Bank of Canada Minutes expect further easing, if with no fixed timetable

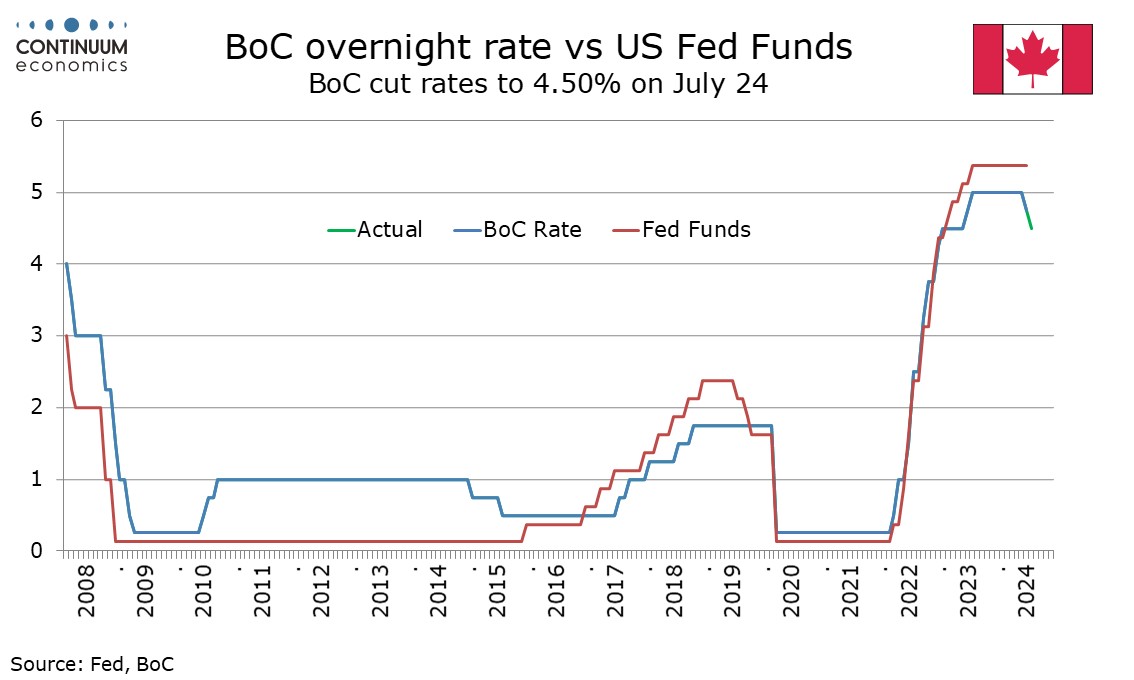

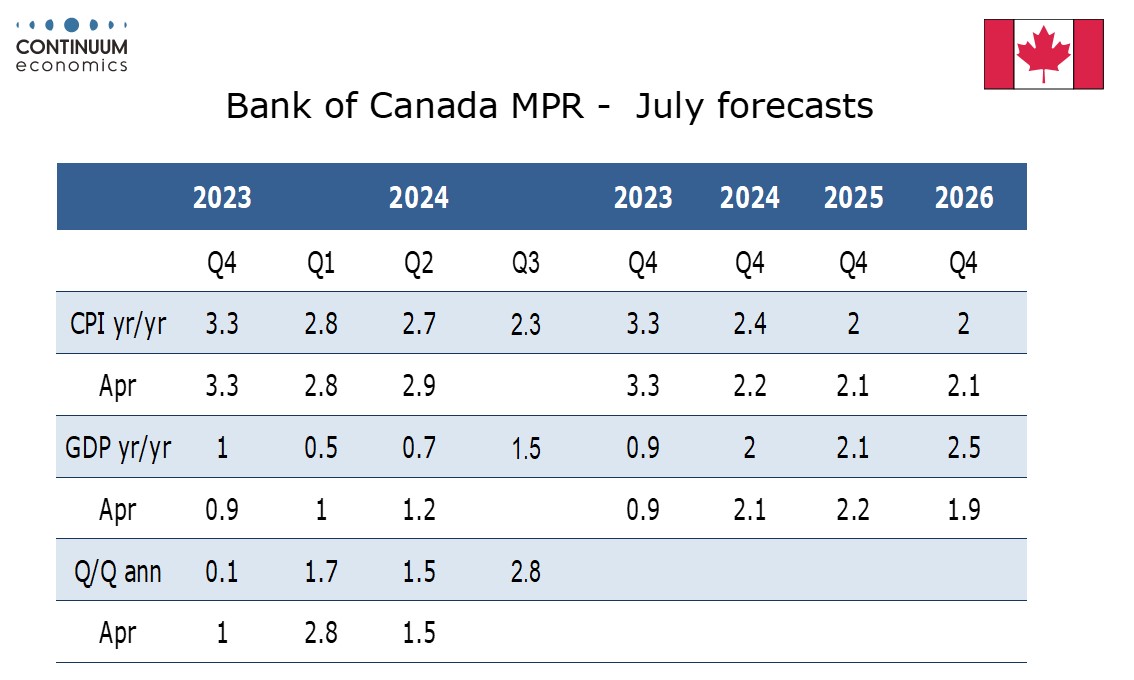

The Bank of Canada has released minutes from its July 24 meeting that delivered a second straight 25bps easing. While risks on both sides are discussed, the tone is on balance dovish, with the BoC increasingly confident that ingredients for price stability were in place. There was a clear consensus to lower the policy rate further if inflation continued to ease in line with the projection.

Countervailing forces on inflation meant that progress was likely to be bumpy and that meant there should be no set path for the policy rate, with decisions to be taken one meeting at a time. Restrictive policy was still seen as justified, with the rate cut decided at the meeting simply making policy less restrictive. However while inflation is still above the 2% target, it is now in the 1-3% control range, and the BoC agreed that they needed to clearly communicate that they would be weighing factors that could pull inflation below target as well as those that could hold it above target.