ECB Policy Clues: July Accounts and Lane

Elements of the July accounts help build confidence in more easing we expect ECB Lane Jackson Hole speech on Saturday to also provide comfort in near-term rate expectations. However, it is clear that key ECB board members do not want to be as clear as the run-up to the June meeting, but this could partially be internal politics and reserving the decision for the September 12 meeting. We see the three key criteria as influencing the ECB to deliver a 25bps cut in key policy rates at the September 12 meeting.

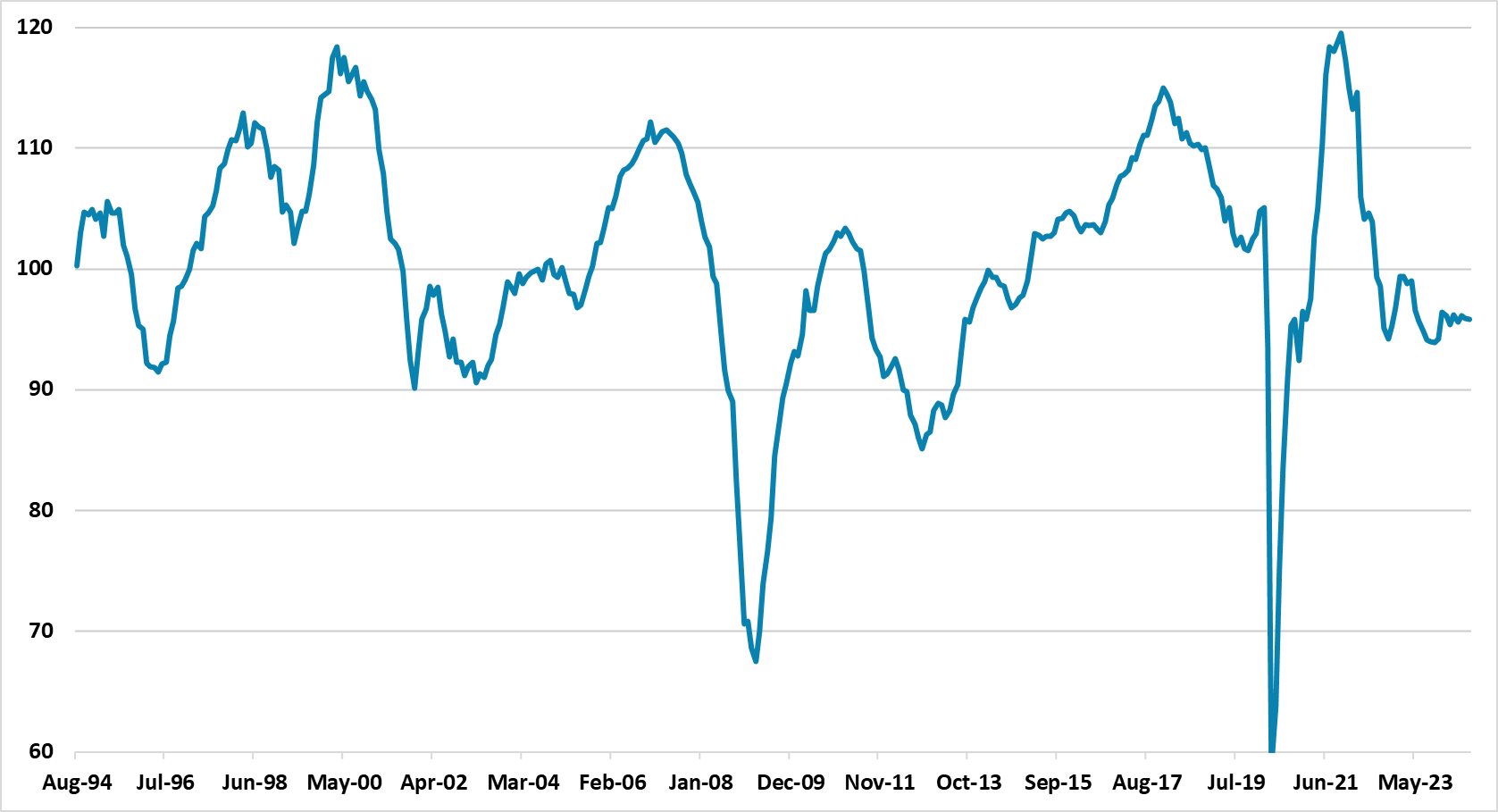

Figure 1: Eurozone Economic Sentiment Indicator (%)

Source Datastream/Continuum Economics

ECB forward guidance is an art rather than a science, with the July meeting accounts providing clues but also less divergence than the June meeting. One of the reason for less division than June is that no proposal existed for a cut. However, the underlying issue is that the hawks place more weight on actually seeing inflation sustainably hit target, which then shapes their views on what to do with policy rates. This will likely be evident once again at the September meeting when the doves will push for a 25bps cut – the July accounts indicated that the September meeting would be a good time to reevaluate restriction.

