Preview: Due June 17 - U.S. May Retail Sales - Autos to correct lower, underlying momentum subdued

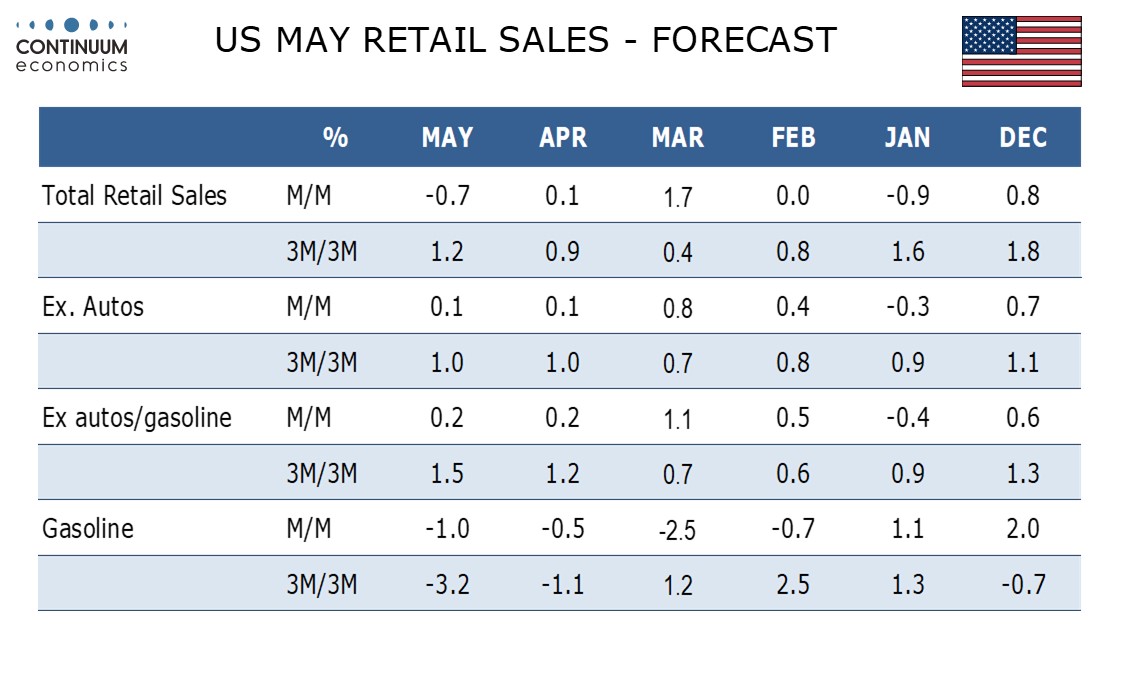

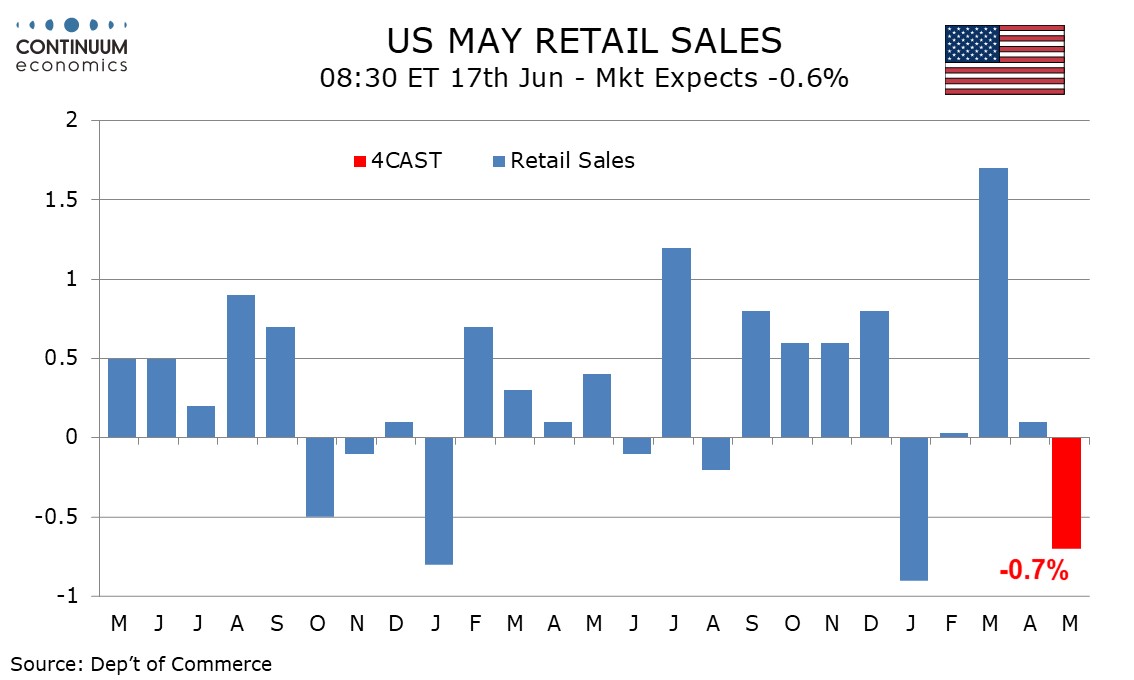

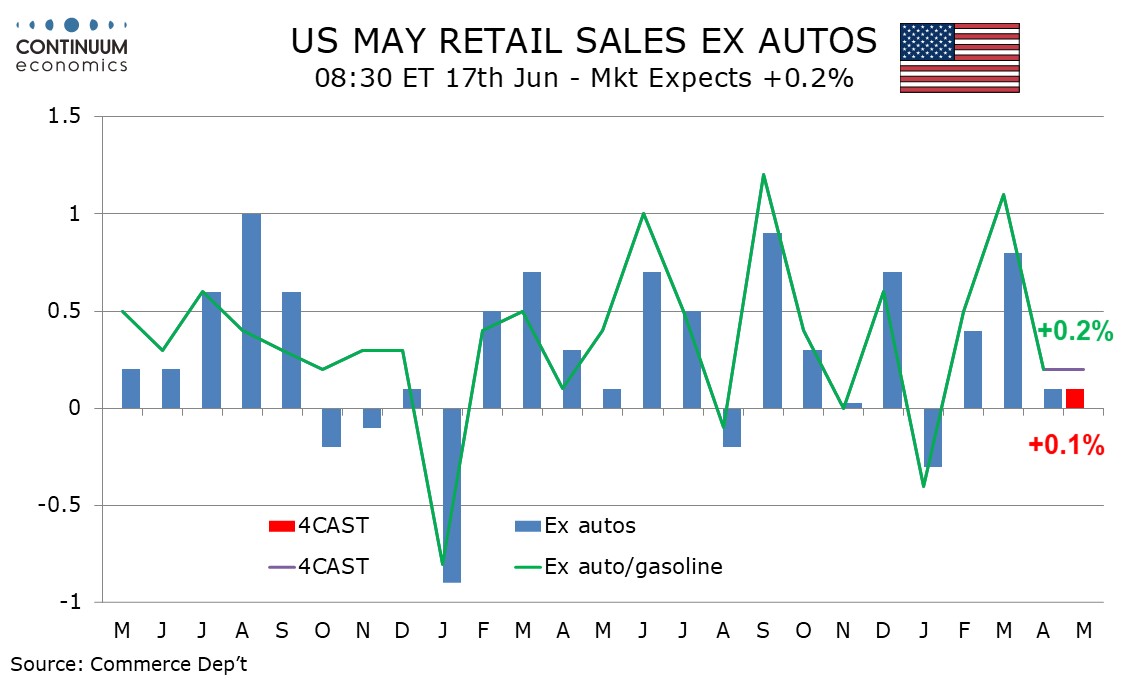

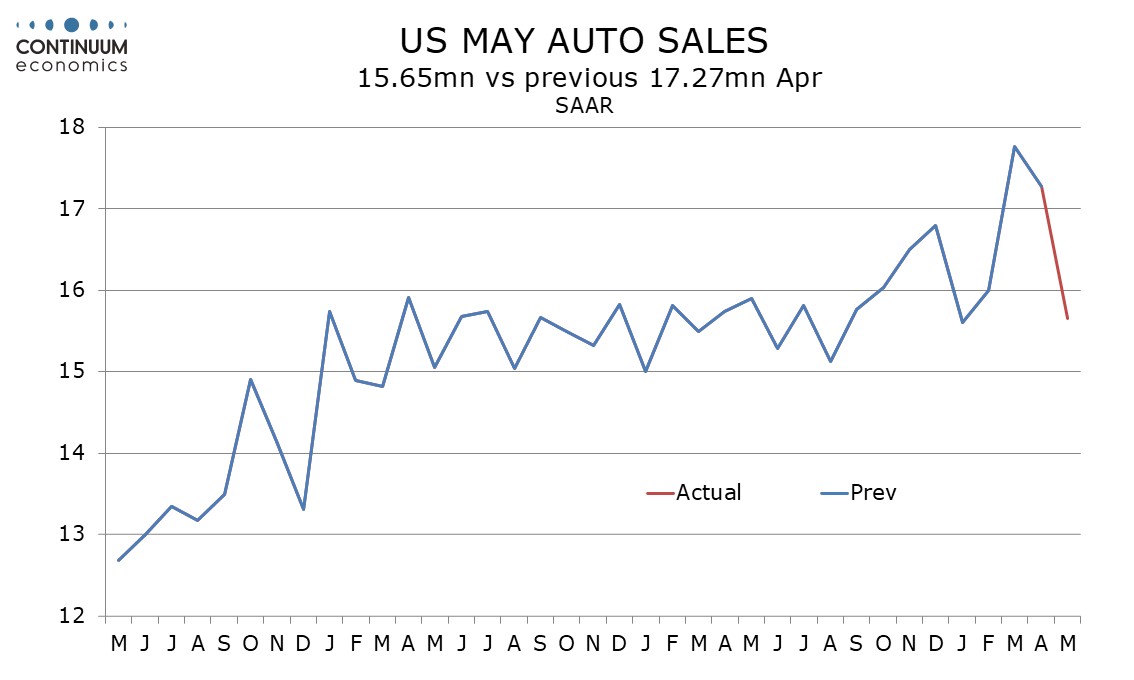

We expect a 0.7% decline in May retail sales as auto sales show a sharp reversal from recent strength. Ex autos we expect a subdued 0.1% increase, with a 0.2% rise ex autos and gasoline. Both of these outcomes would match those of April.

Industry data shows a significant dip in auto sales which looks like a delayed correction from a sharp bounce in March. Strength in March was in part catch up from weather-depressed data in January and to a lesser extent February, but fueled further by a desire to beat tariffs, particularly significant in the case of large items like autos.

April saw a subdued month ex autos and ex autos and gasoline after a strong March and May is likely to see a similar tone with tariffs still weighing on consumer confidence, though the weight may be less in June.

Subdued CPI data suggests prices will have little impact in lifting nominal sales while gasoline prices will be a modest negative on May sales.

We expect most components ex autos and gasoline to be a little stronger than in April, but this is likely to be balanced by corrections lower in building materials and eating and drinking places, both of which saw healthy gains in March and April.