Extreme U.S. Economic Uncertainty Starting to Fade

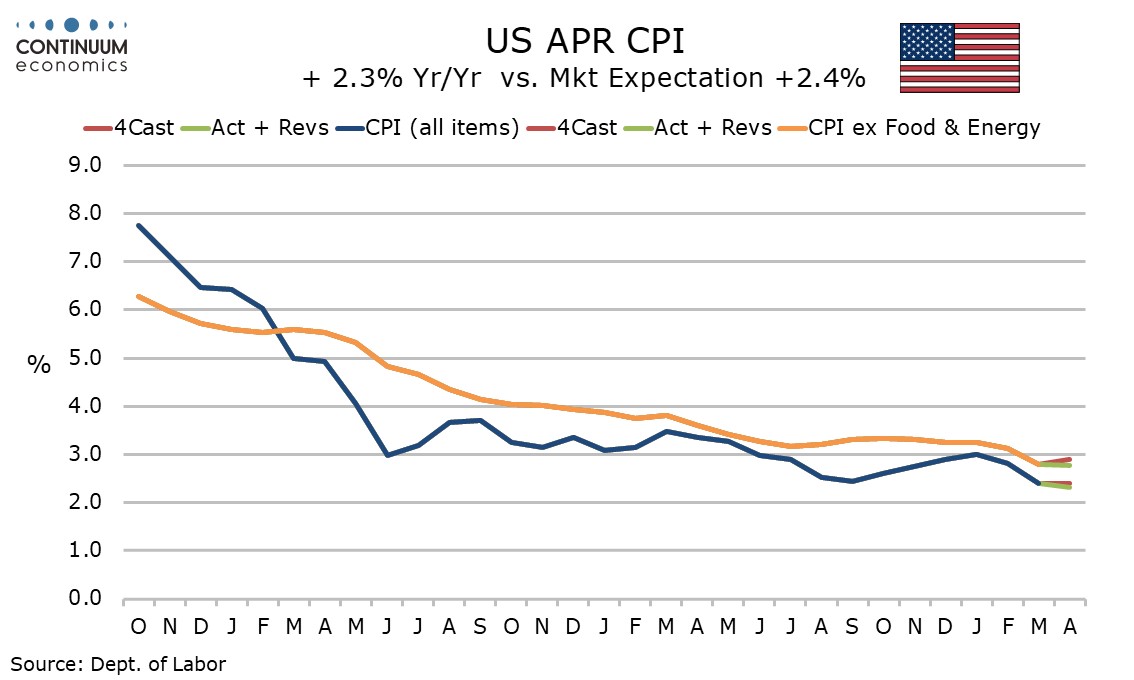

Now that we have seen April’s non-farm payroll and CPI data, the underlying economic picture still looks quite healthy. Activity still seems to have respectable momentum despite a marginal decline in Q1 GDP, while inflation appears to be losing momentum with little pass through of tariffs yet. Uncertainty on trade and fiscal policy remains high, but a core economic view of a moderate slowing in growth, and a moderate rise in inflation, is becoming increasingly likely.

Economic picture still looks healthy entering Q2

Analysis of the 0.3% annualized decline in Q1 GDP largely centered on a positive breakdown outside a sharp negative from surging imports. However, many of the positives, particularly surging business investment, were temporarily inflated by the surge in imports. We also note bad weather in early Q1 as a restraint on consumer spending, and a fall in defense in a correction from a late 2024 acceleration as temporary negatives that took the outcome below zero. The absence of a significant tariff pass through in April’s CPI reflects a Q1 inventory build up and uncertainty over the persistence of tariffs keeping price hikes on hold, though some pass through will be seen once the situation gets clearer. Uncertainty, while still high, has fallen in May.

Tariffs and the economic outlook

The Tariff deal with the UK and the trade truce with China suggest that 10% recprocial tariffs look set to be a floor, while no country looks likely to be subject to tariffs so extreme that bilateral trade grinds to a halt. Some exemptions or quotas on 25% product tariffs are also likely depending on the size of the bilalteral trade deficit (here). An average tariff a little below 15% looks likely. This is still enough to add close to 1% to inflation, but with inflation showing signs of slowing before the tariff impact hits, the acceleration in inflation now looks set to be lower than 1.0%. Reduced willingness to visit the USA, particularly from Canadians, appears to be restraining prices of air fares and hotels.