Otherwise, the long discussion on economy/inflation and policy, were for a change very much in line with the views communicated in the introductory statement and additionally in President Lagarde Q/A. A couple of points are worth noting. Firstly, the July accounts indicated that members were keen for wage growth to come down, which has now started to come through with the sharp drop in negotiated wages to 3.6% with the figures released today. Secondly, uncertainty exists on the economic and inflation trajectory. While these risks around the baseline have been highlighted, it was interesting that a discussion occurred on whether the ECB thinking was too dependent on a consumer recovery – especially with the savings rate drifting up.

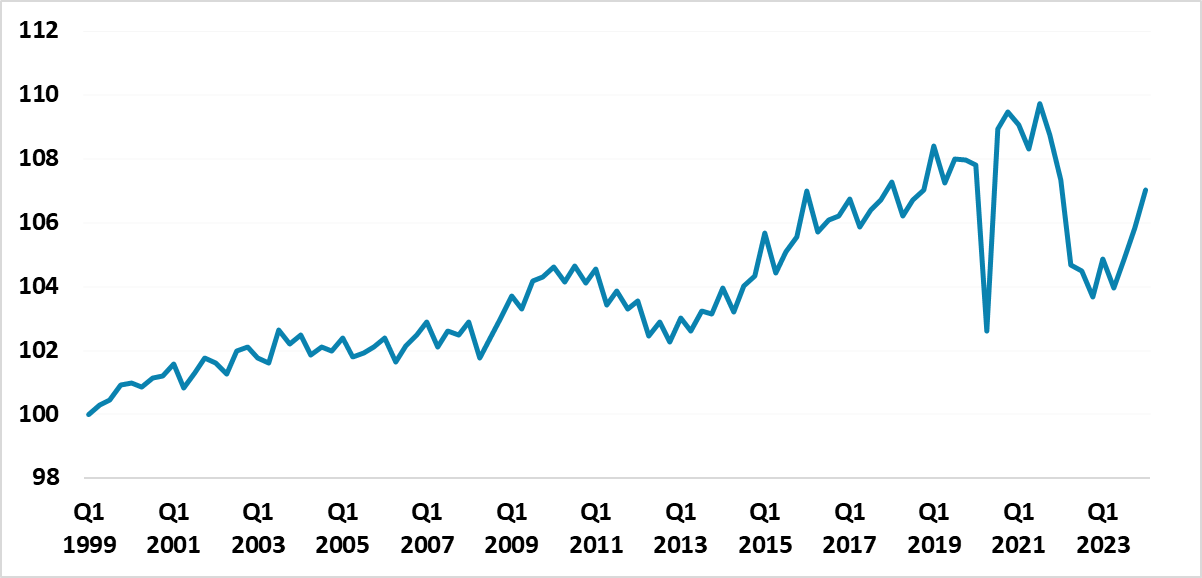

Our interpretation of the real sector data is that the recovery is not gaining traction (here), with the service sector cooling from a good H1 – the August PMI is likely a Paris Olympics bounce that will prove temporary. One of the problems is the lagged feedthrough of monetary policy. Additionally, most of the ECB accepts that one of the reasons to be less restrictive is lower inflation means that the policy rate needs to come down to stop the real policy rate from rising. Furthermore, households are being hit by turbulence this decade. Though wage growth is outstripping HICP inflation currently, we see this as catch-up and not the start of a new wage-price spiral. Figure 2 shows the ratio of hourly compensation/HICP indices to emphasis that some households are suffering from wages having not caught up with CPI inflation increases over the last few years. This prolongs cost of living pressures for low income households that do not have excess savings or wealth. This is a headwind to recovery and disinflationary. Inflation has picked up recently, but should come back down with the August HICP data (here).

Figure 2: Ratio of Hourly Wage Compensation/HICP Indices (1999 = 100)

Source Datastream/Continuum Economics

We see the three key criteria as influencing the ECB to deliver a 25bps cut in key policy rates at the September 12 meeting. Some of the hawks will likely argue against a move. However, the hawks are a minority on the ECB council in June and July, with the majority voting for a June cut and it is worth remember that 21 members sit round the table in governing council meeting and dissent does not stop a quarterly easing pace.

Elements of the July accounts help build confidence in this view and we expect ECB Lane Jackson Hole speech on Saturday to also provide comfort in near-term rate expectations. However, it is clear that key ECB board members do not want to be as clear as the run-up to the June meeting, but this could partially be internal politics and reserving the decision for the September 12 meeting. The macro picture, plus current degree of restriction, suggest that the ECB will also likely deliver 25bps at the December meeting. As wage inflation comes down into 2025, we then see the ECB delivering a further cumulative 100bps to help boost GDP back to trend.