Preview: Due February 7 - U.S. January Employment (Non-Farm Payrolls) - A slower month given bad weather

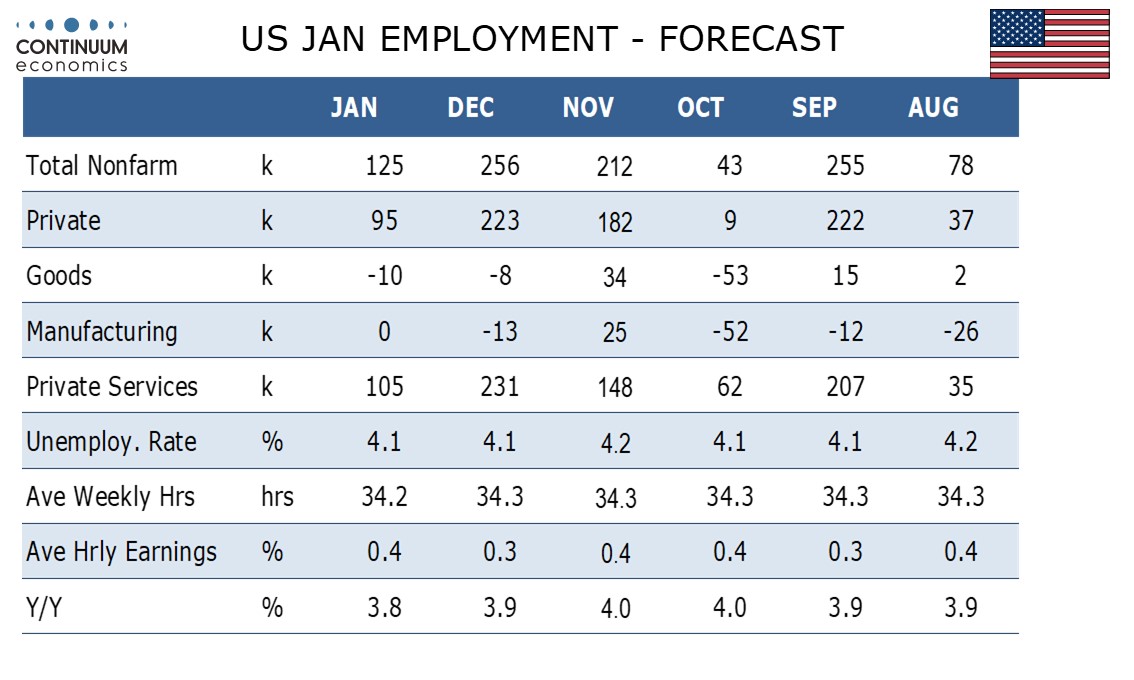

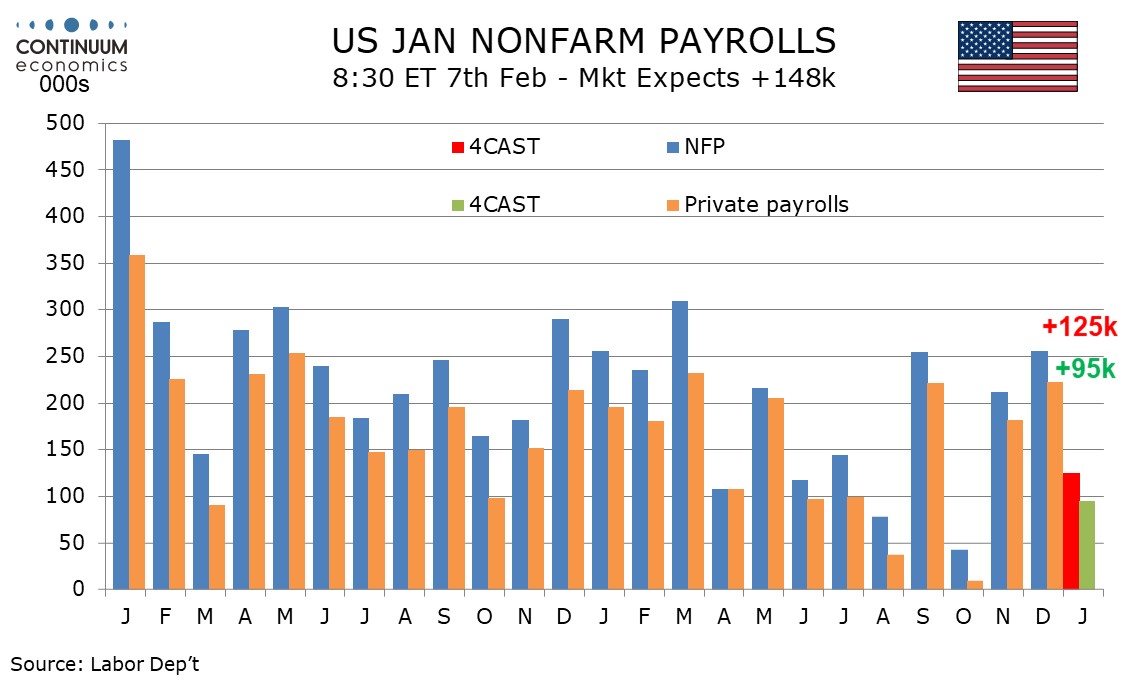

We expect a below trend 125k increase in January’s non-farm payroll, with a 95k rise in the private sector. The data is likely to be restrained by bad weather and a possible correction from an above trend December. The workweek is likely to fall on bad weather but we expect unemployment to be unchanged at 4.1% and a slightly above trend 0.4% increase in average hourly earnings.

Unusually cold weather in much of the country is likely to be the man restraint, outweighing the more localized destruction caused by the Los Angeles fires. The coldest weather however came before and after the survey week