EZ: Is the Labor Market Starting to Labor?

With markets and policy makers very much focused on inflation, the EZ labor market continues to shine – apparently! Indeed, the EZ jobless rate has remains at a record-low of 6.4%, hinting at labor market tightness that will perturb ECB hawks wary of higher ensuing wage pressures. But this apparent record-low may exaggerate the tightness in the labor market. Firstly, it masks a backdrop where labor supply is not only rising but actually far faster than pre-pandemic (Figure 1). Secondly, there are also signs that the tightness is accentuated by labor hoarding (Figure 2). Thirdly, that tightness may already be unwinding and clearly so as business surveys show an increasing reluctance by firms to take on new workers (Figure 3) and broadly so across sectors. All of which has clear and reassuring repercussion for policy makers worries about wage pressures.

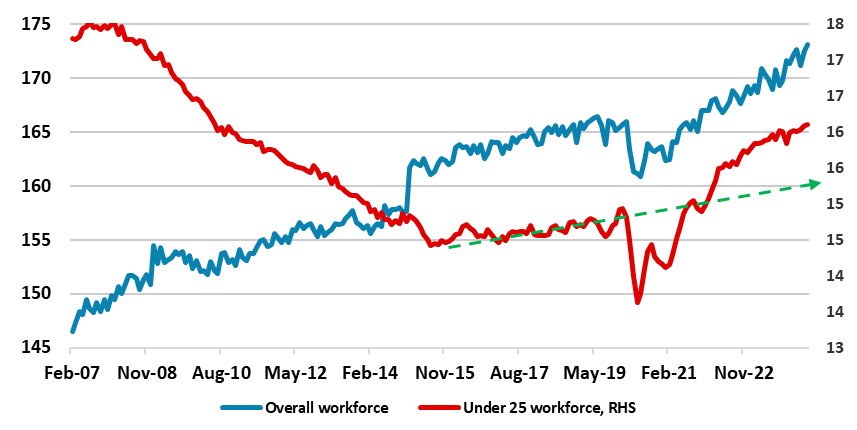

Figure 1: Labor Supply on Firmer Upward Trend

Source: Eurostat, Continuum Economics; millions, dashed lines are pre-COVID trends

Softer Labor Market Signals

Released alongside more high-profile HICP data, the latest EZ jobless data point to a record-low in the level of unemployment of 6.4%. But this continues to mask something unique to the EZ, at least amid the DM world, that is not only an increase in labor supply continues but at a pace exceeding pre-pandemic rates and seemingly gathering momentum (Figure 1). Moreover, while there has been a fall in the overall unemployment level, this has come in spite of a rise in the jobless rate for young (under 25), they more likely than older workers to consider looking for better paid work (ie labour churning). This will surely diminish what may already be slowing wage pressures, especially given that these younger potential works also seem to have a much lower perception and expectation of overall inflation according to the ECB’s consumer expectations survey.

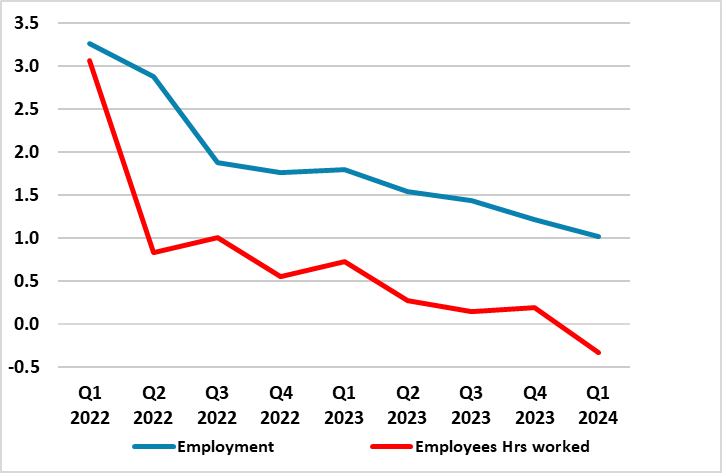

Figure 2: Ever-Clearer Signs of Labor Hoarding

Source: Eurostat, % chg y/y

Notably the record-low jobless rate (admittedly still high compared to the UK and USA) is all the more impressive amid this rise in the workforce. To a large degree, and very much central to ECB thinking is the likelihood that firms are hoarding labor. Simple labor hoarding, where companies hold on to more workers than necessary in the downturn, has occurred in previous EZ cycles and basically means that labour input is not fully utilized by a company during its production process at any given point in time. Under-utilization of labour can manifest itself in various forms, such as reduced effort or hours worked, and the shift of labour to other uses, such as training. From the company’s point of view, some labour hoarding may be optimal given the fixed costs associated with adjusting staff numbers. These costs include costs of recruitment, screening and training of new workers, as well as costs related to the termination of contracts such as severance pay. Therefore, in the face of a downturn in activity, companies may prefer to reduce labour input, at least to some extent, by shortening the hours worked, which is less costly than reducing staff numbers. This seems to be occurring (Figure 2) as the (admittedly less) solid growth in employee employment has increasingly come alongside a drop in the growth of hours worked and now to a degree where overall hours worked have fallen! This is backed up by survey data which show across all main sectors that companies are reporting far fewer labor shortages.

Such labour hoarding has other repercussions over and beyond helping explain reduced wage pressures. Importantly, it suggests less appetite, if not ability, for companies to take on new staff once a recovery occurs, this therefore likely to hold back the pace of any such recovery, a view very much entrenched in our still relatively subdued real economy outlook!

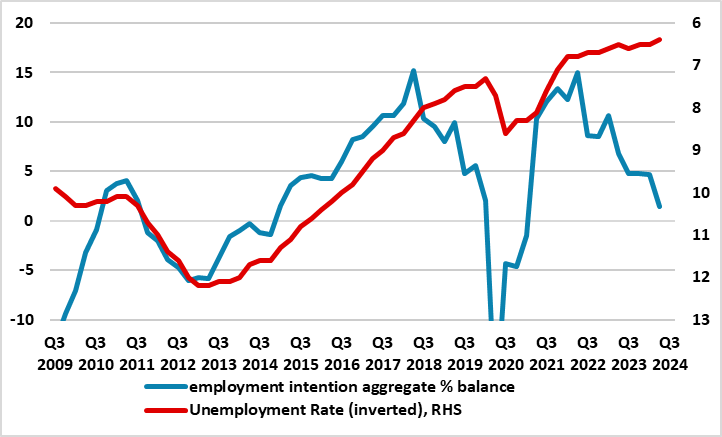

Regardless, there are now signs that the jobless rate may be on the turn, or at least less and less indicative of a tight labor market. Business survey (such as that provided by the European Commission) show that companies employment intentions have fallen quite clearly in the last year or so, something at odds with the trend in the jobless rate (Figure 3). Indeed, employment intentions are actually much softer than prior to the pandemic.

Figure 3: Joblessness About to Rise?

Source: Eurostat, European Commission, CE, % and % balance RHS

For the ECB, there has been much attention placed on the still low jobless rare but little about the details behind it and such a discussion may be more dominant in the next Council discussion on July 18given that a rate cut is unlikely to be on the table. For the hawks there is still the concern that wage pressures will persist at the recent higher pace. In this regard, perhaps the softer signals in both the Indeed and ECB compiled wage tracker can be understood against what is really happening in the EZ labor market!