Published: 2024-04-09T12:27:05.000Z

Preview: Due April 10 - U.S. March CPI - Core rate back to trend after two strong months

Senior Economist , North America

2

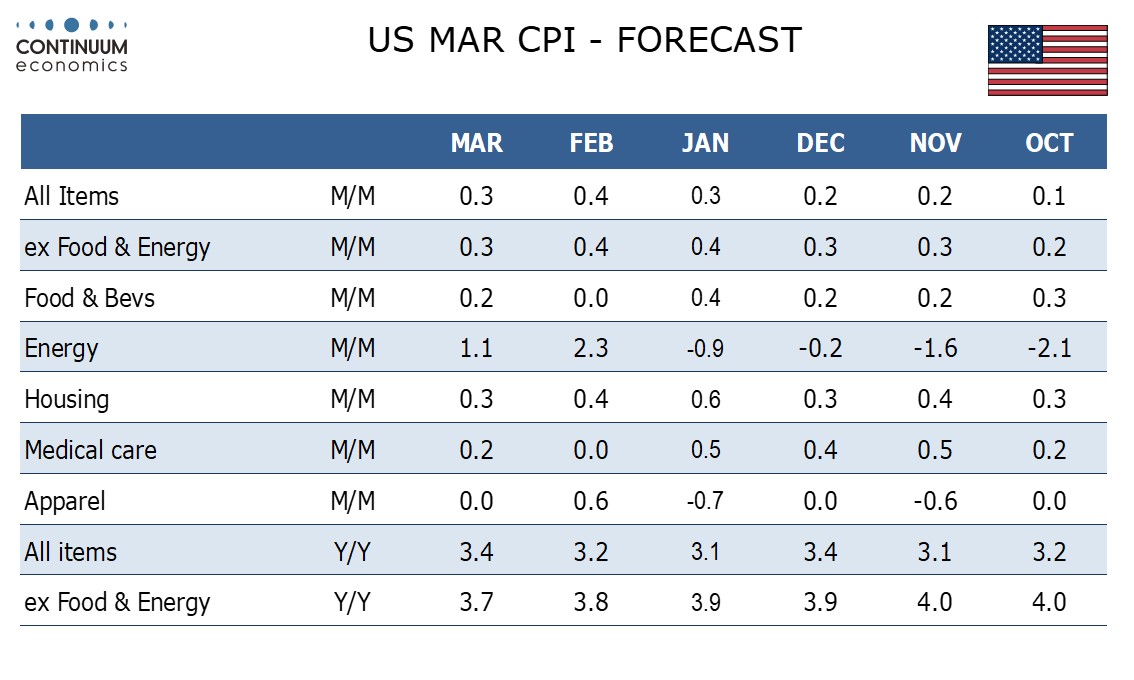

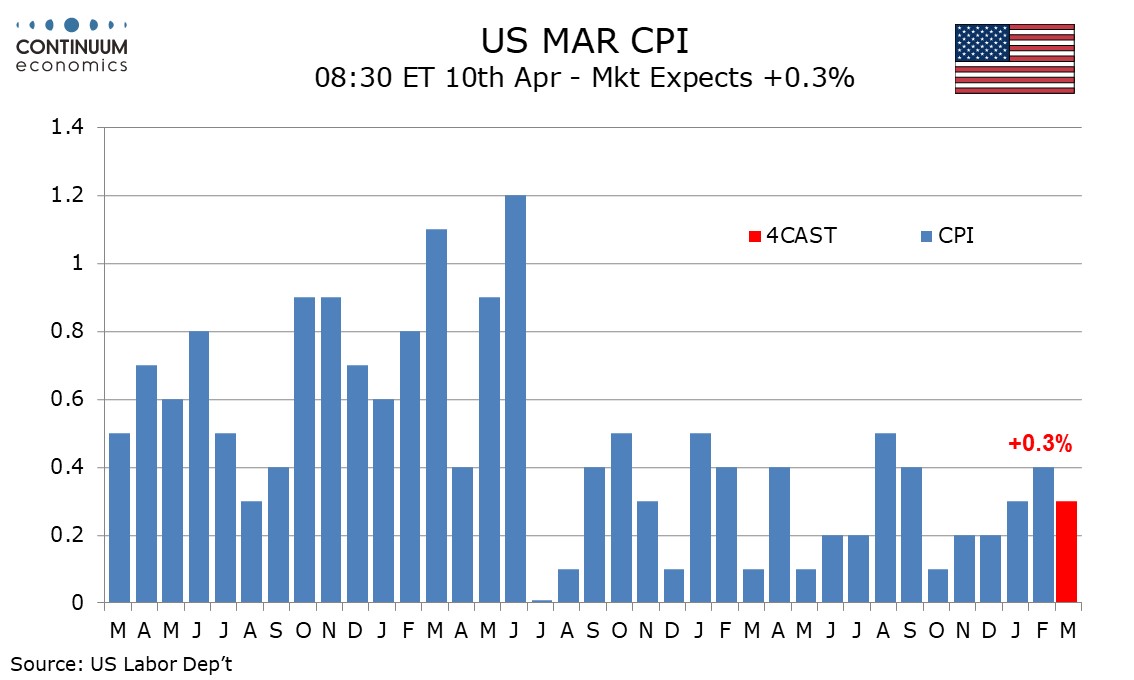

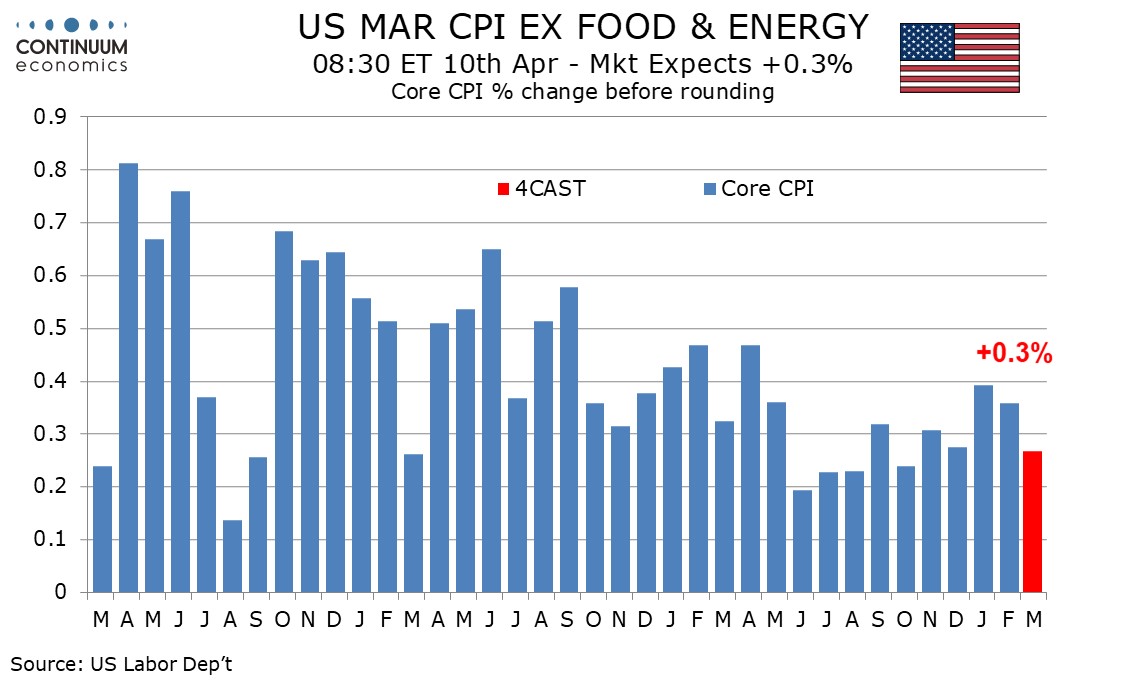

We expect March CPI to rise by 0.3% both overall and ex food and energy, though before rounding we expect the headline at 0.31% to exceed the core rate at 0.27%, the latter a return to trend after two straight disappointing 0.4% gains seen in January and February.

January’s breakdown showed an exceptionally strong 0.7% increase in services ex energy outweighing a below trend 0.3% decline in commodities ex food and energy. February saw commodities ex food and energy correct a little above trend with a rise of 0.1%, as used autos and apparel corrected from sharp January declines while services ex energy were only marginally above trend with a rise of 0.5%.

We expect March to see a breakdown similar to December’s, when services ex energy rose by 0.4% and commodities ex food and energy fell by 0.1%. It is worth noting that March in 2022 and 2023 both saw 0.3% increases ex food and energy after stronger data in January and February.

Gasoline is likely to lead a 1.1% rise in energy, albeit restrained by seasonal adjustments, while we expect a modest 0.2% increase in food. We expect yr/yr growth to increase to 3.4% from 3.2% overall but to slow to 3.7% from 3.8% ex food and energy. The latter would be the slowest pace since April 2021.