USD, JPY, NOK, AUD flows: Mild risk recovery continues

The risk reocvery ocntinued overnigth and the JPY has fallen back, but remains undervalued. CHF still has more downside scope, and high yielders could recover further

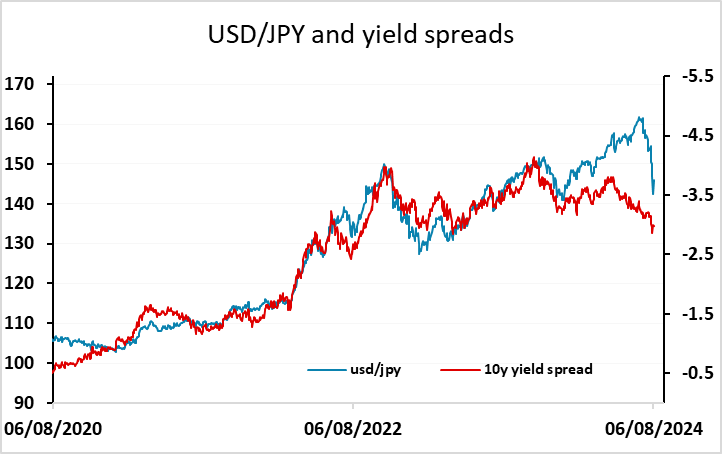

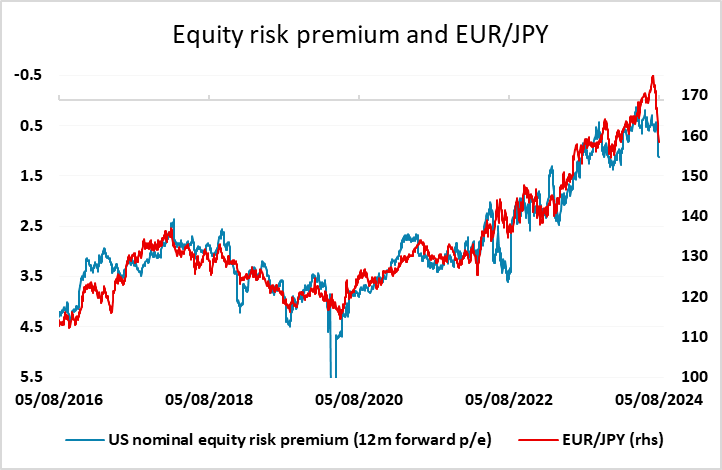

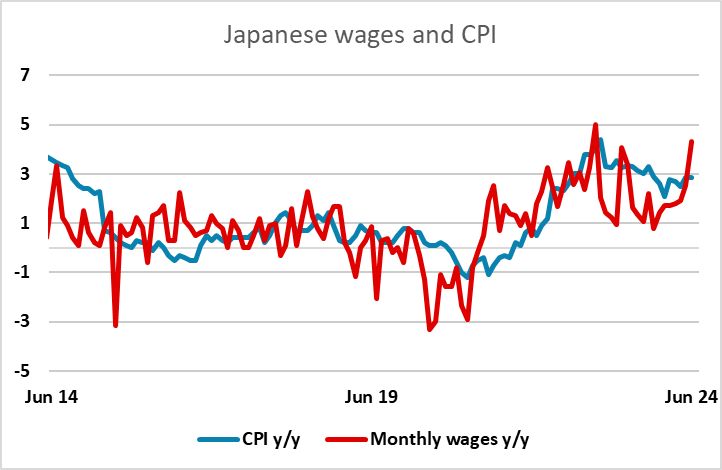

The risk recovery continued overnight, although the moves were still fairly modest. We still see the JPY downside as being very limited, with USD/JPY still not having fallen quite enough to move in line with the yield spread correlation, and EUR/JPY similarly still above the level consistent with the correlation with the equity risk premium. A correction was always likely if we saw a risk recovery, but we still see the risks to be very much n the downside form a big picture perspective, The strong Japanese cash earnings data overnight underpin this view, as they suggest consumer spending will start to improve which will allow the BoJ to continue on their tightening path.

However, there is more scope for some continued recovery in the higher yielders. The loss of risk appetite hit the AUD, NZD and NOK particularly hard, but there is little fundamental reason for weakness in these currencies, with their domestic economies generally among the better performers and their monetary policies consequently likely to remain tighter than most other G10 economies. The NOK looks the most out of line, with CHF/NOK having hit a new all time high yesterday, while the AUD and NZD broke to new lows for the year against the USD. We would expect progress back to the centre of the year’s range for AUD/USD near 0.66, while EUR/NOK should move back well below 12.

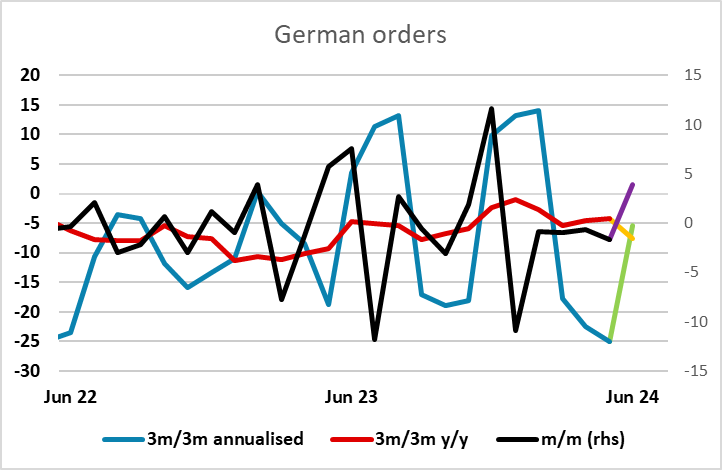

This morning’s German orders data looks superficially strong, with the 3.9% m/m rise much larger than expected, but the underlying trend remains weak and the data doesn’t suggest we are about to see a major manufacturing recovery.