Preview: Due April 30 - U.S. March Personal Income and Spending - Core PCE Prices to match weak Core CPI

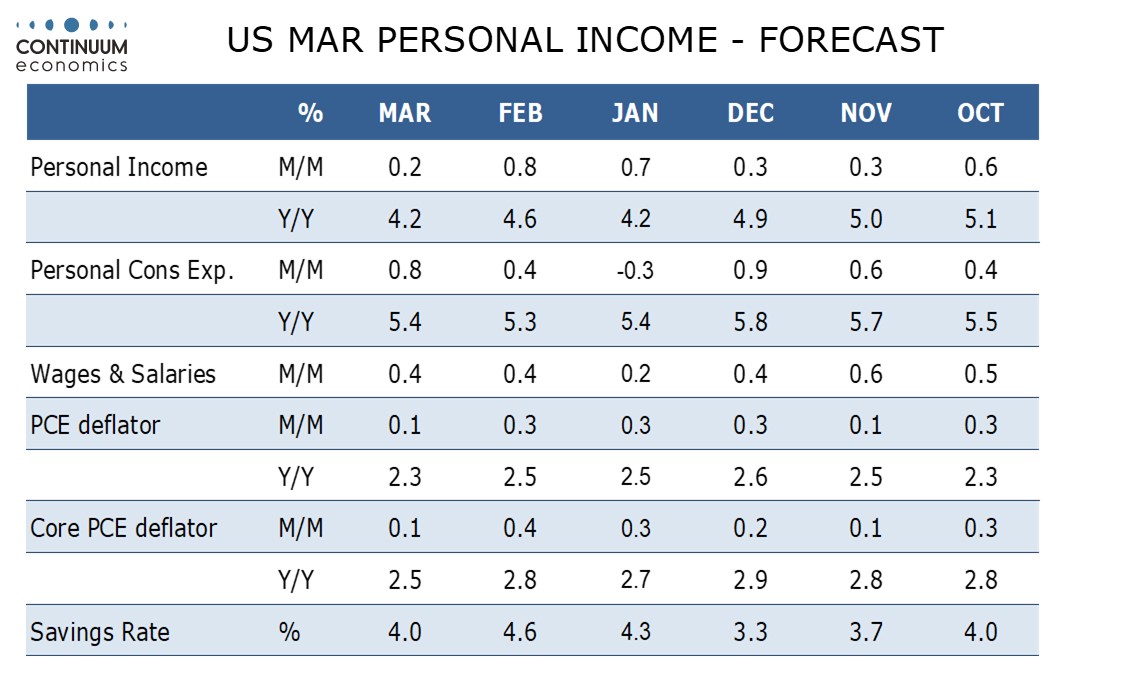

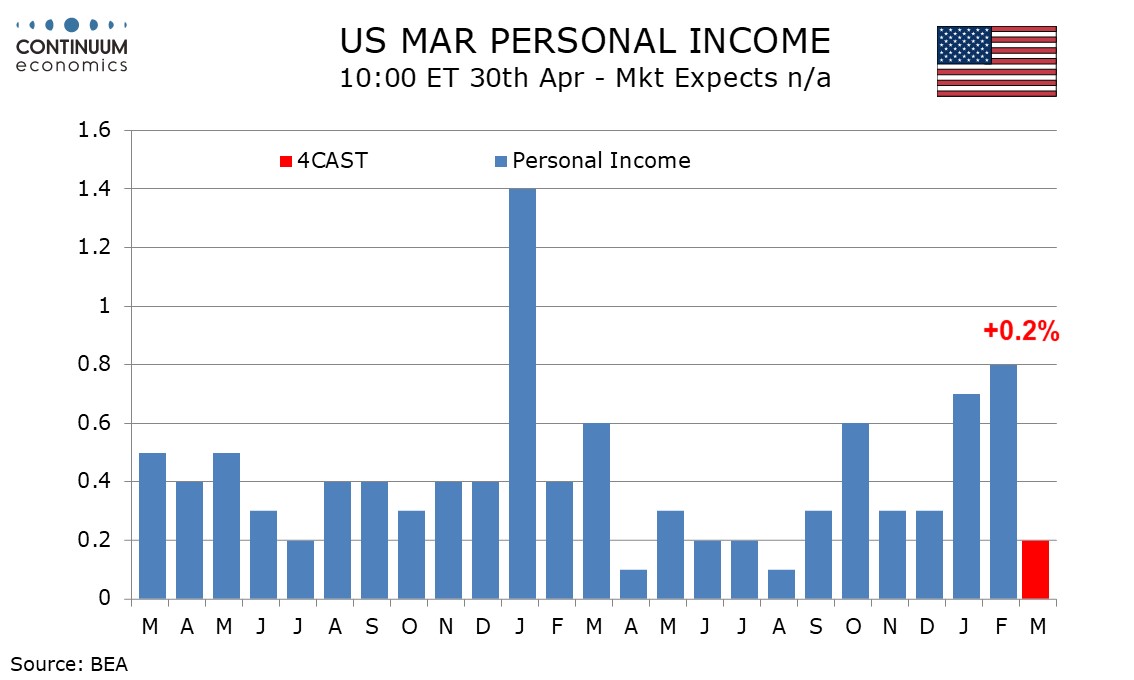

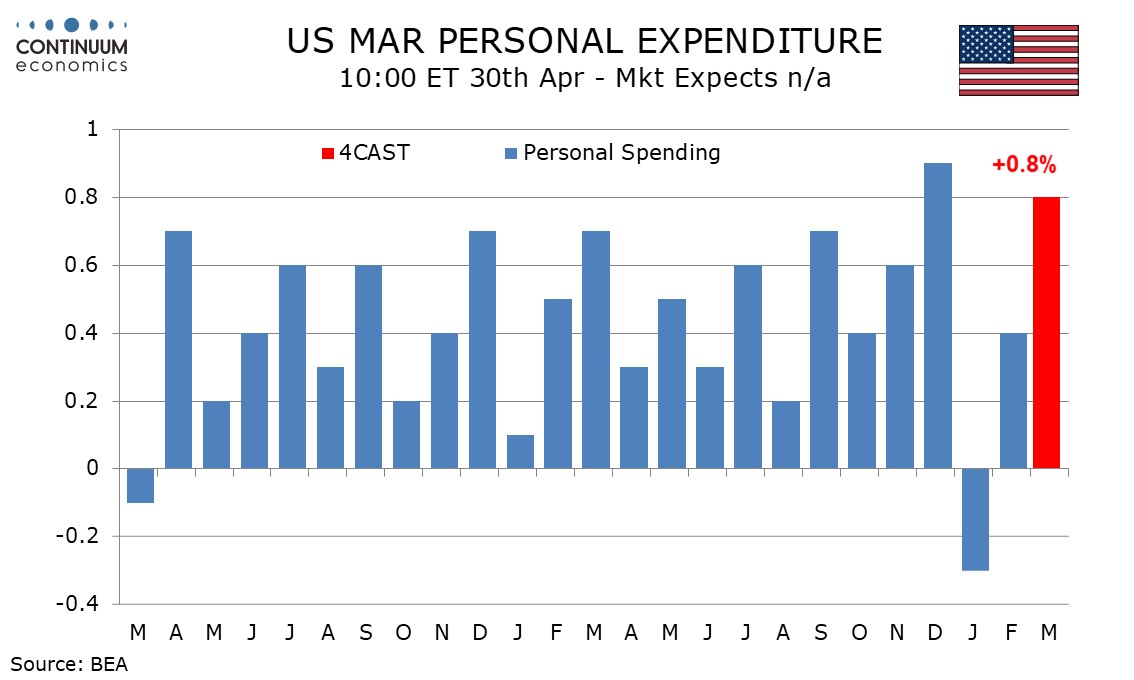

March’s personal income and spending report will be largely old news by the time of the release, with Q1 totals due with the GDP report 90 minutes earlier. We expect a subdued 0.1% increase in the core PCE price index, a subdued 0.2% rise in personal income, but a strong 0.8% increase in personal spending. Any surprises in the Q1 data could also reflect January and February revisions.

