BoE Review: A Dovish Hold?

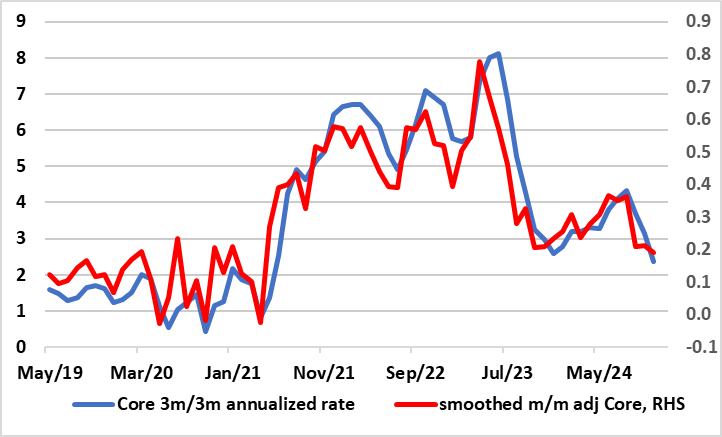

An expected unchanged decision left Bank Rate at 4.75% but what was not foreseen was three dissents in favor of a cut with a further member advocating a more activist strategy (presumably ahead). Overall, the BoE adhered to a gradual approach to removing monetary policy restraint remains appropriate and continued to suggest it will decide the appropriate degree of monetary policy restrictiveness at each meeting. But there were several less hawkish aspects to the statement, including that the labor market may no longer be tight; less reference to inflation persistence; that growth risks had risen to a degree where current quarter GDP may be flat and where the Bank Agents Report suggested a clear slowing in wage pressures into 2025. In addition, the minutes noted that core (and even for services), adjusted m/m data showed a weaker backdrop than headline y/y numbers (Figure 1).

Figure 1: Clear Adjusted Core Inflation Drop Intact?

Source: ONS, CE-computed seasonally adjusted core measures

If the November decision was seen as a hawkish easing, this may be seen as dovish policy hold. It does appear that the BoE is uncertain and is unable to give clear forward guidance, but we think its gradualist approach is consistent with at least four 25 bp moves next year and we think there could be five. Indeed, while there was less mention of its new scenario strategy which had allowed Governor Bailey recently to flag around four 25 bp cuts next year, we think this is still BoE thinking but one that is clouded by added uncertainty. In particular, the MPC majority is perturbed by the extent to which recent developments in output could reflect the weakness of both demand and supply, such that there might be fewer implications for the margin of spare capacity in the economy and thus domestic inflationary pressures. It may also be reassessing its initial judgement about how growth stimulant the Budget actually may prove to be.

But we think disinflation remains the order of the day and that growth risks are real, an outlook largely backed up by the three dissenters. They noted that the most recent data developments pointed to sluggish demand and a weakening labour market, now and in the year ahead, both of which would see further downward pressure on demand, wages, and prices. In the short run, these factors, alongside higher uncertainty and weak global conditions, paired with the temporary uptick in headline inflation entailed a policy trade-off. Indeed, they suggested that in the medium term, a continued stance that was very restrictive risked deviating unsustainably from the 2% inflation target and opening an unduly large output gap. Given the evolving balance of risks, the three dissenters said a less restrictive policy rate was warranted. We think this very much points to a move at the next (Feb 25) meeting the question being whether the BOE then also hints at a more activist outlook as one MPC member pointed to.