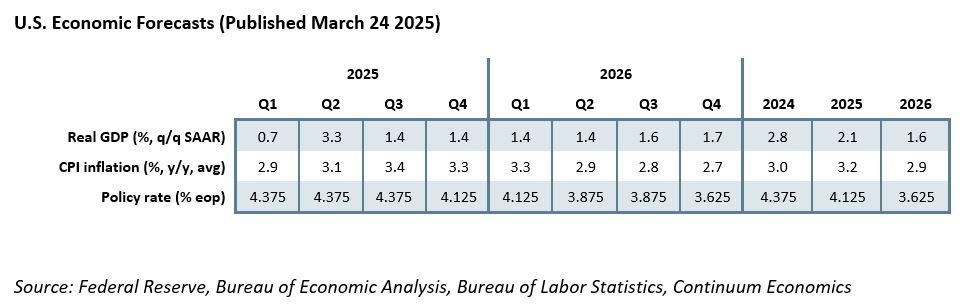

A noticeable but not dramatic increase inflation is likely to slow US economic momentum, but a recession now looks unlikely, with the probability of such an outcome now looking around 20%. A view of a moderate acceleration in inflation and a moderate slowing in growth is consistent with that in our quarterly outlook published in March, with the tariff picture now not far from what appeared likely in late March. However, our March view that Q2 would see an above trend quarter from both GDP (rebounding from Q1) and inflation (on a rapid pass-through of tariffs) looks less probable, with the extreme uncertainty at the start of Q2 likely to weigh on investment, and the pass-through from tariffs to prices taking longer than we expected. Beyond Q2 however, our March forecasts, which saw GDP slowing to 2.1% in 2025 from 2.8% in 2024, and CPI rising to 3.2% in 2025 from 3.0% in 2024, appear to be broadly holding up.

Focus turning towards fiscal policy

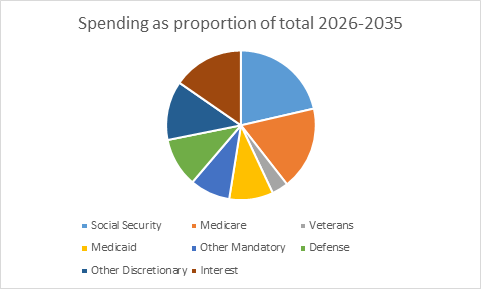

While we now have a central view of the average tariff rate stabilizing a little below 15% , Trump remains unpredictable, and uncertainty will persist at least through the 90-day periods for reciprocal tariffs ending July 9 and for China expiring in mid-August. During that period however trade may end up competing with fiscal policy for attention, with the debt ceiling set to be hit in August and its lifting set to be tied to a “Big Beautiful Bill” dealing with fiscal policy. Given the narrow Republican majorities in Congress, particularly the House, the bill is likely to be passed at the last minute after plenty of argument, though it is highly unlikely that the Republicans will fail to pass anything, and risk a default on the debt. However, reconciling the objectives of making Trump’s tax cuts from his first term permanent, reducing the budget deficit and sparing the working class Trump base from painful spending cuts, particularly in Medicare, looks difficult , and the debates will be tense.

