Banxico Minutes: Unanimous Pause, Diverging Cuts

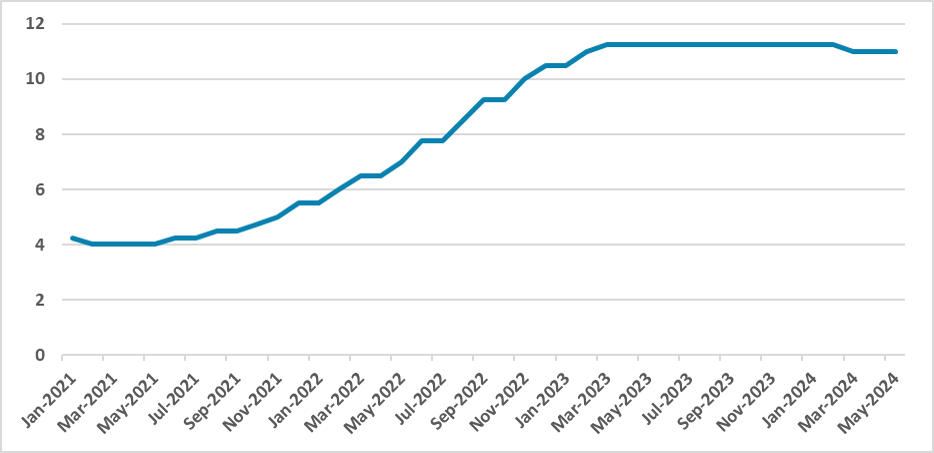

Banxico maintained the policy rate at 11%, reflecting a cautious stance amid persistent inflation and economic uncertainty. The board was unanimous in this decision but divided on the timing of future cuts. Despite expectations for a rebound in economic activity, concerns about inflationary pressures and external conditions influenced their cautious approach. Future cuts will be data-dependent, with a potential 75bps reduction expected by year-end.

Figure 1: Mexico Policy Rate (%)

Source: Banxico

The Mexican Central Bank (Banxico) has released the minutes of its last meeting, during which it opted to maintain the policy rate stable at 11%, following a 25bps cut in March. The decision was unanimous, and most of the board agreed on the status of the Mexican economy and inflation, though some members clearly disagreed on the next steps. All five members emphasized the need to keep monetary policy tight, but their opinions on the extent of future cuts differed.

Regarding the external environment, most members noted that the Federal Reserve will likely cut rates less than previously expected and stressed the persistence of services inflation in the U.S. Most central banks in advanced economies have left their policy rates unchanged since their last meetings. Interestingly, there was little discussion about whether Banxico should respond to potential changes in Fed cuts, indicating that Banxico's decision was primarily influenced by domestic factors. Additionally, despite some volatility in the MXN, most of the fluctuations were reversed, and the Mexican currency remains stable at levels unlikely to generate inflationary pressures.

On the domestic front, the entire board agreed that the Mexican economy weakened in the last quarter of 2023 and likely continued to do so in the first quarter of this year. However, they anticipate that economic activity will rebound in the second half of the year, as it typically does during electoral times. Furthermore, the strong fiscal package approved by the government is expected to impact the construction sector positively. The board expects both consumption and investment to rise in the second half, which could have inflationary impacts. Additionally, the prospect of a looser fiscal policy, especially concerning PEMEX's financial situation, will also add new inflationary risks.

Regarding inflation, most of the board agreed that the recent rise in the year-on-year CPI from 4.4% to 4.6% in April was due to increases in non-core groups. They also highlighted the persistence of services inflation, which has yet to show a significant decline. The view within Banxico is that inflation will likely fall more slowly than previously thought, and the shocks from the post-pandemic period and the Ukraine war have not yet dissipated. The convergence of inflation is now expected only in the fourth quarter of 2024. Expectations for both 2024 and 2025 remain above the inflation target, at 3.8% and 3.4%, respectively.

The decision to keep the policy rate unchanged at 11% surprised us, as we still saw conditions favoring continued cuts, although many market participants believed that Banxico should respond to the recent rise in inflation. The view within Banxico suggests they now see inflation as more persistent than previously thought, possibly due to updates in their models or a response to the rise in non-core groups. It seems they want to exercise greater caution in cutting rates, especially given tighter conditions abroad and internal risks that demand could heat up inflation.

Nonetheless, the board disagreed on the prospective path for the interest rate. All members wanted to convey that future cuts will be data-dependent and that they will not provide any forward guidance. However, some members advocated for a potential rate cut in June, while others preferred another pause in July. The first group believes that a cut in June would maintain the policy rate tight and would only be a marginal adjustment, while the other group argued that cutting in the next meeting would signal that Banxico is complacent with inflation, potentially harming its credibility. From their communication, it can be inferred that Banxico aims to be more cautious and has some doubts about the success of the disinflation process. We now expect Banxico to implement a 75bps cut by the end of the year, with three 25bps cuts spread across the upcoming five meetings.