SARB MPC Preview: Easing Cycle to Continue on November 21

Bottom line: After South African Reserve Bank (SARB) cut the key rate to 8.0% on September 19 following seven consecutive meetings at a 15-year peak of 8.25% given that September inflation hit below the midpoint of target band of 3% - 6%, power cuts (loadshedding) are suspended and inflation expectation decelerated, we now foresee SARB will further lower policy rate by 25 bps to 7.75% at its final meeting of the year on November 21 amid muted growth and price pressures.

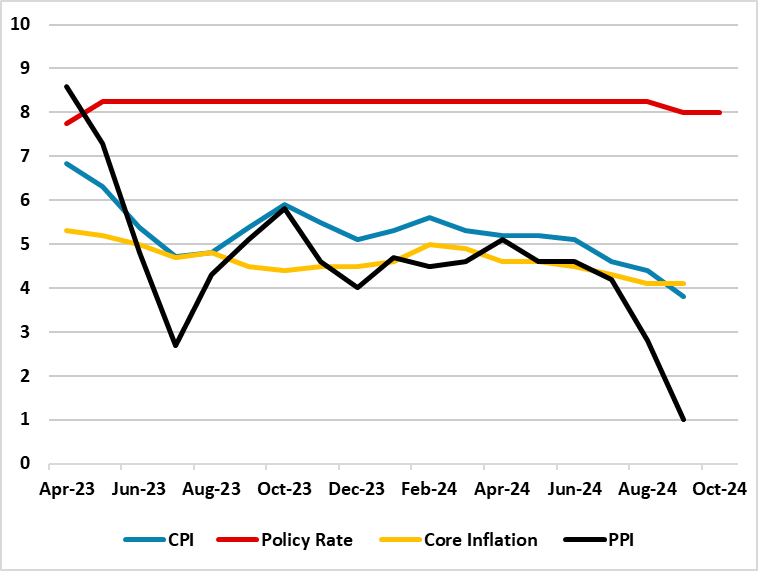

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), April 2023 – October 2024

Source: Continuum Economics

After SARB announced its interest-rate decision on September 19 and cut the policy rate by 25 bps from 8.25% to 8.0% for the first time since its Covid-19 response over four years ago, we now expect SARB will further lower policy rate by 25 bps to 7.75% at its final meeting of the year on November 21 amid muted growth and price pressures.

November 21 decision will be supported by the dip in September headline inflation (3.8% YoY) and core inflation remaining slightly below the mid-point of the target range (4.1% YoY). The fall in inflation, coupled with suspended power cuts and deceleration in inflation expectations have relieved SARB.

On the power cuts front, South Africa’s national electricity utility company, Eskom, announced on November 8 that load shedding remained suspended for 226 consecutive days, reflecting structural generation improvements and new investments. Eskom also highlighted that investments in the generation recovery plan continue to pay off, driving efficiencies and supporting economic growth as diesel savings reached 14.6 billion ZAR YoY. Suspension continue to help businesses and households to relieve facing increasing costs from using alternative sources such as diesel backup generators, contributing at lower inflation figures.

The inflation expectations continued to decline in Q3, as shown by the BER’s latest survey released on September 12. The average inflation expectations of analysts, business people and trade unions demonstrated that they now expect headline inflation to be 5.1% this year, before subsiding to 4.8% in both 2025 and 2026. In Q2, they still expected consumer inflation to register 5.3% this year and fall to 4.9% in 2026. This was a key data point for SARB as SARB governor Kganyago repeatedly said the regulator is paying full attention to the inflation expectations.

We think SARB is also relieved following the rate decisions by Fed and ECB, as both banks continue their cutting cycles, loosen global financial conditions and potentially ease pressure on the ZAR. Despite continued DM easing cycles, the result of recent U.S. presidential elections caused ZAR to face a difficult time against a resurgent USD as investors ponder to what extent president Trump is likely deliver tariffs across the world. (Note: ZAR depreciated from 17.6 to 18.3 against the USD between November 1 and 15).

Under current circumstances, we expect data driven and cautios SARB will likely cut the rate to 7.75% on November 21 as they pay attention to inflationary pressures are under control backed up by data and expectations.