USD flows: Softer after data, EUR leading

USD lower as prices rise more than expected and income and spending disappoint

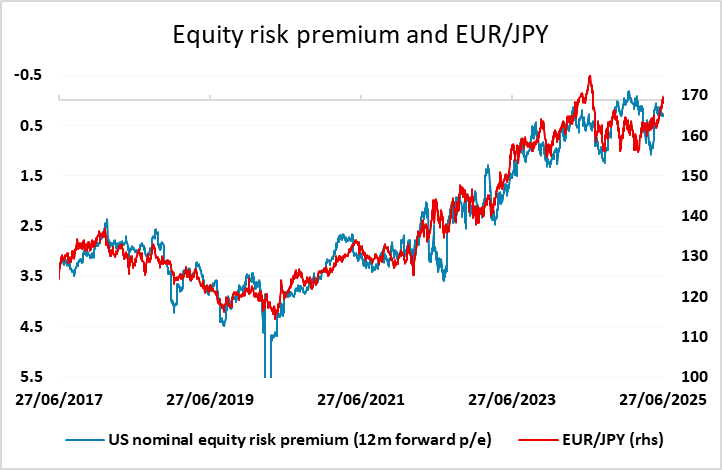

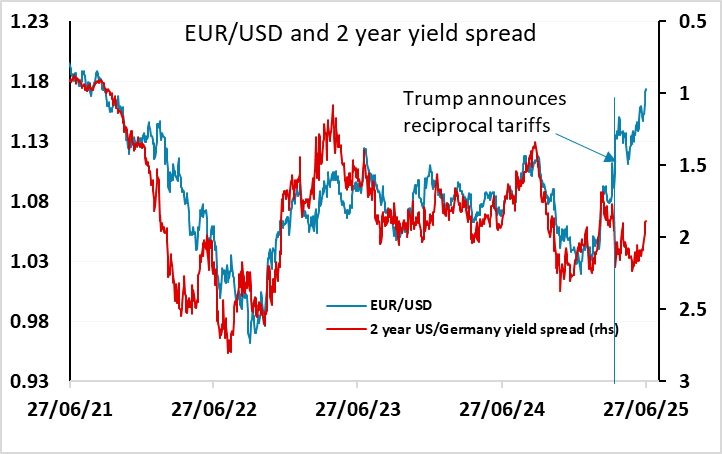

The USD is generally a little softer after the data, with the decline in personal income and spending suggesting a softening in the economy, albeit far from conclusive at this stage, while core PCE prices were a little firmer than expected at 0.2% m/m. The combination of higher prices and weaker spending may be the theme going forward as tariffs hit, but at this stage it is too early to draw any firm conclusions. Nevertheless the USD is generally weaker, with the EUR leading the way. Even USD/CAD has moved a little lower, despite a 0.1% decline in GDP in May following a similar decline in April and indicating the Canadian economy is feeling the impact of tariffs. EUR/USD looks stretched here, but the uptrend is hard to oppose, while strength in equities continues to support EUR/JPY as well. Although this too looks somewhat overdone, it is unlikely to reverse unless we see some change in risk sentiment. The cash equity open will be interesting with futures already pricing a new all time high in the S&P 500.