Japan: 10yr JGB Yields To Exceed 1% in 2024?

Though BOJ soothed markets with last Tuesday’s rate hike and scrapping of yield curve control, we see scope for 10yr JGB yields to rise through 1% by summer/autumn. The current pace of net JGB purchases is a lot lower than H1 2023, while Ueda noted that this pace could be slowed in the future. Provided that the 10yr JGB yield rise is gradual, we feel that the BOJ will not protest aggressively.

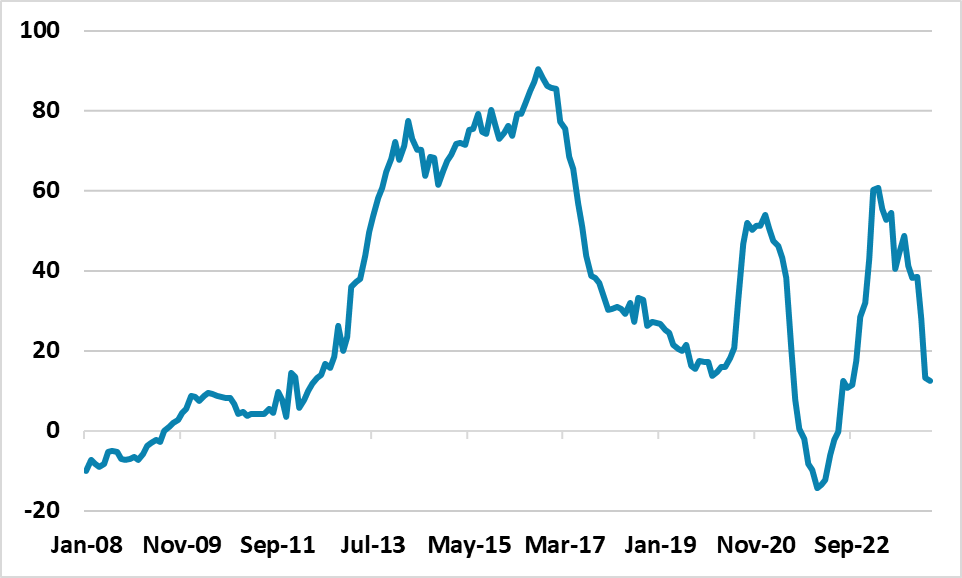

Figure 1: JGB Purchases (Annualized Yen trns)

Source: Continuum Economics.

The initial reaction in the JGB market to the sooner than expected 10bps BOJ policy rate hike and the scrapping of yield curve control has been muted. BOJ’s forward guidance suggest that the policy rate will only move slowly and that bond purchases will remain broadly the same, have helped produce the sense that accommodative policy remains and will keep JGB yields low. However, other comments in the BOJ press conference, suggest that we will likely see higher 10yr JGB yields later in the year.

· Bond purchases bias to reduce/monetary base growth commitment scrapped. It is worth remembering that the current pace of bond purchases is a lot lower than H1 2023 (Figure 1) when the BOJ were resisting the rise in JGB yields and is now down to Yen13trn annualized. BOJ governor Ueda also indicated that in the future that the BOJ could reduce the pace on (net) bond purchases. Additionally, the BOJ scrapped the commitment to keep increasing the monetary base (largely via JGB purchases). Finally, Ueda also indicated that JGB yields are now market determined.

· Weak forward guidance. The BOJ has provided soft words to the market over the past 15 months, but then acted quicker than expected. It was only 6 weeks ago that the market expected the BOJ policy hike to arrive in June! Additionally, despite the soft GDP numbers, the BOJ board were keen to get moving. It could be argued that the press conference forward guidance is only a short-term tactic and that by June we could see a further 10bps hike in the BOJ policy rate and a reduction in net JGB purchase rate. Remember that the pace of net JGB purchases was Yen1.6trn in 2010-11 (Figure 1). It could be that net JGB purchases slow towards this level, but with the threat that it will be scaled up if JGB yields spike too aggressively.

· 1% 10yr yields into the summer/autumn. We feel that the BOJ would be fine with a gradual rise in 10yr JGB yields through 1%. Ueda has previous suggested that in level terms the BOJ would only be concerned if 10yr JGB yields rose to 2%, though they are more sensitive to the pace of yield rise. Meanwhile, 10yr JGB yields were between 1-2% between 2003 and 2011, when wage settlements were not as high as recently. We see scope for 10yr yields to rise to 1.2% by the autumn. In 2025, we see 10yr yields falling back below 1% however, as we downside surprises on CPI inflation as this year wage inflation is not followed by sustainably higher CPI inflation or policy rate hikes beyond +0.1%.