China Fiscal Stimulus: Details to Follow

Further details of the size of extra central government spending/scaled up local authority purchases of unsold complete homes for affordable housing should be seen late October/early November from the National People Congress. We estimate Yuan1.5-2.0trn in total of extra spending, which leads us to increase the 2025 GDP forecast to 4.5% from 4.0% -- fiscal impact on 2024 will likely be very small. The more active government policy stance, also reduces the risk of a harder landing (circa 3%) to 10-15% from 20-25% in 2025.

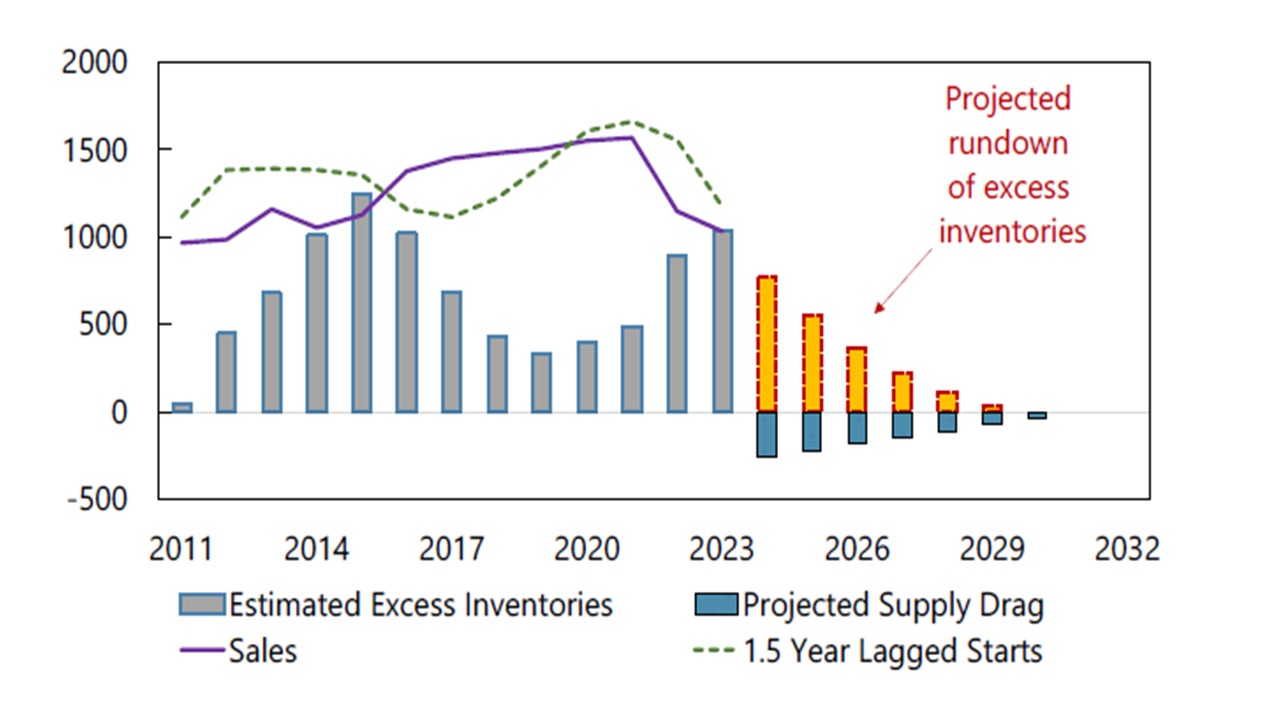

Figure 1: Developers Excess Inventory (Mlns Sqm)

Source: IMF Select Issues Feb 2024

Saturday’s MOF press conference did not provide specific details, but these will likely follow by later October/early November when the National People Congress meets. Key points to note are

