EUR, USD, JPY flows: USD strength after FOMC to fade

While Powell's indication that the Fed were unlikely to cut in April triggered USD gains, the USD still looks vulnerable, especially against the JPY, due to low long term yield spreads and renewed banking sector concerns

USD and JPY strength has been the main feature overnight, although the JPY has been the best performer over the past 24 hours. While the Fed statement and Powell’s press conference sustained expectations of easing this year, Powell indicated that a March easing, which had been priced as around a 50-50 chance, was unlikely, saying the FOMC needed more confidence inflation was moving sustainably to target before easing. This triggered some modest gains in US short term yields, supporting the USD, but undermining equities, which were already struggling a bit due to the revival of banking sector concerns with the stock of New York Community Bancorp falling sharply. This ensured that the JPY was firm on the crosses.

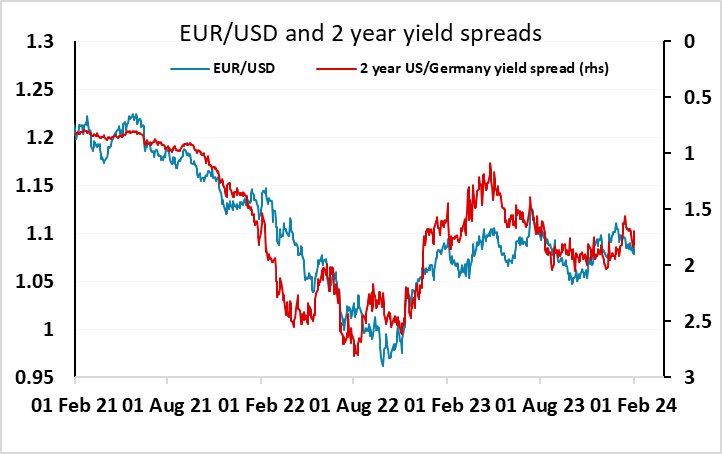

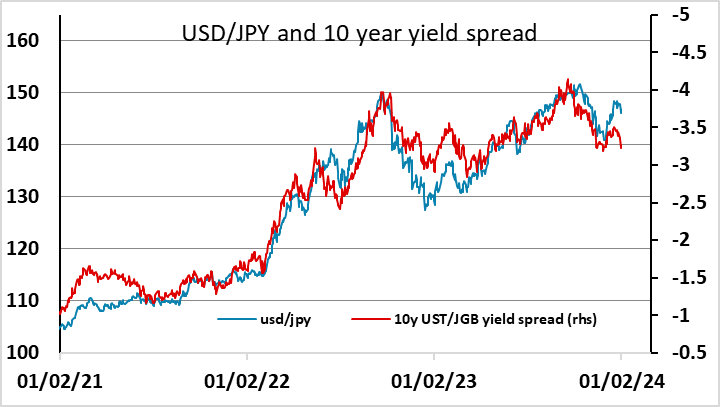

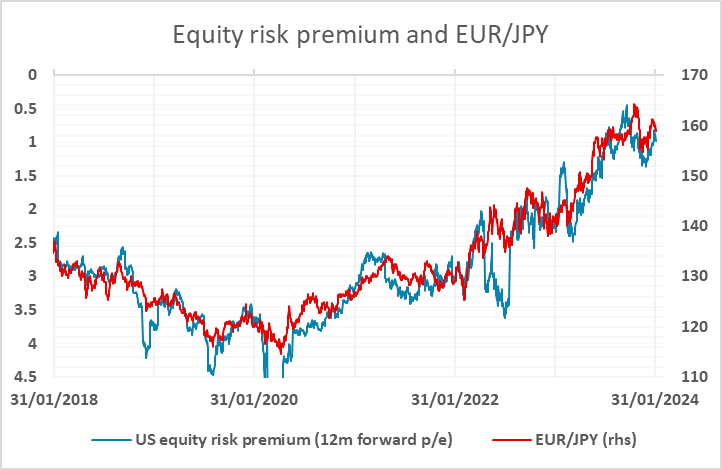

From here, yield spreads still suggest there is substantial scope for JPY gains against the USD. JPY gains on the crosses are supported by the move up in US equity risk premia, which has correlated strongly with JPY crosses in recent years, but further risk premia increases are needed to extend JPY strength. For EUR/USD, there hasn’t been enough rise in US yields to justify further EUR/USD declines, especially if US equities underperform due to renewed US banking sector concerns. This suggests that there may be scope for some general USD declines from here, with the JPY favoured.