BoE Preview (Nov 7): Activism vs Gradualism Debate Ferments MPC Divisions?

As with several recent BoE verdicts, the Nov 7 policy decision will be more important for what is said, than done, especially as it seems that even a further projected undershoot of the inflation target may not placate the MPC hawks! A 25 bp cut to 4,7% seems highly likely but the question is whether there is a formal shift away from the gradualist approach that has been explicitly flagged and the extent to which there may be dissent against any cut as well as any change in guidance. Indeed, against Chief Economist’s well adverted policy caution outlook, it will be interesting to see if Governor Bailey’s pointer to a possible more activist policy outlook is instead.

We do not think that the recent Budget boost will have a material impact on MPC thinking, with it likely that recent soft data and higher market rates should still mean an inflation target undershoot is projected from mid-2026 onwards in the updated Monetary Policy Report (MPR). But this does not make the December MPC meeting outlook any less uncertain. Regardless, given the below-consensus outlook we still envisage, there may be an additional 125 bp of easing by end-2025

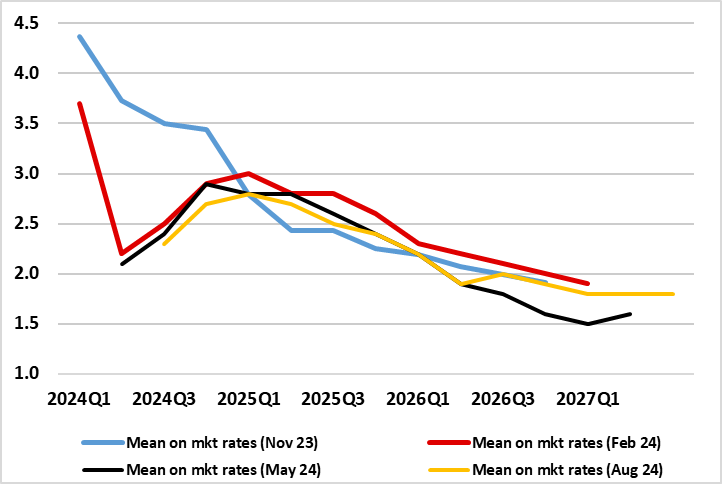

Figure 1: Another Inflation Undershoot Projection on the Cards?

Source: BoE last four MPR

Hawks vs Doves…

Notably, in the August MPR, Bank Rate cuts to around 3.7% by 2026 saw an inflation outlook undershooting target at both the 2-year and 3-year forecast horizons (Figure 1), this showing the impact of a policy stance in restrictive territory is largely seen to have. Given the current 0.4 ppt undershoot of actual CPI inflation and the recent rise in market rates, we see a below-target inflation outlook persisting. But, even if so, it is clear that the hawks on the MPC will continue to be more circumspect. This reflects what are clearly a range of views among MPC members.

Firstly, there are differences over the degree to which the unwinding of past global shocks, the normalisation in inflation expectations and the current restrictive policy stance would lead underlying domestic inflationary pressures continuing to unwind. Secondly, whether these pressures could prove more entrenched, possibly as a result of more structural factors or greater momentum in demand. This line of thinking is puzzling to us, not least as conventional policy is being buttressed by QT and where other European central banks main worry is that the transmission mechanism of monetary policy may prove to be much stronger than both previous cycles and central thinking.

…Activism vs Gradualism – A Tweak in Guidance?

As for the likely rate cut this month, if this involves another formal dissent from Chief Economist Pill, then a further easing in December would be more problematic. Indeed, the question is for how long could Pill formally dissent against an MPC majority, especially as his recent speech seemingly questioned the validity not only of the BoE’s formal CPI projections but also some of the assumptions that his MPC colleagues had agreed (most notably whether the neutral policy rate has risen of late or not). Indeed, this week’s MPC meeting may be important as a change in formal guidance is considered and debated; Governor Bailey has been open about the extent to which inflation has surprised on the downside and hinted at a more activist policy stance, but this has contrasted with Pill’s steadfast caution. Perhaps a (poor) compromise may be amend the current guidance ‘gradual approach to removing policy restraint remains appropriate’ to allow more flexibility ahead.

Downside Risks Persist

In this regard, other considerations will be important, not least the extent and speed to which other DM central banks may ease policy. This is linked to downside growth risks, which according to business surveys, may be spilling over to the UK somewhat sooner and more sizably than the BoE has expected; the labor market is clearly slowing both in terms of becoming less tight and where the drop in private sector jobs questions the validity of the apparent upbeat GDP backdrop. The fiscal backdrop is also uncertain; while the recent Budget was certainly stimulative, the boost is likely to be short-lived and may have the BoE making a clearly less positive growth response than the Office for Budget Responsibility (OBR). Indeed, it could be argued that boost in government spending may be more neutral as the hike in employer National Insurance contributions (NIC), through which they are largely funded, dents already weak employment and then weighs on average earnings growth. Such a different interpretation to the NIC impact has already been flagged by the Institute for Fiscal Studies which suggests that the increase in employers’ NICs would not raise anything like the £25bn stated on the Treasury’s expected fiscal arithmetic because it would result in lower wages and profits, reducing its net revenue to about £16bn.