USD, JPY, CHF flows: Steadier markets as risk stabilises

Riskier currencies edging higher, JPY stable as risk stabilises and Japan Tokyo CPI comes in in line with expectations.

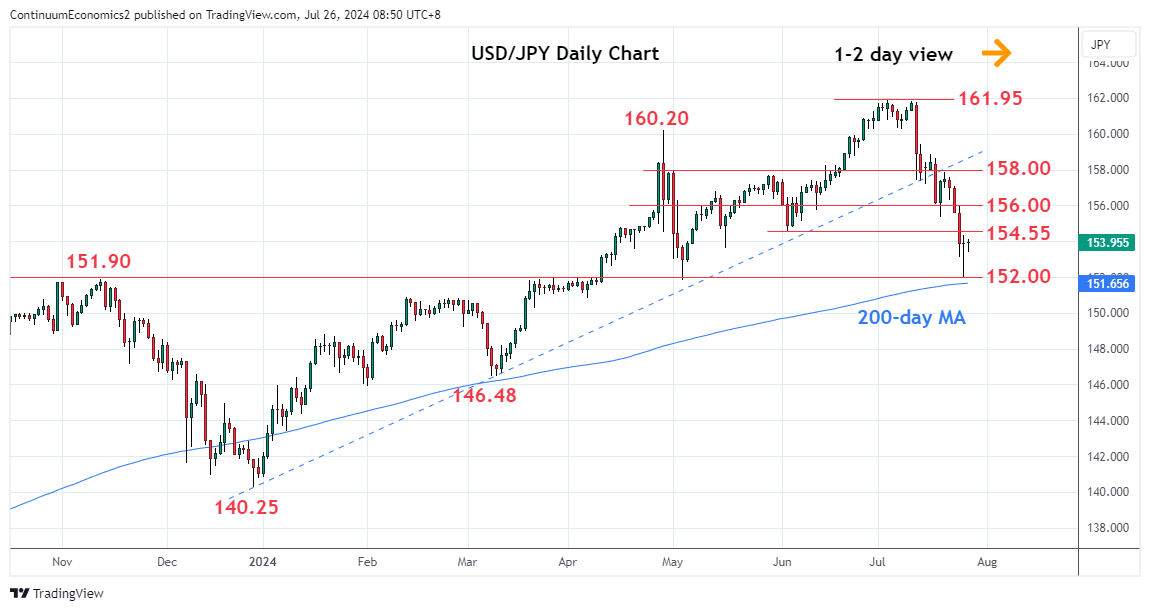

We’ve seen a more stable FX picture overnight, and riskier currencies are off their lows even though we still had some more weakness in Chinese equities. USD/JPY is not much changed. The July Tokyo CPI data was essentially in line with expectations, with core at 2.2% y/y. A hike in the BoJ policy rate of 10 bps at next week’s BoJ monetary policy meeting is now around 70% priced in, and this looks likely to be the trigger for the next JPY move. If the BoJ hold off and leave rates unchanged, we are likely to see the JPY fall back further, while if they hike a test of the recent JPY highs may be seen. However, with the pricing as it is, the risk on the meeting is more towards a lower JPY, especially since we expect they will leave rates unchanged next week and only adjust their JGB buying. Technically, all the JPY pairs have stabilised and shied away from the 200 day moving average support, so a new trigger may be needed for a break.

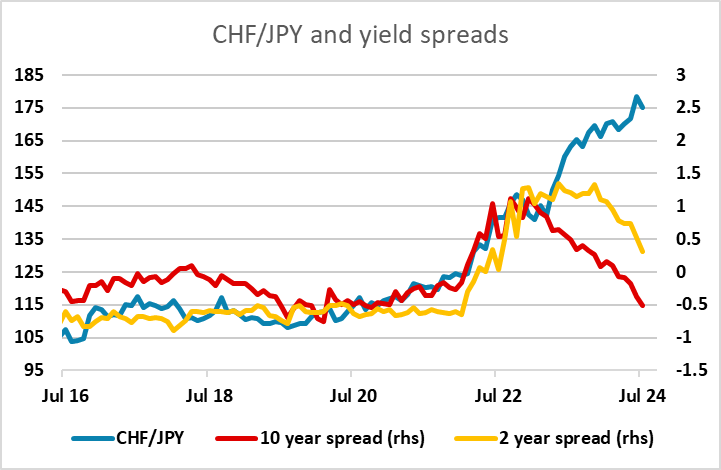

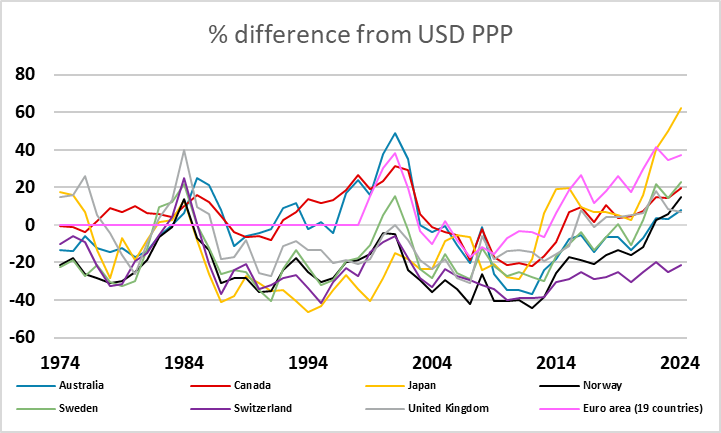

Of course bigger picture we still see scope for substantial JPY gains, as in spite of the 10 figure decline in USD/JPY in the last 3 weeks, the JPY is still extremely weak. Indeed, it is still weaker than any major currency has ever previously been relative to PPP against the USD. But things don’t move in straight lines, so JPY bulls like ourselves may need to be patient. We still see CHF/JPY as the most clear-cut value trade, as it doesn’t depend on weaker risk appetite and has minimal carry.