Published: 2024-07-15T14:53:37.000Z

Canada - BoC Q2 Business Outlook Survey shows little change in views on economy or inflation

2

The Bank of Canada’s Q2 Business Outlook Survey is not much changed either in its economic view or expectations of inflation. That suggests the BoC might be cautious about delivering a second straight easing on July 24, though tomorrow’s June CPI will be watched closely.

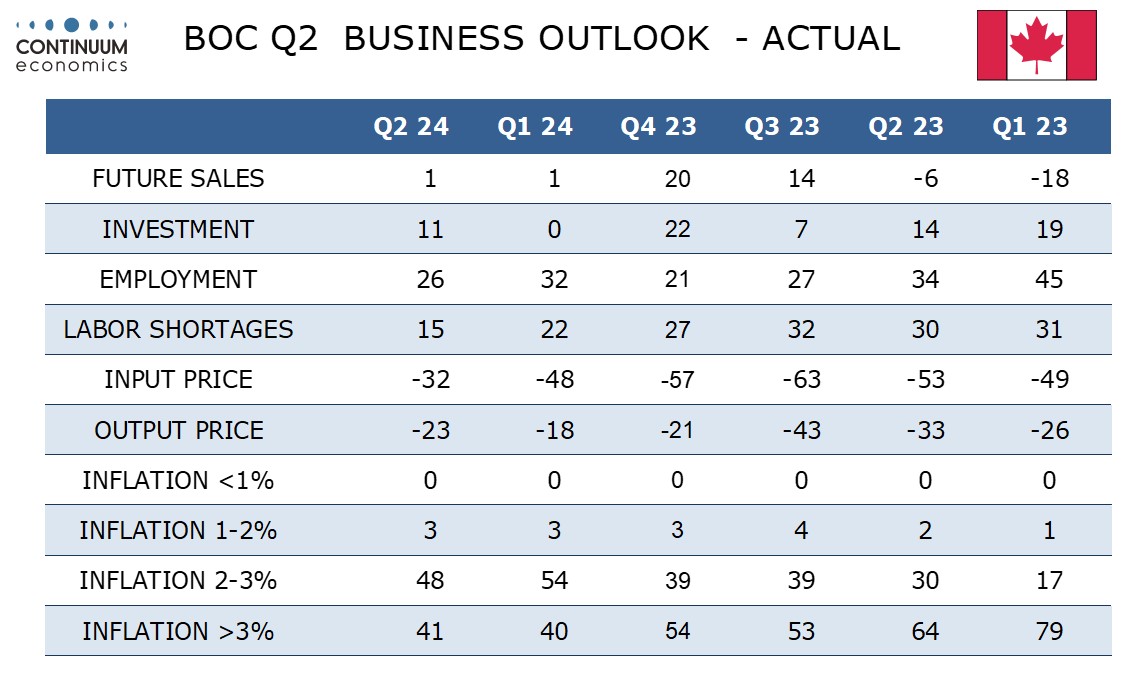

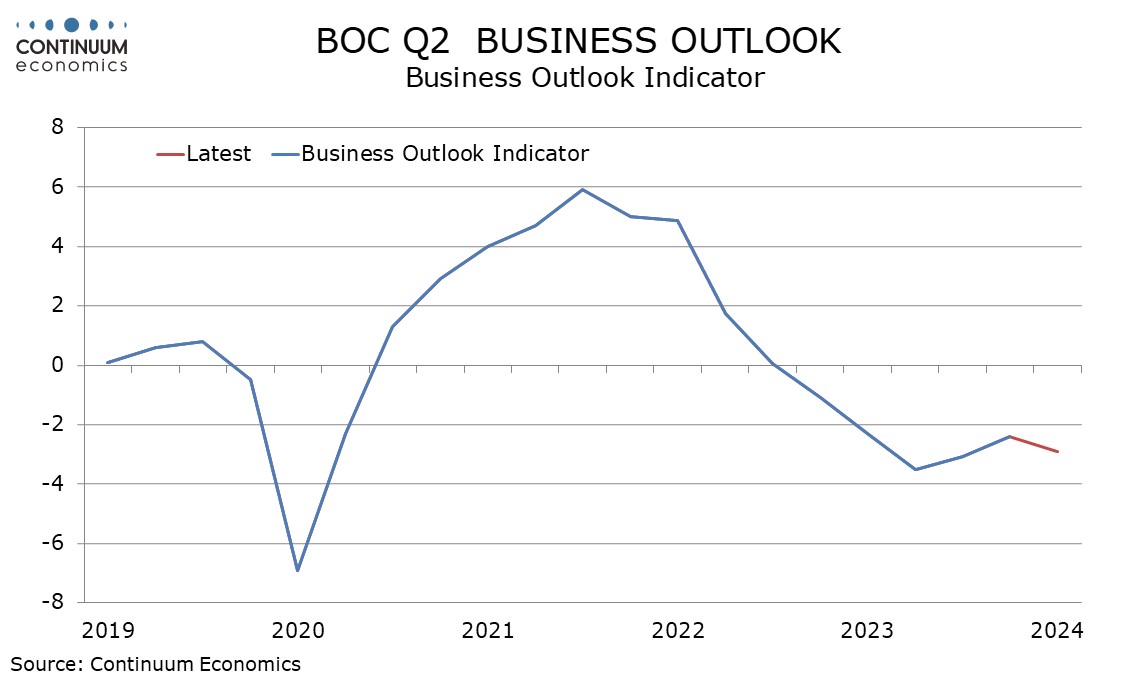

The Business Outlook Indicator slipped to -2.90 from -2.39, its first dip in three quarters, while each of the last six quarters have been modestly negative. During that time the Canadian economy has been quite subdued, but has not entered recession. One positive signal was a rise in the investment index to 11 from zero in Q1, though labor market tightness continues to ease.

There is not much change in inflation expectations with a clear majority still seeing inflation above 2% and the proportion seeing it above 3% marginally higher than in Q1. A separate survey of consumer expectations also shows persistent concerns over inflation, with a 5-year expectation of 3.20%, up from 3.12% in Q1.