Brazil CPI Review: Drop on Electricity Prices Warrants Stability in August

In August, Brazil’s CPI remained stable at 0% month-over-month, with the year-over-year rate dropping to 4.2% from 4.5% in July. This stability was driven by declines in the Housing group and food prices. Education and household expenditures increased by 0.7%, while the Transport group stayed unchanged. Despite positive overall measures, potential inflation risks from increasing droughts and hydroelectric capacity issues loom. Inflation is projected to end 2024 at 4.2%, with convergence towards the 3.0% target expected in 2025-2026.

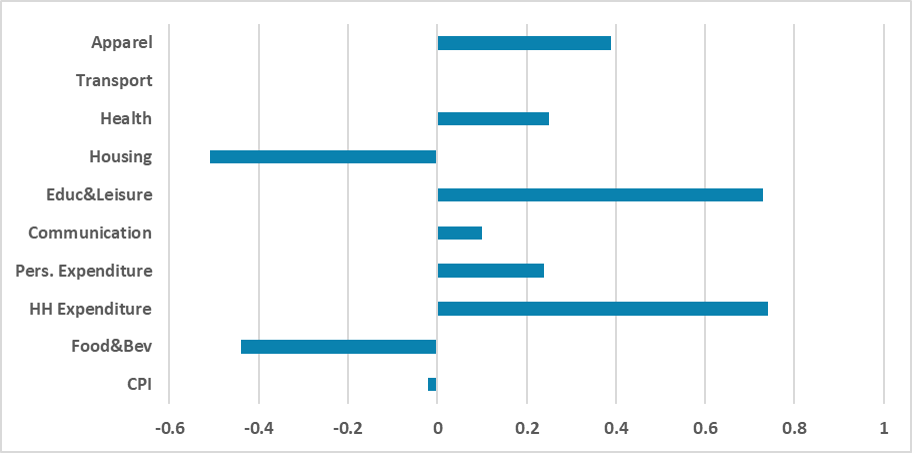

Figure 1: Brazil CPI by Groups (%, m/m)

Source: IBGE

The Brazilian National Statistics Institute (IBGE) has released the CPI figures for August. The data show that Brazil’s CPI remained unchanged (0% m/m) during August. Therefore, the year-over-year (Y/Y) CPI has dropped to 4.2% from 4.5% in July. The main factor contributing to this stability was the decline in the Housing group (-0.5% m/m) due to a decrease in electricity prices, as several electricity companies reduced their prices during August. The Food and Beverages group also experienced a contraction in its CPI (-0.4% m/m) due to decreases in the prices of potatoes (-19.0%), tomatoes (-16.9%), and onions (-16.9%).

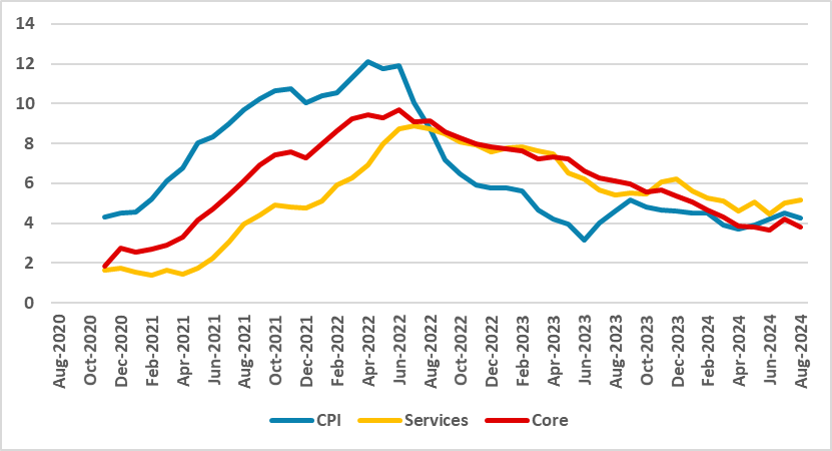

Figure 2: Brazil CPI (%, Y/Y)

Source: IBGE

Looking at other groups, education rose by 0.7%, affected by seasonal adjustments in school prices, while household expenditures also grew by 0.7%. However, these increases were offset by decreases in the food and housing groups. The Transport group rose by 0% (m/m) as the increase in diesel oil prices was offset by decreases in airfare ticket prices. Overall, the small rise in core CPI was offset by the drop in non-core items.

We believe this stability in the CPI could provide an argument for the BCB not to raise rates at their upcoming September meeting. The overall measure was positive and suggests that the risks of exchange rate devaluation and economic overheating have not yet materialized into higher inflation numbers. However, a new risk is starting to appear on the horizon. Droughts in regions where hydroelectricity is generated seem to be increasing, which could affect hydroelectric capacity and, therefore, put pressure on inflation. Clearly, there is little the BCB can do to avoid this, but arguments for future inflation pressures could emerge. The fiscal situation will always be a factor in inflation discussions. Although we believe that at the moment supply has been able to meet higher demand and we are not seeing price pressures from demand, the number for August was favorable.

Despite this, inflation is yet to approach the BCB's target of 3.0%, and expectations are not converging in this direction. We are forecasting inflation to end 2024 at 4.2%, meaning it will remain sticky in the coming months, although a surge is not expected. We believe the process of converging inflation towards 3.0% will only be achieved in 2025 and 2026.