USD flows: New highs in S&P supportive for USD/JPY

Quiet overnight session but equity strength keeping JPY under pressure

A fairly quiet overnight session saw somewhat weaker than expected Tokyo CPI data but little FX movement. Most notable was the rise in equities and equity futures, with S&P 500 futures hitting a new all time high after the cash market closed just marginally below February’s all time high in the US. This risk positive tone has been helped by a reduction in Middle East tension and lower rate expectations in the US, encouraged by some statements from Fed officials, notably Daly yesterday.

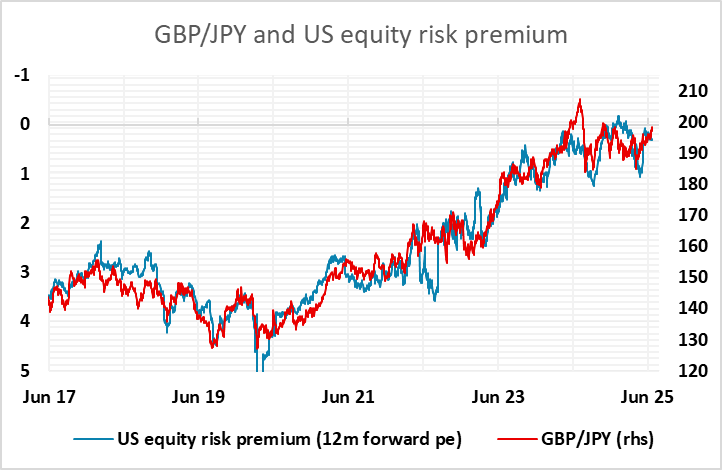

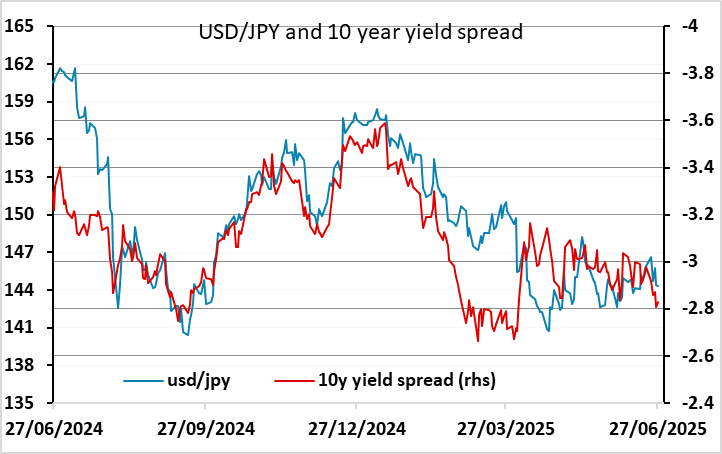

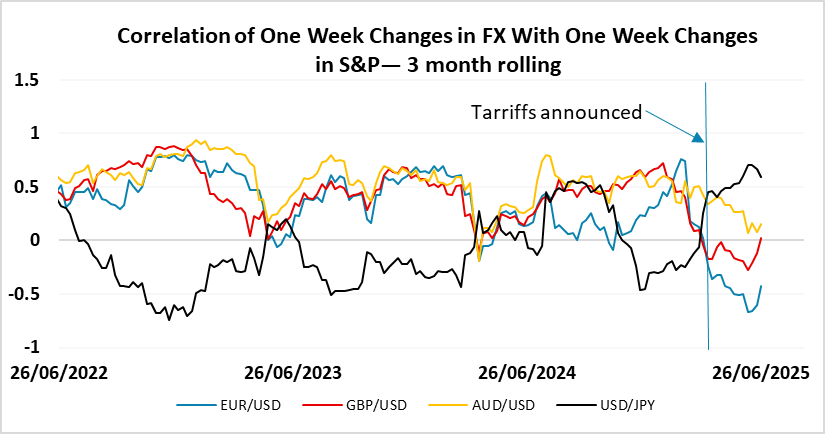

The behaviour of the USD in relation to equities has definitely changed this year, particularly since the announcement of reciprocal tariffs back in early April. The so called riskier currencies are no longer positively correlated with equity indices, and USD/JPY has become very much positively correlated with equities. The move to new highs in the S&P can therefore be expected to be supportive for USD/JPY and negative for the JPY on the crosses, although inasmuch as it is due to lower US yields, the effect is diminished. Equity risk premia are not hugely changed, being more driven by yields than equity prices, and still suggest the JPY is a little cheap on the crosses, but as long as the positive equity tone persists, expect the JPY to remain under pressure.