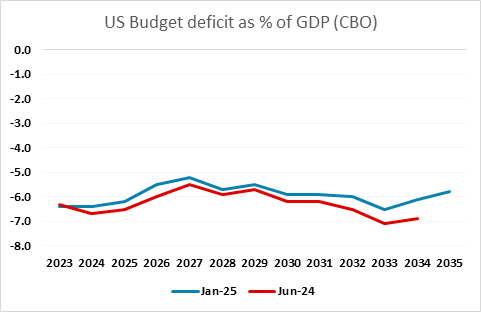

House Republicans are talking about USD4-4.5 trillion in tax cuts over 10 years with around USD $1-1.5 trillion in spending cuts. The tax cuts will largely sustain existing rates so the net impact to the economy will be modestly contractionary. Tariffs are likely to raise less than USD1 trillion in revenues over the 10yr period. We are probably looking at USD2.5-3.0 trillion being added to the existing Congressional Budget Office forecast for the 10 year deficit, which would lift it to around 6.5% of GDP from a current forecast of 5.8%, similar to the 6.4% seen in FY 2024. 7.0% is quite possible if a modest slowing in growth is sustained. This is too high to be sustainable, but unlikely to trigger a panic in the bond market. A risk is that as his term continues, Trump will seek to gradually increase tariffs further in an attempt to reduce the deficit and given his instinicts, which could prevent the tariff boost to inflation from being a one-time problem that drops out in Q2 2026.

Implications for the Fed

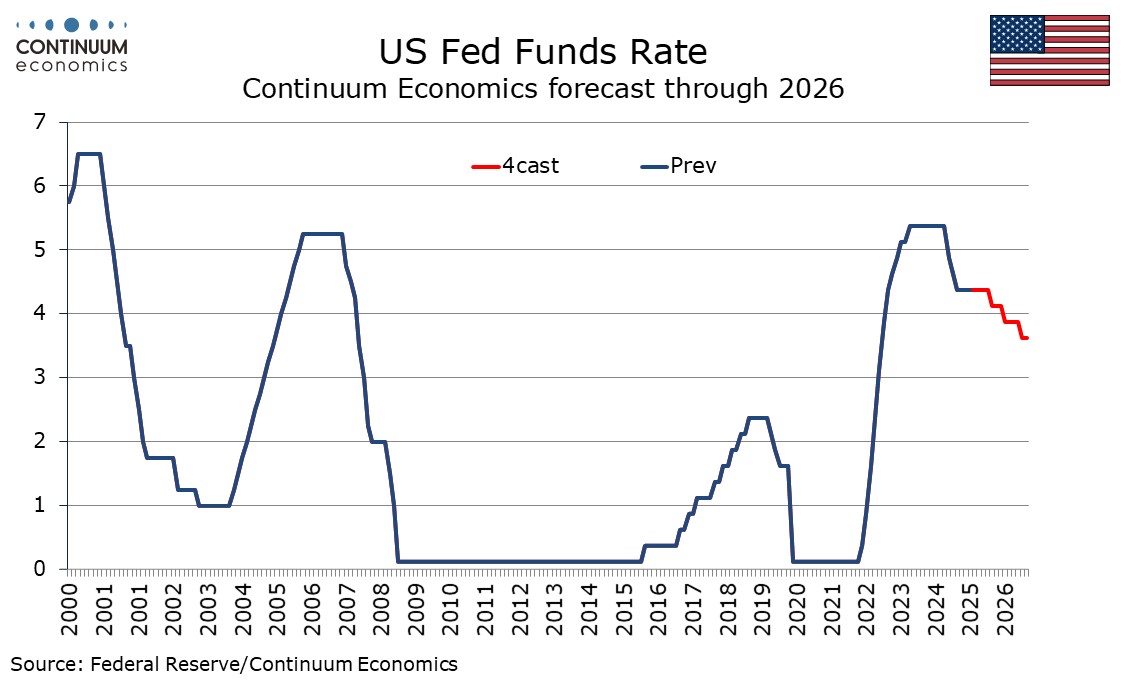

We are not ready to revise our Fed call from one easing in 2025, by 25bps in December, and two easing of 25bps in 2026, taking the end 2026 Fed Funds target to 3.5-3.75%, still above the Fed’s 3.0% median estimate of neutral. However, the reduced tariffs on China and particular have changed the picture. Under the aggressive tariff regime that was implied immediately after “Liberation Day”, elevated inflationary and recession risks had us expecting easing only if the economy entered recession, which then looked a significant risk. Now with reduced inflationary and recessionary risks, easing could be seen if inflation remains controlled and growth slows modestly, though we expect the FOMC would want to wait until its September meeting without any stark surprises in the data. Our view is that the only 2025 move will come in December, but a move in September or October, and two moves overall in 2025, is a significant risk.

Our next quarterly economic outlook will be published in June. May employment and inflation data will provide important insight, but there may be only limited further clarity on trade and fiscal policies before Q3.