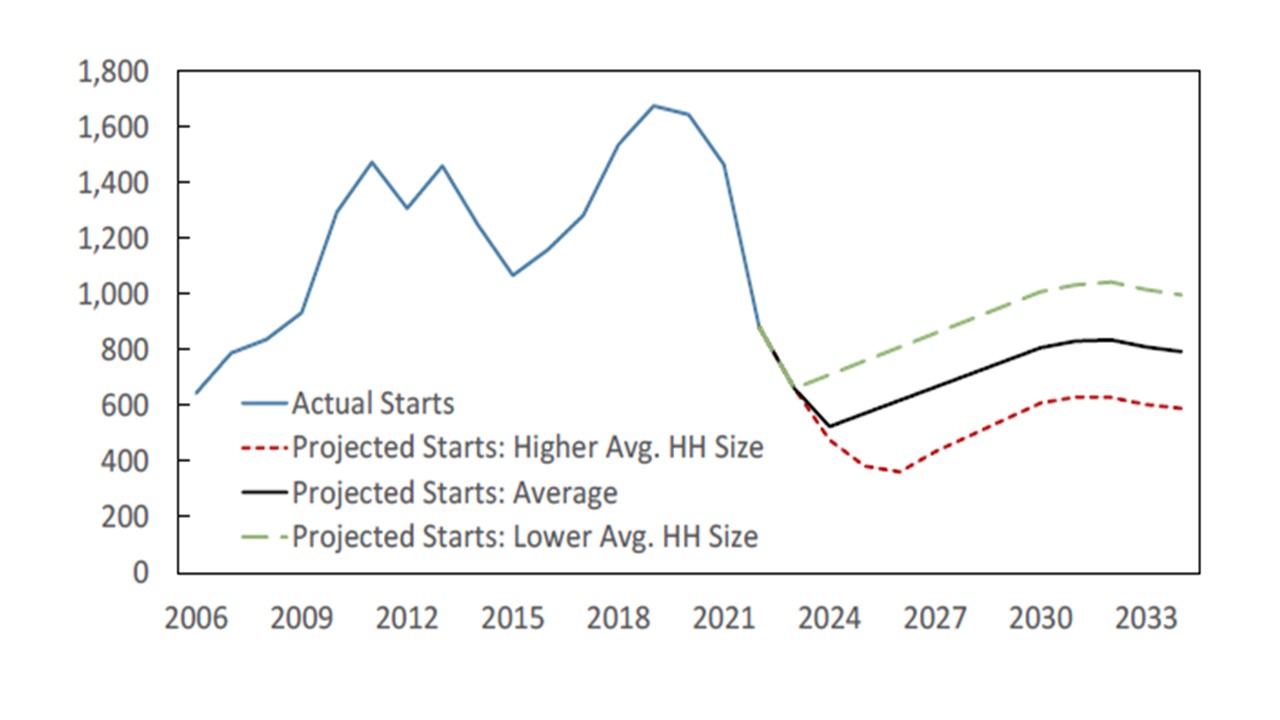

• More help for buying excess homes. The first key commitment was more money for local authorities to buy completed homes for affordable housing. So far Yuan300bln has been allocated and we would pencil in a further Yuan750-1000bln, which will mainly impact in 2025. This step up is helpful, but unlikely to be a game changer. The authorities do not want to restimulate housing too much and also feel constrained in their fiscal space. IMF estimates of 1bln sqm of excess inventory (Figure 1) would mean a more substantive program would be require (Yuan 3-4trn) to remove excess inventory from the market. Additionally, housing demand is slowing down noticeably, due to population aging and less young households buying houses. The IMF have a slow recovery in housing starts projected for coming years (Figure 2). However, we feel it will likely be worse and more like an L shape, as house prices continue to fall and partially completed construction gets finished. We see residential construction still subtracting 1% per annum from GDP in 2025-26. We had previously penciled in 1 ½% adverse impact for 2025, so it is less negative.

Figure 2: Real Estate Starts: Actual and Projected

Source: IMF Select Issues Feb 2024

• Central government spending. Saturday press conference also promised more central government spending and issuance of sovereign bonds. We would pencil in Yuan750-1000bln of extra spending for infrastructure and also high tech manufacturing. What will be lacking is spending to help households. While some support to reduce youth unemployment is occurring, China is reluctant to increase welfare safety net in cyclical terms (e.g. spending vouchers) or structural (health/unemployment/pension). This central government spending, combined with some extra support means we increase the 2025 GDP forecast to 4.5%, but the lack of consumption measures means that it is unlikely to hit 5%. China consumers are hurt by housing wealth, but also slow employment and wage growth.• LGFV debt swap. The final signal came for LFGV debt, where the MOF promised the largest debt swap for years – unclear whether this will be local government or also central government debt for LGFV debt. The 2023 swap was Yuan1trn, while the 2015 was Yuan12trn. A figure between these is feasible. It will be largely neutral for GDP, as it is not extra spending but rather a shuffling of LGFV from corporate debt to government debt (here).