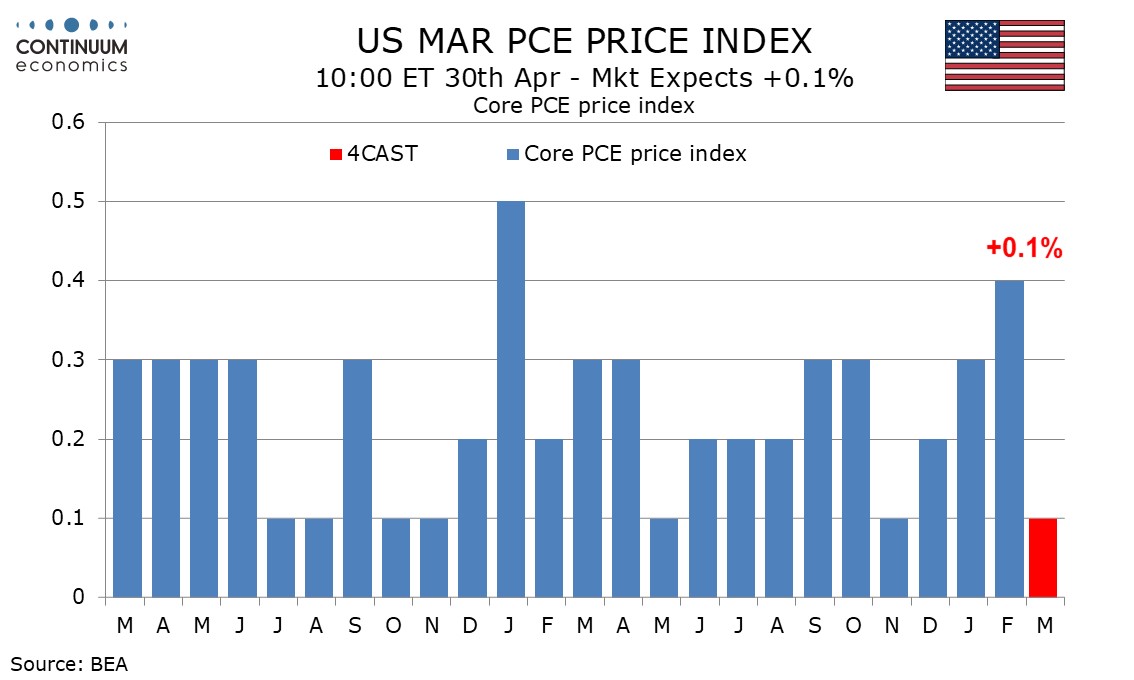

Core CPI prices rose by only 0.1% in March and we expect a similar rise from core PCE prices. The CPI was restrained by sharp falls in air fares and hotels, with the Cleveland Fed’s Median CPI quite firm at 0.3%. However with the components of the PPI which contribute to core PCE prices, notably including air fares, looking soft, core PCE prices looks set to see a weak March outcome.

This would see yr/yr core PCE prices fall to 2.5% yr/yr from 2.8%, consistent with forecasts from Fed officials. They saw overall PCE prices falling to 2.3% yr/yr from 2.5%, which would be consistent with a 0.1% increase in overall PCE prices, stronger than a 0.1% decline in overall CPI. With PCE prices less sensitive to gasoline than the CPI, we expect that will prove to be the case.

While a healthy non-farm payroll gain, albeit with a subdued rise in average hourly earnings, suggests a 0.4% rise in wages and salaries, we expect overall personal income to rise by only 0.2% as the other components pause after strong gains in January and February caused by gains in government benefits that are unlikely to be repeated.

We expect a strong 0.8% rise in personal spending, led by a 1.4% rise in retail sales that was led by a surge in autos ahead of threatened tariffs. The retail sales detail also showed strength in eating and drinking places, which are counted as services in the PCE detail. We expect a 0.5% rise in services after a 0.2% increase in February. The savings rate would then fall to 4.0% from 4.6%, still above December’s 3.3%.