for January’s non-farm payroll rather than in the survey week itself. The underlying labor market picture still looks healthy and we expect employment growth to regain momentum once weather improves.

December saw an above trend 256k increase that may have been inflated by continuing recovery from October’s weak 43k rise that was depressed by hurricanes and strikes. The 3-month averages of 170k overall and 138k in the private sector may better represent trend. Historical data will see annual revisions with the January report. The preliminary estimate for the March 2024 benchmark revision was significantly negative, at -818k.

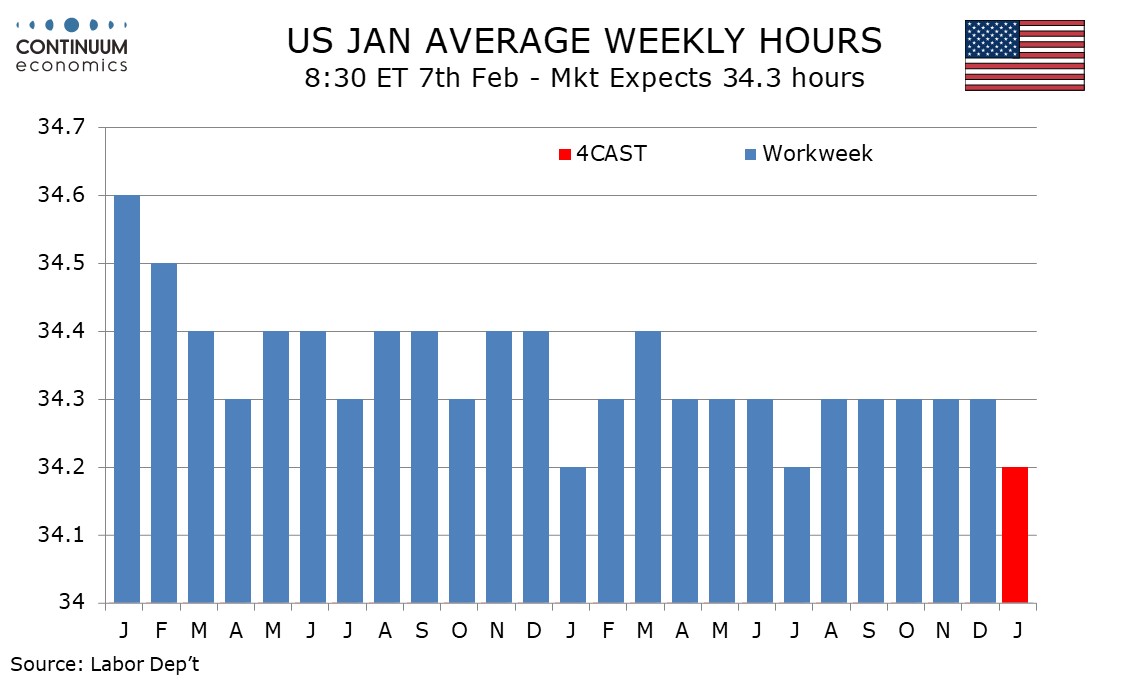

We expect bad weather to depress the workweek, bringing a fall to 34.2 hours after force straight months at 34.3.

