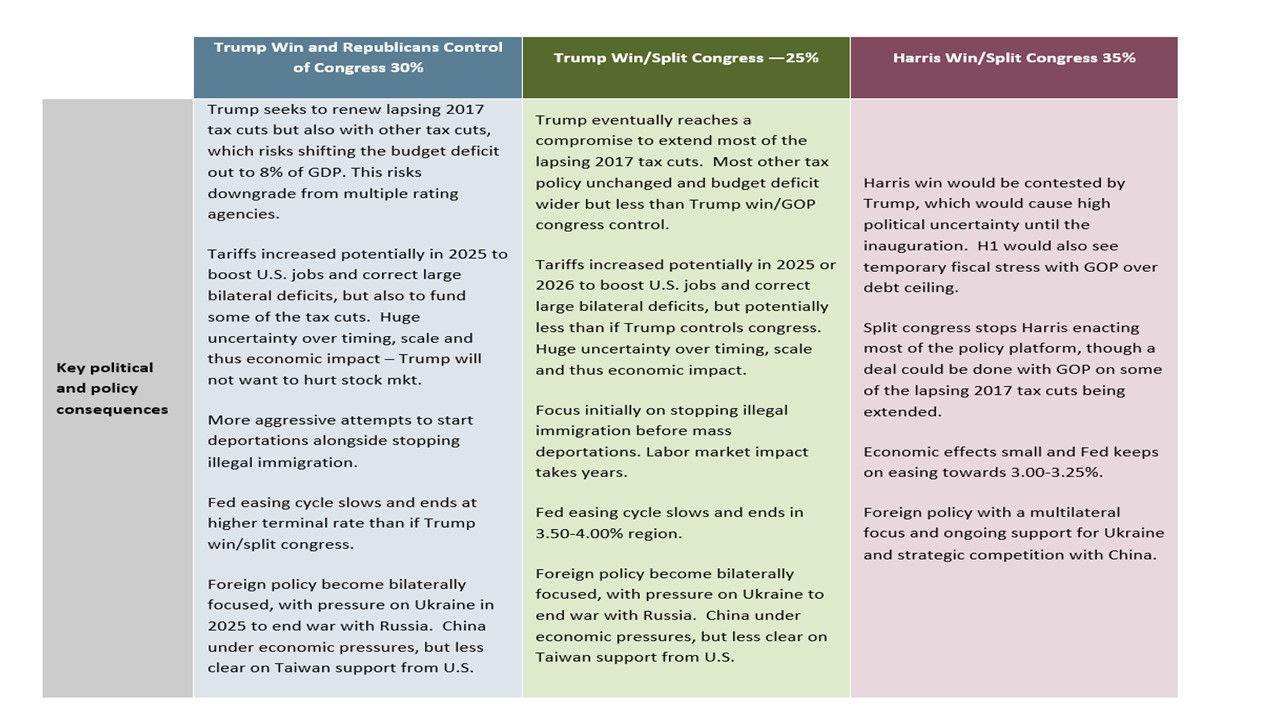

Figure 3: 12mth Fwd S&P500 P/E Ratio and 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2025

The U.S. equity market faces a potential economic and corporate earnings hit depending on the scale of tax cuts versus tariff increases, which is too uncertain pre-election and clarity may not come until H1 2025. However, what could end up being important is government bond yields and bringing valuations back into focus. A Trump victory with a split Congress would likely see 10yr yields moving above 4.5% if the economy remains relatively resilient and the slowdown is shallow. A clean sweep from the Republicans in Congress could prompt a larger increase in 10yr yields towards 5%. So far the U.S. equity market has been able to ignore the rise in 10yr yields since the summer, but these type of moves could produce more of a focus on valuations. Under Trump 1.0, the 12mth forward P/E ratio was lower (Figure 3) and real 10yr bond yields were more aligned with equity valuations, which is not the case in 2024.

The multi quarter outlook depends on corporate earnings versus valuations. Expectations of 2025 S&P500 earnings have slowed but still appear too high at 13% and are likely to be trimmed further into 2025. A persistent rise in government bond yields under a Trump presidency would cause a headwind and could mean choppy consolidation or modest correction in 2025, while any major hit to corporate earnings would leave the U.S. equity market vulnerable.