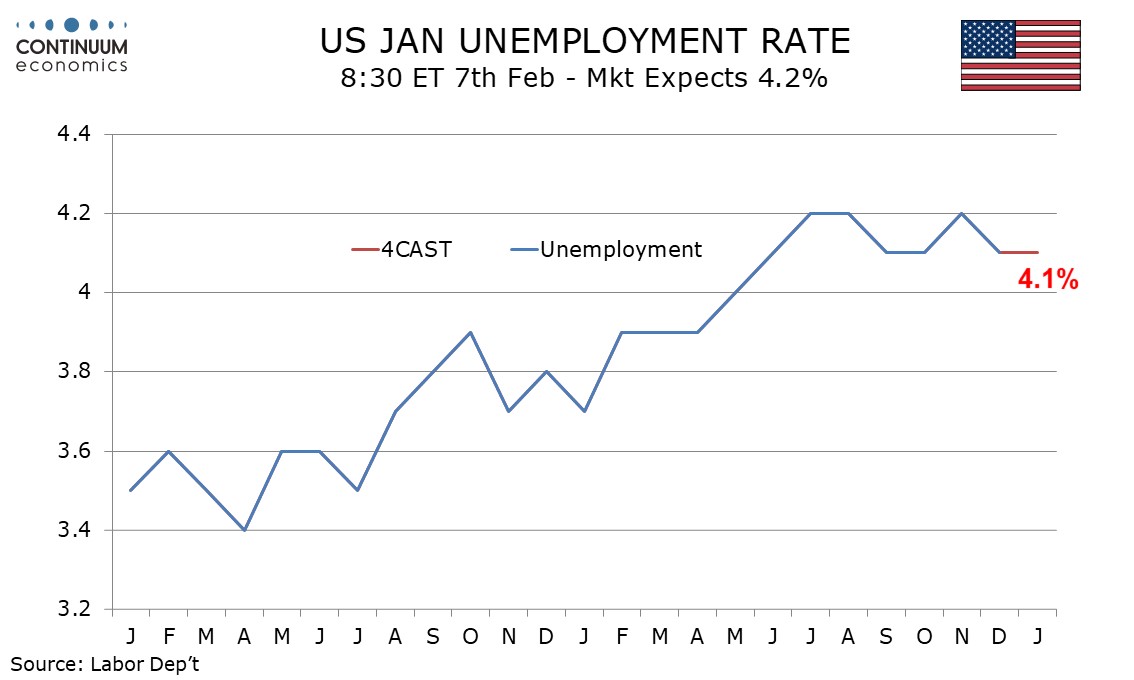

However, the unemployment rate is unlikely to be lifted by bad weather, with the labor force as well as employment likely to be restrained. We expect the rate to remain at December’s 4.1%.

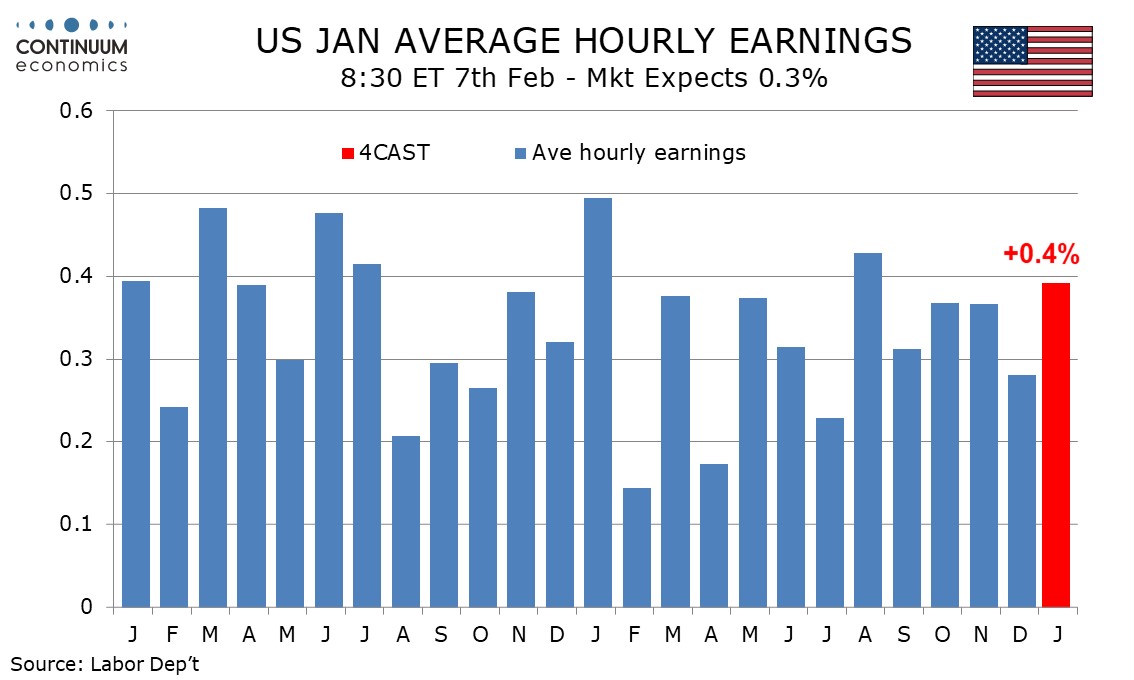

A lower workweek, and the possibility that job weakness in January could come in low paying sectors such as retail and leisure/hospitality mean some upside risk to average hourly earnings. We expect a 0.4% increase, up from 0.3% in December, though an even stronger rise in January 2024 will see yr/yr growth slip to 3.8% from 3.9%.